Top Stories This Week Larry Fink, the CEO of BlackRock, has recently delivered pro-crypto remarks, claiming “Bitcoin is an international asset” and suggesting U.S. regulators consider how an ETF directly linked to Bitcoin could democratize finance in the country. Under Fink, BlackRock has attempted to launch a spot BTC ETF with crypto exchange Coinbase acting as a surveillance partner. It’s unclear if the U.S. Securities and Exchange Commission (SEC) will approve the investment vehicle, given its track record of rejecting all previously filed spot BTC ETF applications to date. Gemini…

Day: July 8, 2023

Circle, Tether freezes over $65M in assets transferred from Multichain

Stablecoin issuers Circle and Tether have frozen over $65 million in assets tied to the suspected exploit of cross-chain router protocol Multichain. The move follows unexplained large outflows from the Multichain MPC bridge on July 6. According to the knowledge graph protocol 0xScope, three addresses that received at least $63.2 million in USD Coin (USDC) from Multichain are now frozen. Another report from the Fantom Foundation notes that more than $2.5 million in Tether (USDT) had also been frozen from two addresses listed by Etherscan as “Multichain Suspicious Addresses”. Over…

What is prompt engineering, and how does it work?

Prompt engineering has become a powerful method for optimizing language models in natural language processing (NLP). It entails creating efficient prompts, often referred to as instructions or questions, to direct the behavior and output of AI models. Due to prompt engineering’s capacity to enhance the functionality and management of language models, it has attracted a lot of attention. This article will delve into the concept of prompt engineering, its significance and how it works. Understanding prompt engineering Prompt engineering involves creating precise and informative questions or instructions that allow users to…

