Taurus says it works with more than 25 financial institutions, including Credit Suisse and Deutsche Bank, as well as Arab Bank Switzerland and Pictet Group, who also joined the funding round. Taurus offers custody, tokenization and trading of digital assets, including support for staking, decentralized finance (DeFi). Source

Day: February 14, 2023

Bitcoin price targets range from $19K to $25K as CPI day dawns

Bitcoin (BTC) saw ongoing rejection below $22,000 into Feb. 14 as markets braced for macroeconomic data impact. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin vs. CPI: “Expect volatility” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD failing to expand beyond $21,800 ahead of the United States Consumer Price Index (CPI) print for January. Already called the “most important” CPI release, the data, due at 8:30am Eastern Time, is a classic volatility catalyst for risk assets. Crypto market participants thus expected a busy trading day, with both $19,000 and…

US Judge Approves Removal of FTX Turkish Units From Bankruptcy Case

FTX had asked the court to greenlight the dismissal after Turkish authorities ordered the seizure of most of the crypto exchange’s assets in the country. Source

Rwanda Government Orders Banks to Stop Facilitating Crypto-Related Transactions – Regulation Bitcoin News

According to the National Bank of Rwanda, the country’s regulated financial services providers are now prohibited from facilitating crypto-related transactions. In her Jan. 31 letter justifying the decision, the acting governor Soraya Hakuziyaremye cites the unregulated status of most crypto assets and how this leaves users without the “guarantees and safeguards associated with regulated financial services.” Rwanda’s Growing Interest in Crypto The National Bank of Rwanda (NBR) has said the country’s financial services providers are forbidden from engaging in “any crypto-related activities until a regulatory framework has been put in…

Crypto Exchange Coinmetro Buys Social Fundraising Platform Ignium

With the €4 million ($4.3 million) acquisition, the Estonia-based crypto exchange Coinmetro intends to broaden its securities market offerings and develop tools for small businesses to raise funds directly from their communities using non-fungible tokens. Source

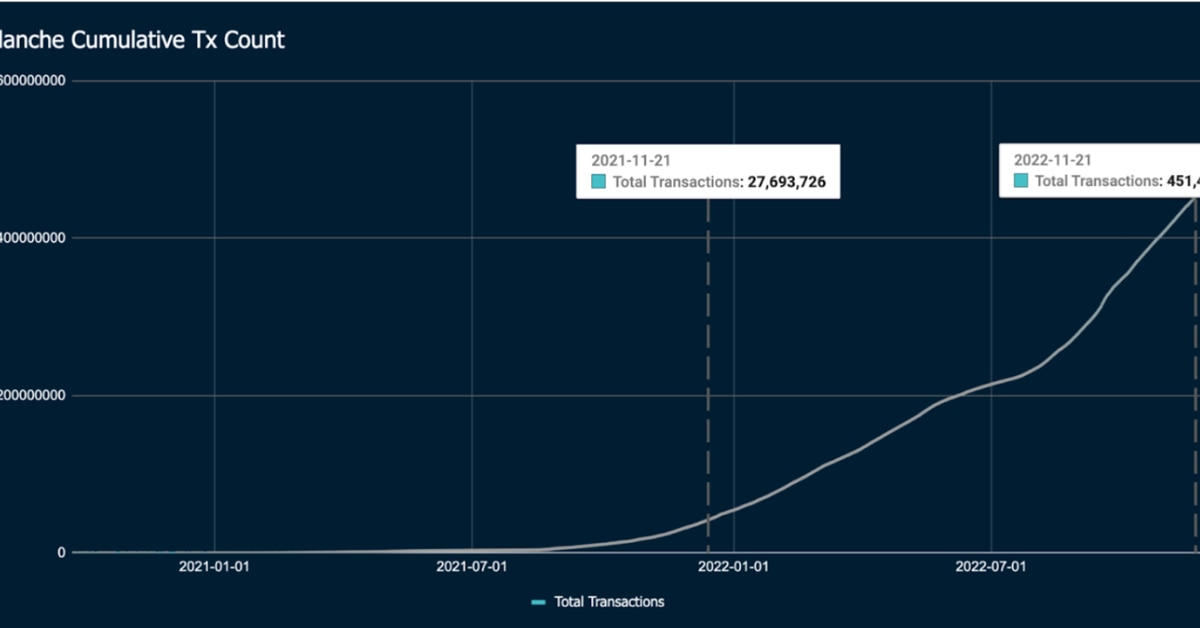

Avalanche Blockchain Saw 1,500% Transactional Growth in 2022: Nansen

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity…

Sam Bankman-Fried’s Super Bowl VPN Use Prompts Government Concern

The former FTX chief has being using privacy tools which prosecutors worry could be used to access the dark web. Source

Interest-Free Stablecoin Lender Liquity’s LQTY Token Surges 45% as Regulator Goes After Paxos’ BUSD

The protocol runs a two-token model like MakerDAO. The difference, however, is that Liquity doesn’t have a governance system. Therefore, large holders of LQTY cannot influence decision-making. The fully-decentralized setup also means the protocol’s original design cannot be altered to introduce centralized stablecoins, which have recently come under regulatory scrutiny, as new collateral. Source BUSDInterestfreeLenderLiquitysLQTYPaxosRegulatorStablecoinSurgesToken CryptoX Portal

Bitcoin miners already made nearly $600K from Ordinals’ NFT transactions

Bitcoin (BTC) miners have earned nearly $600,000 in two months from a new controversial NFT protocol called Ordinals that has triggered a surge in user activity. What are Bitcoin Ordinals? Ordinals allow users to inscribe data in the form of images and other media types in newly mined blocks on the Bitcoin blockchain that’s otherwise largely used for peer-to-peer monetary transactions. Fee spent on inscribing Ordinal NFTs on the Bitcoin blockchain. Source: Dune Analytics Since the launch of Ordinals in mid-December, however, users have inscribed nearly 74,000 NFTs into the Bitcoin…

Stablecoin Lender Liquity’s LQTY Token Surges 45% as New York Regulator Goes After Paxos’ BUSD

The protocol runs a two-token model like MakerDAO. The difference, however, is that Liquity doesn’t have a governance system. Therefore, large holders of LQTY cannot influence decision-making. The fully-decentralized setup also means the protocol’s original design cannot be altered to introduce centralized stablecoins, which have recently come under regulatory scrutiny, as new collateral. Source