FTX’s efforts to claw back customer funds are continuing. Alameda Research and FTX filed suit on July 19 seeking the return of $71.6 million in allegedly commingled corporate and customer funds related to investments and donations to life sciences companies. The defendants in the suit are six life sciences companies, the FTX Foundation philanthropical organization, the Latona Biosciences Group “sham” nonprofit, former FTX CEO Sam Bankman-Fried, FTX Foundation head Nicholas Beckstead and Latona head Ross Rheingans-Yoo. The suit claims that the FTX Foundation and Latona donated or invested funds in…

Day: July 20, 2023

Former Binance.US CEO joins Hashdex board

Brian Brooks, former acting comptroller of the currency for the United States government, has joined the board of directors for crypto-focused asset manager Hashdex. In a July 20 announcement, Hashdex said Brooks had become the fifth member of its board and will serve as a strategic adviser to the firm. Brooks was the chief legal officer of Coinbase from 2018 to 2020, served as acting comptroller of the currency from 2020 to 2021, worked as the CEO of Binance.US for roughly four months and was the CEO of Bitfury from…

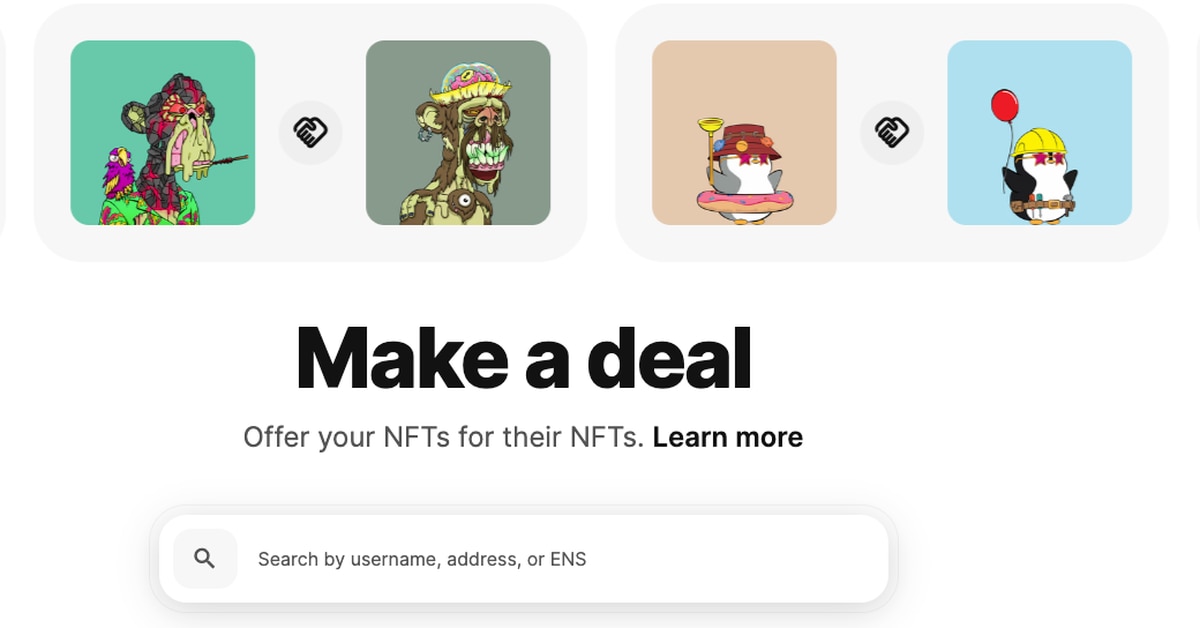

OpenSea Makes ‘Deals,’ Launches Peer-to-Peer NFT Swaps

The new feature allows collectors to trade NFTs directly with each other as well as add WETH to “sweeten the deal.” Source

Possible identities of AnubisDAO rug pull suspects revealed

Two years ago, AnubisDAO was rug-pulled for about $60 million worth of Ethereum (ETH) and funds were never recovered. However, the blockchain never forgets and block analysts have been keeping an eye on Anubis exploiter wallets. New on-chain analysis by ZachXBT may have revealed who the scammers are. Deeper analysis reveals possible identity of exploiters An analysis done by ZachXBT, an on-chain analyst, shows that the funds ended up in two exchange deposit addresses. These addresses are 0x51da686c7a2f973ad11fafed6ce9a3ffc020349f, herein marked as (1) and 0x253d7ba533b7d13720fb5ec5a7d1e64d4ff3f58b, herein labeled as (2). 1/ Here…

Terraform Labs seeks access to FTX wallets in fraud defense

Terraform Labs is seeking permission from a judge to subpoena data from bankrupt crypto exchange FTX, claiming the information could help its defense against a lawsuit brought by the United States Securities and Exchange Commission in February, a court filing shows. In a search for evidence that could back its defense from fraud charges, Terraform’s lawyers filed a motion on July 19 in FTX’s bankruptcy case to access the company’s information about digital wallets used by short sellers between March and May 2022. Terraform claims its stablecoin failure was a…

Why Nasdaq Backing Out of Custody Is Bad, Bad News for Crypto

Notably, in February, the SEC voted to expand its existing regulations over all trading and lending firms by requiring them to keep customer assets with “qualified custodians,” meaning chartered bank or trust companies, SEC-registered broker-dealers or Commodity Futures Trading Commission (CFTC) derivatives merchants. Crypto speaks about the proposal as the “custody rule.” Source

XRP price can fall 40% by September — Fractal analysis

The double-digit percentage gains for XRP (XRP) this month may have reached the exhaustion point, reflecting the trends elsewhere in the cryptocurrency market. This follows the euphoria surrounding Ripple’s partial win versus the U.S. Securities and Exchange Commission, resulting in bullish calls for as high as $15 in the coming months. $15 is reasonable I believe over 18 months or so. If they IPO and time it correctly, could be up to $35 imo. Make no mistake… it may not go that high… but $XRP IS breaking an all time…

MakerDAO Votes to Halt Lending to Tokenized Credit Pool After $2M Loan Default

The embattled Harbour Trade credit pool minted $1.5 million of DAI stablecoin secured with loans to a consumer electronics firm, which defaulted on $2.1 million of debt. Source

UK financial watchdog announces launch of permanent Digital Sandbox in August

The United Kingdom’s Financial Conduct Authority (FCA) has announced the launch of its Digital Sandbox, aimed at supporting tech firms in the early stages of product development. In a July 20 announcement, the FCA said the Digital Sandbox will become available on a permanent basis starting on Aug. 1. The financial watchdog conducted two pilot programs of the initiative, which will be open to businesses, startups and data providers — including those involved in banking, investment, lending and payments. A sandbox allows projects to operate in a testing environment to…

The UK Financial Conduct Authority Is Designing Prudential Requirements for Firms Carrying out Crypto Activities

The regulator, which is in charge of maintaining a registry of crypto firms approved for operations under the country’s anti-money laundering requirements, will also consult on prudential rules for companies engaged in crypto activities once the “Treasury and Parliament bring those activities under our regulation,” the regulator said in its annual report published Thursday. Source