“Deposit-taking institutions and insurers need clarity on how to treat crypto-asset exposures when it comes to capital and liquidity,” said Peter Routledge, Superintendent of Financial Institutions, in a statement. “We look forward to giving them this clarity through these new guidelines that reflect industry input and international standards.” Source

Day: July 26, 2023

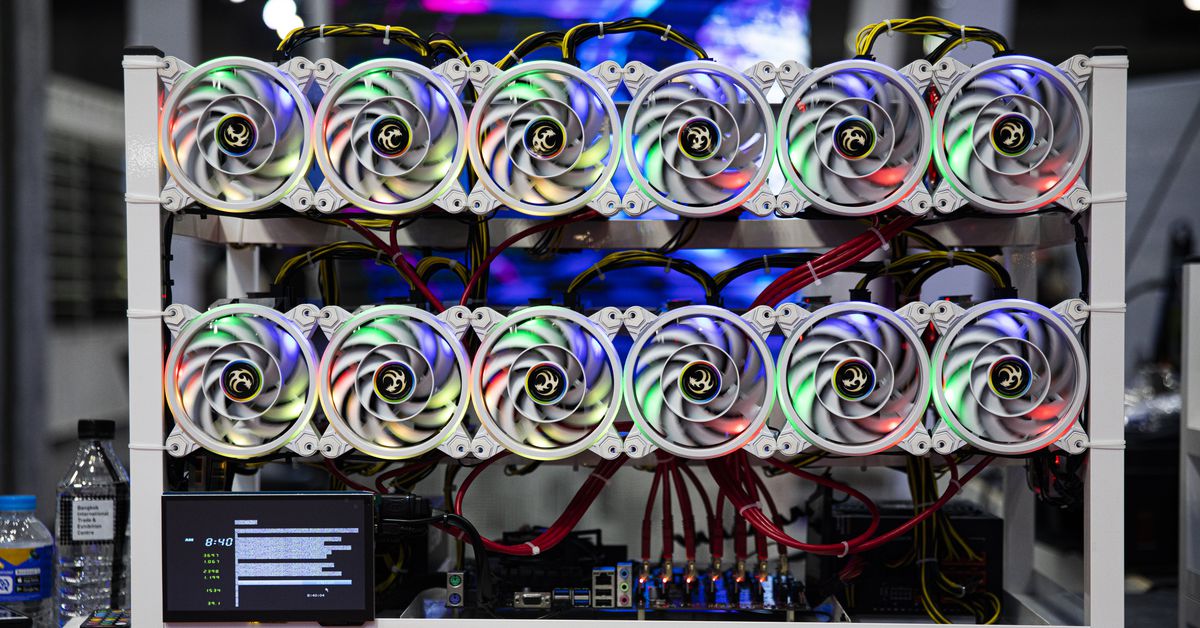

Bitcoin Miners Buy up Rigs as Prices Near All-Time Lows

Mining rigs are getting cheaper mainly due to a decline in bitcoin’s hashprice, the revenue miners generate per terahash of computing power. This measure of profitability, which factors in Bitcoin’s network difficulty, price, energy costs, block subsidies and transaction fees, has been “choppy and steadily decreasing” in the past year, Harper said. Original

EOS Foundation to sue Block.one on failure to honor $1B commitment

The EOS Network Foundation (ENF) is the latest entity to initiate legal action against major investor Block.one (B1) over failure to honor $1 billion investment commitments. On July 25, ESN founder and CEO Yves La Rose took to Twitter to announce that the ESN is preparing a lawsuit against B1 for “failure to follow through on its $1B commitment.” The CEO mentioned that Block.one is already working to settle another class action lawsuit for $22 million, after rejection of a proposed $27.5 million settlement with lead plaintiff Crypto Assets Opportunity.…

LayerZero Crosses This Significant Milestone, But Is An Airdrop Coming?

Cross-Chain communication protocol platform LayerZero has crossed 50 million cross-chain messages, as revealed by the platform on Tuesday, July 25. This significant milestone proves the massive trading activity and cross-chain token swaps that happen across several chains daily. LayerZero’s Impressive Growth The ‘50-million cross-chain messages’ is undoubtedly a testament to how much LayerZero has achieved in the space. Due to the project’s disruptive vision, it has received enormous backing from some of the ecosystem’s biggest Venture Capitalists (VC). Three months ago, LayerZero raised $120 million from prominent backers like auction…

