Hong Kong’s rapid adoption of cryptocurrencies and Web3 is a sign of some “big moves” happening in mainland China, a co-founder of the local game software firm Animoca believes. The current crypto trend in Hong Kong is “not really just about” the city-state, but about wider China, despite mainland China banning crypto, according to Animoca co-founder Yat Siu. Speaking at the EthCC conference on July 19, Siu mentioned that China released its Web3 white paper in May, in which the government “basically indicated that Web3 is the future of the…

Day: July 19, 2023

BNB Chain Burns Nearly 2M BNB Tokens

BNB uses an auto-burn system that aims to reduce its total supply to 100 million BNB, from the original 200 million BNB, over time. The auto-burn mechanism adjusts the amount of BNB to be burned based on BNB’s price and the number of blocks generated on the BNB Smart Chain (BSC) during the quarter. Source

Marinade Finance, Solana’s Largest Protocol, Bets on ‘Native’ SOL Staking Product for Growth

The protocol’s new service, called Marinade Native, eliminates the smart contract risk of swapping SOL for mSOL while preserving the expected yield of around 7%, developers say. That’s because users retain custody of their SOL as opposed to receiving what amounts to a yield-infused depository receipt. Source

Celsius could repay all claims if Bitcoin, Ether prices rose 2X — Simon Dixon

Bankrupt crypto lender Celsius is battling a Chapter 11 bankruptcy with billions of dollars in claims made by various parties. A new estimate by the Bank of the Future suggests that the troubled crypto lender could likely repay the claims if the price of Bitcoin (BTC) and Ether (ETH) — two assets held by the firm — doubled their current market prices. Simon Dixon, the founder of Bank of the Future — a crypto-centered investment firm — tweeted the estimated price BTC and ETH would need to reach for Celsius…

Litecoin halving is 13 days away — So where is the LTC price rally?

Bitcoin (BTC) is still almost a year away from its next block reward halving, but Litecoin (LTC) miners are already bracing for impact. In less than two weeks, Litecoin’s block subsidy will drop from 12.5 LTC to 6.25 LTC per block. Whales stock up on LTC — but BTC value stays weak Despite its fair share of controversy, Litecoin remains the 12th largest cryptocurrency by market cap at around $6.8 billion. Its miners currently rake in 7,200 LTC in block rewards daily, equal to a U.S. dollar value of around…

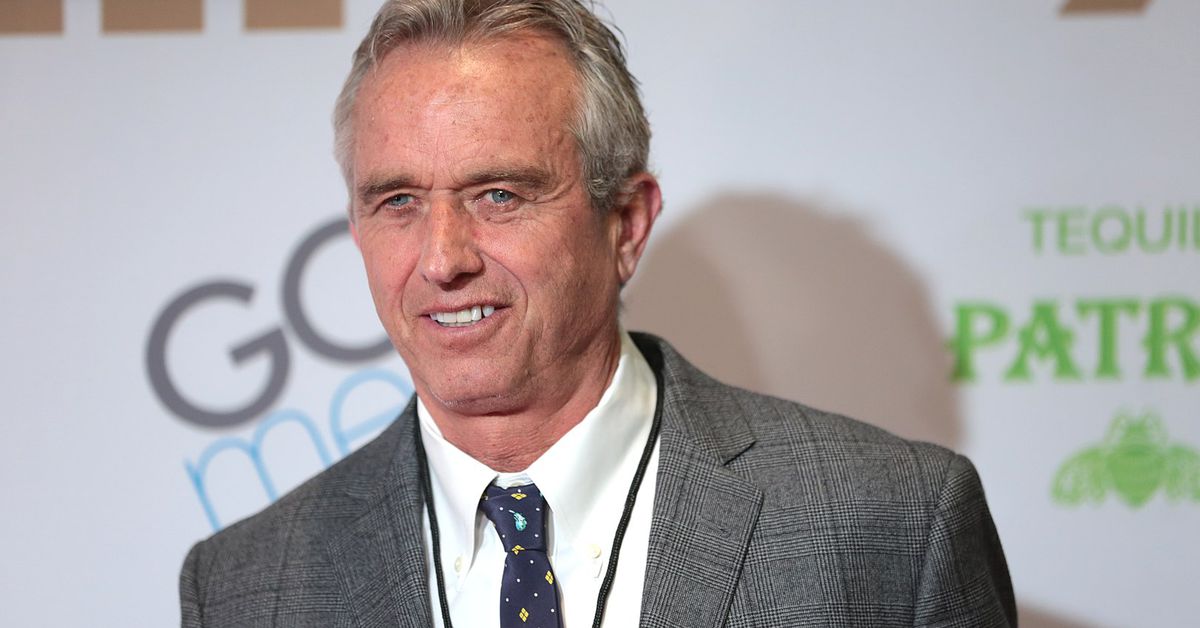

Democratic Presidential Candidate RFK Jr. Vows to Exempt Bitcoin From Capital Gains Tax if Elected

“Backing dollars and U.S. debt obligations with hard assets could help restore strength back to the dollar, rein in inflation and usher in a new era of American financial stability, peace and prosperity,” said Kennedy. He would start the process, he said, “very, very small, perhaps 1% of issued T-bills” would be backed by hard currencies like gold, silver platinum or bitcoin. Source

GOP Lawmakers Suggest Gensler’s SEC Is Gaming News Cycle to Thwart Crypto Legislation

