In a blog post, Oasis, which develops multi-signature wallet software that the hacker deposited funds into, said whitehats recently notified it of “a previously unknown vulnerability in the design of the admin multisig access.” Following a Feb 21. Court order from the High Court of England and Wales, it exploited that vulnerability to take back the funds. Source

Day: February 24, 2023

CRYPTO Arbitrage between cryptocurrency exchanges DOGE + usdt |340$ FOR 15 minutes

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Buy crypto – Sell crypto – (without KYC 4 BTC) Hello all, in this video I will show … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Crypto Investors’ $28M ‘Black Thursday’ Lawsuit Against DeFi Giant Maker Dismissed by US Judge

But Peter Johnson, the lead plaintiff, claimed that Maker advertised the over-collateralization policy as a safeguard that caps losses at 13% and that the collateral would return to users. When ETH’s price sharply dropped in March 2020 during a market-wide crash, his position and that of many others on the platform were liquidated, Johnson alleged. Source

Ripple XRP News – 🚨WARNING🚨 THE SEC IS ATTACKING CRYPTO! STABLECOINS/TETHER! BITCOIN CRASH INCOMING

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Ripple XRP News: Latest News | Ripple XRP News Today #Ripple #XRP #Bitcoin ✓Buy Land In The Lux Lions Oasis … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

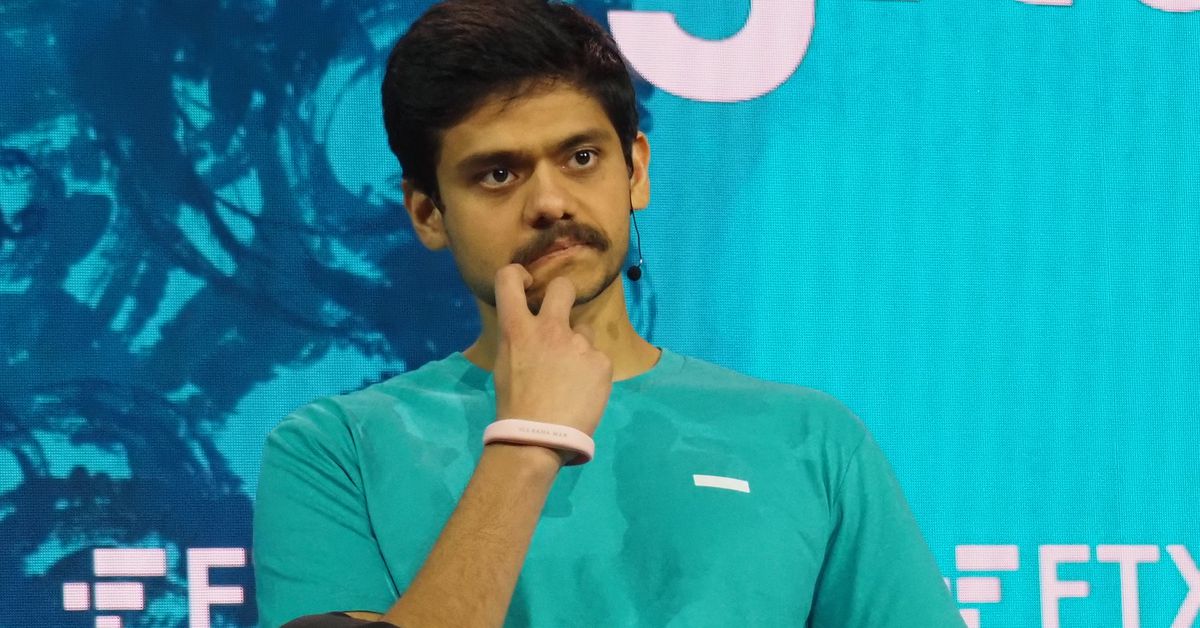

Sam Bankman-Fried’s lawyers request extension for bail condition proposal

Lawyers representing former FTX CEO Sam Bankman-Fried in federal court have requested an extension to file a proposal related to his bail conditions. In a Feb. 24 filing with the United States District Court for the Southern District of New York, Mark Cohen of Cohen & Gressler said the legal team wanted until March 3 to file a proposal for additional bail conditions for Bankman-Fried as well as find a suitable candidate to act as a technical expert in the case. The lawyers agreed to hire an expert following a…

Commodity Strategist Mike McGlone Predicts a Recession as Top Catalyst for Gold’s Rise Above $2,000 – Markets and Prices Bitcoin News

This week, Bloomberg Intelligence Senior Macro Strategist Mike McGlone shared his March outlook and noted that the “top catalyst” that could push gold above the $2,000-per-ounce range is a recession. McGlone further explained in an update about bitcoin and the Nasdaq that a key ingredient to force the U.S. Federal Reserve to pivot its stance is “a sharp drop in the stock market.” Mike McGlone Shares March Outlook for Precious Metals and Cryptocurrencies Gold and silver prices were lower this past week, with gold close to dropping below the $1,800-per-ounce…

Bitcoin on-chain data highlights key similarities between the 2019 and 2023 BTC price rally

Bitcoin’s (BTC) recent price rally from $16,500 to $25,000 can be attributed to a short squeeze in the futures market and recent macroeconomic improvements. However, while prices increased, data suggests that many interested buyers (including whales) were left on the sidelines. The recent rally to $25,000 shared many similarities with the 2019 bear market rally, which saw a 330% surge in Bitcoin’s price to highs around $14,000 from the November 2019 low at $3,250. Recently, the BTC/USD pair rose 60% from its November 2022 low. On-chain and market indicators relative…

IMF offers Jordan’s central bank recommendations for implementing retail CBDC

The Central Bank of Jordan is closer to its next step toward a retail central bank digital currency (rCBDC) with the completion of an International Monetary Fund (IMF) technical report on the country’s markets. The IMF conducted a three-month mission last year to assist the bank with preparations for a CBDC feasibility report. The IMF released its report Feb. 23. Working between July and September 2022, the IMF gave the country’s existing retail payment market a largely positive review, calling it well-integrated. Two nonbank payment service providers (PSPs) have “generally…

Token Offering of Asset Management Platform Factor Raises Roughly $7.6M

First among these changes was increasing the liquidity owned by the protocol for the USDC/FCTR pair on Camelot. When participating in the token generation event, users would deposit stablecoin USDC into the protocol in exchange for FCTR. Half of the USDC funds raised from the public sale will now be deployed into a liquidity pool that is owned by the protocol. Initially, only 40% was to be used for protocol owned liquidity. Source

Change lies ahead for haphazard crypto regulation

The World Wide Web, as its name implies, is borderless, and so is crypto. The internet and cryptocurrency’s common ethos is wide-open communication and exchange, unimpeded by national boundaries. On the ground, however, as crypto has become a more significant player in the financial system, nations have begun to consider issues of sovereignty and regulation. While many countries have so far remained open to crypto, others have restricted its use or outright banned it. The same reason that some have advocated for crypto and blockchain technology — as a means…