Italian central bank backs DeFi tokenization project with Polygon, Fireblocks

The Bank of Italy’s Milano Hub innovation center will provide support for a project developed by Cetif Advisory to research a security token ecosystem for institutional decentralized finance (DeFi). The project has no “commercialisation purpose,” but will extend “the scope of analysis” of security tokens on secondary markets. Security tokens are digitized representations of the ownership of real-world assets. Cetif Advisory general manager Imanuel Baharier said in a statement: “We believe it is vitally important to create the conditions for DeFi to become a safe and open operating environment for…

Bank of Italy Taps Decentralized Finance Project of Polygon (MATIC), Fireblocks to Help Banks Dabble With Tokenized Assets

Cetif Advisory, a consultancy spinoff of the Università Cattolica del Sacro Cuore of Milan’s Cetif Research Centre, will lead the platform’s development, coordinating the efforts of Polygon Labs, Fireblocks, tech developer Reply, legal and tax consultant Linklaters and web3 studio DVRS. Source

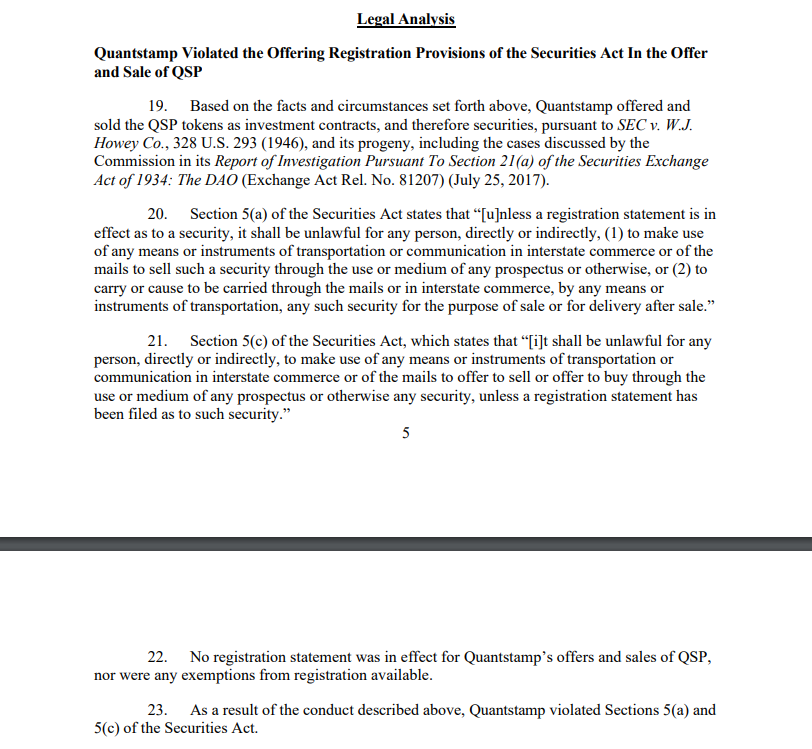

SEC files charges against Quantstamp for $28M initial coin offering

Blockchain security firm Quantamp is set to return $28 million raised in a 2017 initial coin offering following charges brought by the United States Securities and Exchange Commission (SEC). The U.S. agency announced that it had formally charged the California-based firm on July 21 for conducting an unregistered initial coin offering of “crypto asset securities”. According to the statement from the SEC, Quantstamp agreed to settle the charges. The SEC’s order outlines how Quantstamp’s ICO, which took place in October and November 2017, raised over $28 million by selling its…

The Ever More Efficient Bitcoin Mining Machine

A recent report by Coin Metrics has news for fans of energy efficiency: ASIC miners overall are reducing their energy consumption per coin produced. But which are the most efficient? For Mining Week, CoinDesk dug deeper to determine which of 11 popular mining machines were the most competitive. Original

It’s Time for Publicly-Traded Miners to Stop With the Gimmicks

While capital is useful, equity markets are not dissimilar to the token markets many miners disparage. Retail investors huddle in Telegram groups, poking and prodding for updates from each firm, urging one another to “hodl” the stock or trust the executives on the ground, only for the leadership team to dilute stocks to worthless drivel, purchase ASICs at the top or fail to hedge energy contracts (believe me, these are not uncommon occurrences). The real vice here: marketing. Source

TD Cowen analyst just made a risky buy call on a bitcoin play

Investors looking for ways to bet on crypto should look closer at a software company with a unique balance sheet, according to TD Cowen. Analyst Lance Vitanza initiated coverage of MicroStrategy at outperform, saying in a note to clients on Wednesday that the stock was the “best way for institutions to acquire exposure to bitcoin.” “MSTR is a leading provider of [business intelligence] software, but with a twist: it uses all its retained earnings – and then some – to buy and hold bitcoins. This is not a short-term trading…