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity…

Open Interest on XRP Futures Climbs to 2023 High

Open interest, or the number of unsettled futures contracts, has risen 21% since Tuesday. Higher open interest is a sign of increased bets on any asset, such as tokens or stocks, as it suggests an inflow of new money into a financial market – usually meaning a current trend is expected to continue. Source

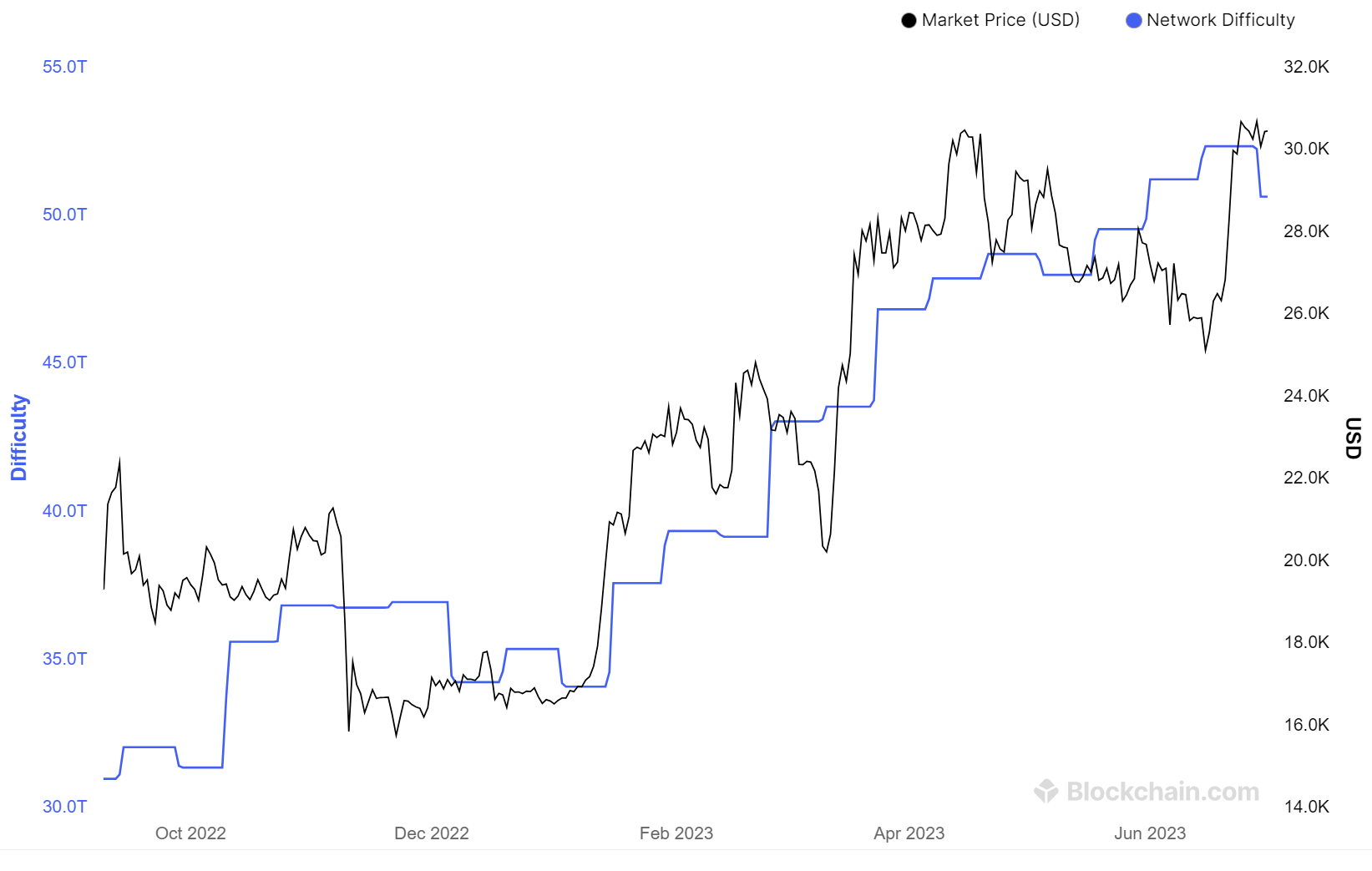

Bitcoin miners hedging with recent sell-offs: Bitfinex report

Bitcoin (BTC) mining companies are employing derisking strategies by offloading BTC to exchanges, according to a market report from Bitfinex. The cryptocurrency trading platform’s latest newsletter addresses the Bitcoin mining sector at length, highlighting a recent surge in miners selling large volumes of BTC to exchanges. This has led to a corresponding increase in the value of shares in Bitcoin mining companies as institutional interest in BTC picks up in 2023. The report notes that Poolin has accounted for the highest amount of BTC sold to the market in recent…

Bitcoin miners hedging with recent sell-offs

Bitcoin (BTC) mining companies are employing derisking strategies by offloading Bitcoin to exchanges, according to a market report from Bitfinex. The cryptocurrency trading platform’s latest newsletter addresses the Bitcoin mining sector at length, highlighting a recent surge in miners selling large volumes of BTC to exchanges. This has led to a corresponding increase in value of shares in Bitcoin mining companies as institutional interest in BTC picks up in 2023. The report notes that Poolin has accounted for the highest amount of BTC sold to the market in recent weeks. Bitfinex…