▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io VIP Chat + Alt-Coin Picks · BITGET Get Up to $5000 In Bonuses … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Month: February 2023

Coinbase Account Full Verified | Coinbase Account Kivabe Khulbo | Coinbase Account Verify | Bitcoin

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin | Coinbase Account Full Verified | Coinbase Account Kivabe Khulbo | Coinbase Account Verify Problem Coinbase Account … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Citizens Trust Bank to Hold $65 Million in USDC Reserves as Circle Expands Bank Partnerships – Bitcoin News

On Friday, the cryptocurrency firm and stablecoin issuer Circle announced that the financial institution Citizens Trust Bank will hold $65 million in usd coin cash reserves. Circle said the move is part of the company’s plan to allocate shares of the stablecoin’s denominated reserves to minority-owned depository institutions (MDIs) and community banks across the United States. Circle Partners With Atlanta-Based Citizens Trust Bank The digital currency firm Circle has announced that Atlanta-based Citizens Trust Bank, founded in 1947, will hold $65 million in usd coin (USDC) reserves. This move follows…

Oasis Exploits its Own Wallet Software to Seize Crypto Stolen in Wormhole Hack

In a blog post, Oasis, which develops multi-signature wallet software that the hacker deposited funds into, said whitehats recently notified it of “a previously unknown vulnerability in the design of the admin multisig access.” Following a Feb 21. Court order from the High Court of England and Wales, it exploited that vulnerability to take back the funds. Source

CRYPTO Arbitrage between cryptocurrency exchanges DOGE + usdt |340$ FOR 15 minutes

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Buy crypto – Sell crypto – (without KYC 4 BTC) Hello all, in this video I will show … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Crypto Investors’ $28M ‘Black Thursday’ Lawsuit Against DeFi Giant Maker Dismissed by US Judge

But Peter Johnson, the lead plaintiff, claimed that Maker advertised the over-collateralization policy as a safeguard that caps losses at 13% and that the collateral would return to users. When ETH’s price sharply dropped in March 2020 during a market-wide crash, his position and that of many others on the platform were liquidated, Johnson alleged. Source

Ripple XRP News – 🚨WARNING🚨 THE SEC IS ATTACKING CRYPTO! STABLECOINS/TETHER! BITCOIN CRASH INCOMING

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Ripple XRP News: Latest News | Ripple XRP News Today #Ripple #XRP #Bitcoin ✓Buy Land In The Lux Lions Oasis … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

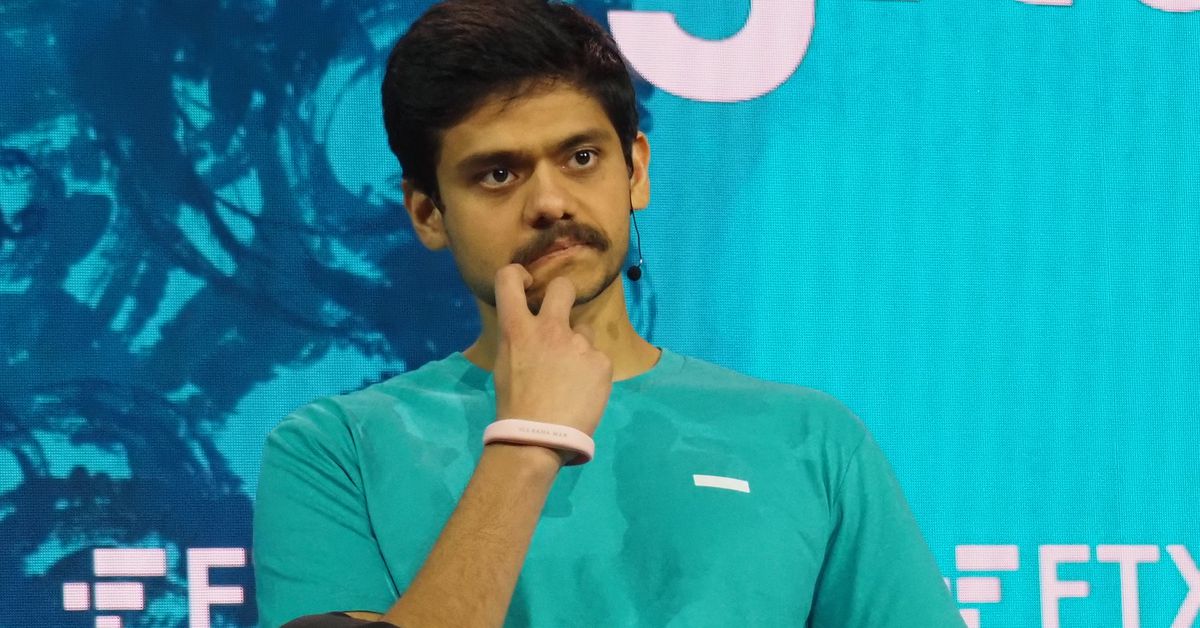

Sam Bankman-Fried’s lawyers request extension for bail condition proposal

Lawyers representing former FTX CEO Sam Bankman-Fried in federal court have requested an extension to file a proposal related to his bail conditions. In a Feb. 24 filing with the United States District Court for the Southern District of New York, Mark Cohen of Cohen & Gressler said the legal team wanted until March 3 to file a proposal for additional bail conditions for Bankman-Fried as well as find a suitable candidate to act as a technical expert in the case. The lawyers agreed to hire an expert following a…

Commodity Strategist Mike McGlone Predicts a Recession as Top Catalyst for Gold’s Rise Above $2,000 – Markets and Prices Bitcoin News

This week, Bloomberg Intelligence Senior Macro Strategist Mike McGlone shared his March outlook and noted that the “top catalyst” that could push gold above the $2,000-per-ounce range is a recession. McGlone further explained in an update about bitcoin and the Nasdaq that a key ingredient to force the U.S. Federal Reserve to pivot its stance is “a sharp drop in the stock market.” Mike McGlone Shares March Outlook for Precious Metals and Cryptocurrencies Gold and silver prices were lower this past week, with gold close to dropping below the $1,800-per-ounce…

Bitcoin on-chain data highlights key similarities between the 2019 and 2023 BTC price rally

Bitcoin’s (BTC) recent price rally from $16,500 to $25,000 can be attributed to a short squeeze in the futures market and recent macroeconomic improvements. However, while prices increased, data suggests that many interested buyers (including whales) were left on the sidelines. The recent rally to $25,000 shared many similarities with the 2019 bear market rally, which saw a 330% surge in Bitcoin’s price to highs around $14,000 from the November 2019 low at $3,250. Recently, the BTC/USD pair rose 60% from its November 2022 low. On-chain and market indicators relative…