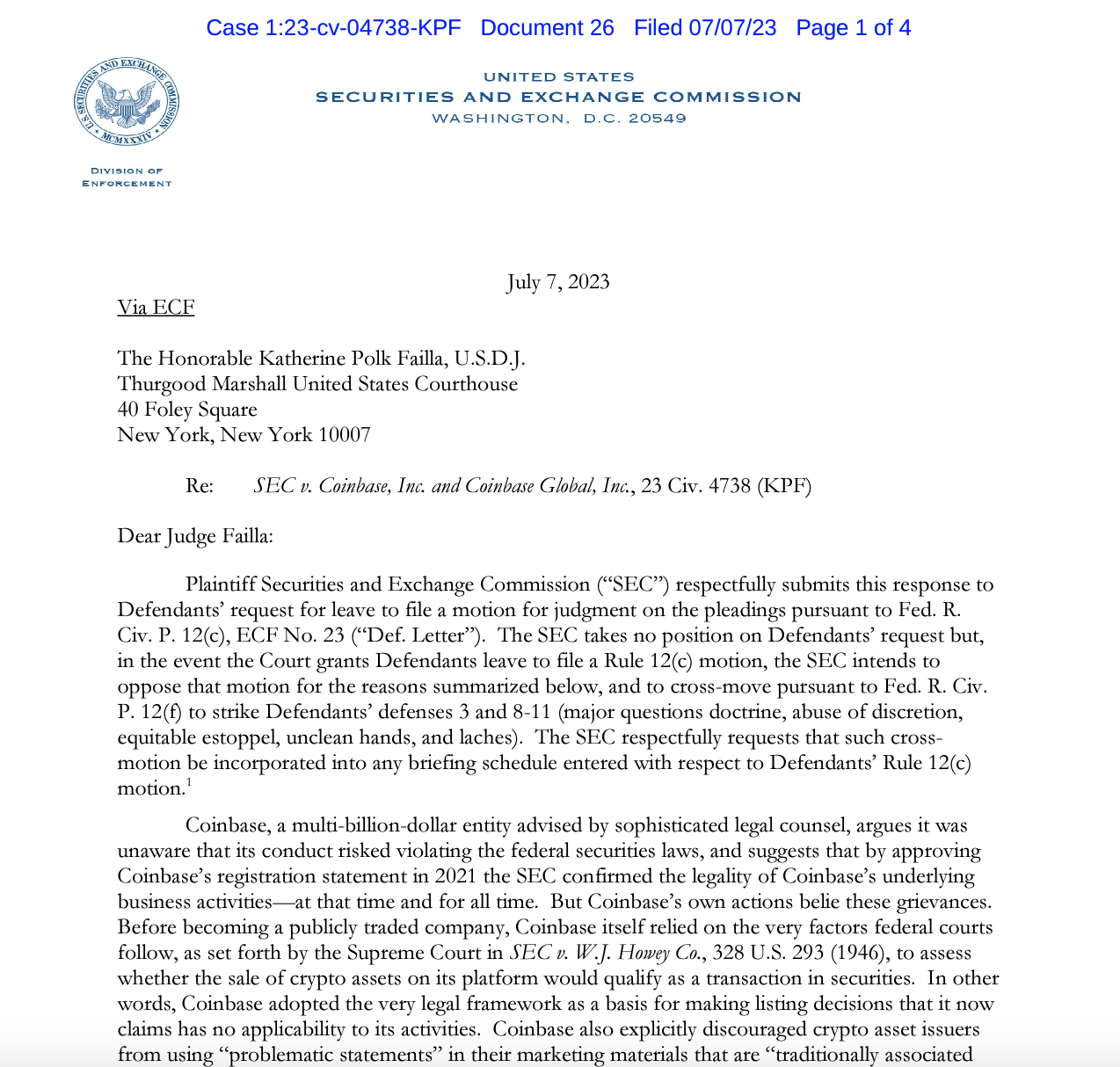

Coinbase was aware of securities law violations, SEC claims in letter

The United States Securities and Exchange Commission (SEC) filed a response to Coinbase’s claims that the regulator lacks jurisdiction to prosecute the crypto exchange. According to a letter sent by the SEC to a district judge on July 7, Coinbase had knowledge of the probability that federal securities laws would apply to its operations, openly informing its shareholders about the possibility of assets traded on its platform being classified as securities. “Since becoming a public company, Coinbase has repeatedly informed its shareholders of the risk that the crypto assets traded on…

Coinbase was aware of securities law violations, the SEC claims in letter

According to a letter sent by the SEC on July 7 to a district judge, Coinbase had knowledge of the probability that federal securities laws would apply to its operations, openly informing its shareholders about the possibility of assets traded on its platform being classified as securities. “Since becoming a public company, Coinbase has repeatedly informed its shareholders of the risk that the crypto assets traded on its platform could be deemed securities and therefore that its conduct could violate the federal securities laws,” reads the regulator’s response. As per…

Tether freezes USDT addresses linked to the $130 million Multichain exploit

Tether Holdings, the issuer of the USDT stablecoin, has frozen two addresses on the Ethereum network that received funds from Multichain’s multi-party computation (MPC) address. The two addresses, currently flagged by Ethereum block explorer Etherscan as “Multichain suspicious addresses,” are claimed to collectively hold about 2.53 million USDT. Tether has frozen 2 addresses on Ethereum that hold about 2.53 million USDT: 0x9d5…2b68, 0x48B…4537. Both of these addresses have received funds from the Multichain team’s MPC address and are currently flagged by Etherscan as “Multichain Suspicious Addresses.”… — Wu Blockchain (@WuBlockchain)…

What is The Graph, and how does it work?

The Graph (GRT) is a decentralized cryptocurrency with multiple use cases and a community-driven, open ecosystem that provides indexing and query options to developers building DApps. The Graph utilizes blockchain technology and a sophisticated indexing protocol to facilitate more efficient blockchain data querying. It first enables DApps to augment Ethereum with data via smart contract transactions. The Graph uses GraphQL technology, in particular, to describe each API’s data in detail. Graph Nodes perform the initial stage of data aggregation. They are the network’s backbone and scan smart contracts. The Graph…

XRP prices and revenue from XRPL surged in Q2 2023

The recent Q2 2023 On-Chain Report from Messari highlighted advancements in XRP and XRP Ledger (XRPL). XRP, the native to the XRPL and used for fees and wallet reserves, has seen its prices rise by over 50% this year. Messari reports that this year, 42.5% of XRP’s market value growth was in Q1 2023. Despite a drop in XRP prices in May, the coin recovered in June but did not surpass its March 2023 highs. The analytics firm also notes that the ongoing legal dispute between Ripple and the United…

Winklevoss slams Silbert, Twitter’s double-edged sword and more

Twitter’s plans to roll out a payment platform took a major step forward this week as its subsidiary, Twitter Payments, received its first money transmitter licenses in the United States states of Michigan, New Hampshire and Missouri. The company — reportedly building a solution with crypto in mind — is seeking to provide transfer services in all 50 U.S. states, with further approvals still pending and no clear timeline in place. As with every business, Twitter is seeking new sources of revenue supported by its massive user base. In a…

institutional investors accumulated more bitcoin in June

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied According to Ark Invest’s Bitcoin Monthly report for June 2023, there has been a significant increase in bitcoin (BTC) stored on over-the-counter (OTC) trading desks. This suggests that institutional investors are more interested in buying the cryptocurrency as they consider it a safe and secure investment. Bitcoin attracting more institutional investors The report also sheds light on the company’s earnings and details on-chain activity, transparency, and accessibility of blockchain data. According to their evaluation, there has…