ETH was recently changing hands at $1,857, off 1.2% from Sunday. Ether has been narrowly range-bound over the past seven days between $1,840 and $1,890. SOL and MATIC, the token of the smart contracts Solana and Polygon platforms, were recently off 4.5% and 4.2%, respectively, over the past 24 hours. Popular memecoin DOGE off 3.7%, respectively. The broader CoinDesk Market Index (CMI) recently moved 0.9% lower for the day. Original

Day: July 30, 2023

Vyper vulnerability exposes DeFi ecosystem to stress tests

Decentralized finance (DeFi) protocols are undergoing a stress test following a critical vulnerability was found on versions of Vyper programming language, resulting in the theft of millions of dollars’ worth of cryptocurrencies on July 30. A number of pools using Vyper 0.2.15, 0.2.16 and 0.3.0 have been exploited due to a malfunctioning reentrancy lock, targeting at least four liquidity pools on Curve Finance protocol. “The short answer is that everything that could be drained was drained. The targeted pools are aETH/ETH, msETH/ETH, pETH/ETH and CRV/ETH. All remaining pools are safe…

Curve Finance Exploit Puts $100M+ Worth of Crypto at Risk; CRV Token Tumbles

Upwards of $100 million worth of cryptocurrency are at risk due to a “re-entrancy” bug in Vyper, a programming language used to power parts of the Curve system. Several stablecoin pools on the platform — used for pricing and liquidity on a number of different DeFi services — have been drained by hackers so far. Source

Litecoin halving approaching, Cardano building as Borroe presale progresses

Next week, the crypto industry will closely follow the Litecoin (LTC) halving, which takes place every four years. Experts are monitoring the potential outcomes with interest. At the same time, investors are exploring Borroe and its prospects for 2023 as Cardano (ADA) continues to grow and develop. >>Buy ROE tokens now<< Litecoin halving approaching The Litecoin halving is scheduled for on or around August 2, 2023. It could impact LTC prices and the broader crypto ecosystem. After halving, miner block rewards will drop from 12.5 to 6.25 LTC. Historically, prices…

Curve Finance pools exploited in over $24M due to reentrancy vulnerability

Several stable pools on Curve Finance using Vyper were exploited on July 30, with losses reaching $24 million at the time of writing. According to Vyper, its 0.2.15, 0.2.16 and 0.3.0 versions are vulnerable to malfunctioning reentrancy locks. “The investigation is ongoing but any project relying on these versions should immediately reach out to us,” Vyper wrote on X. We’re running a large white hat rescue operation. Please reach out if you think you’re affected as a project. https://t.co/tssWcRHg35 — sudo rm -rf –no-preserve-root / (@pcaversaccio) July 30, 2023 According…

DOGE, MKR, OP and XDC gather strength as Bitcoin price remains range-bound

Bitcoin (BTC) has been stuck in a narrow range for the past several days. A minor positive is that the range has formed near the recent local high. This suggests that the bulls are not rushing to the exit as they anticipate another leg higher. Bitcoin’s consolidation has pulled its market dominance to 48% from over 50% on June 30. This shows that market participants have been gradually shifting their focus to select altcoins, which are starting to move up. Crypto market data daily view. Source: Coin360 However, an altcoin…

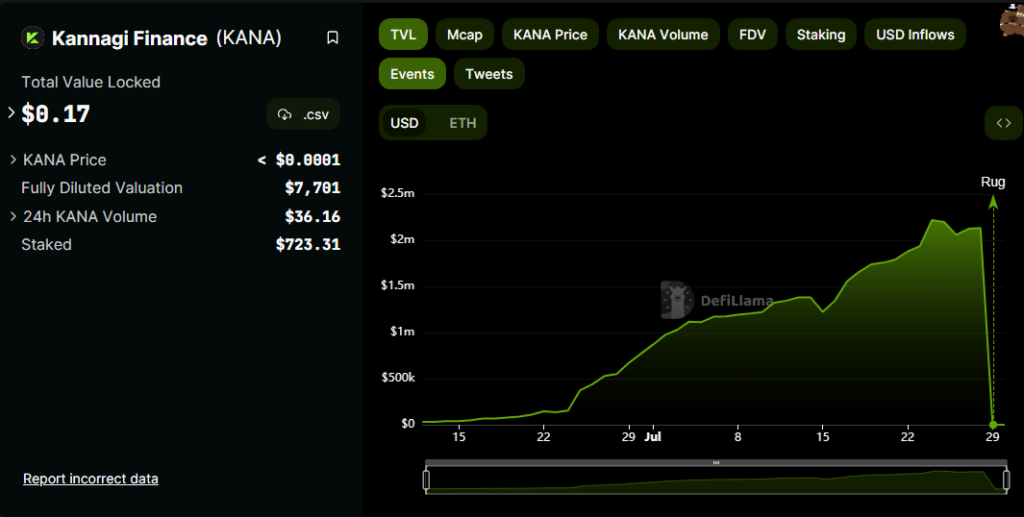

zkSync Era’s Kannagi Finance rug pulls and steal $2.13m

Kannagi Finance, a decentralized yield aggregator, has rug pulled with an estimated $2.13 million of investor funds. According to the blockchain security company, Peckshield, Kannagi Finance erased its digital footprint after bolting with more than $2 million worth of investors’ funds. Its official website, along with social media and communication channels, are offline. A rug pull refers to a form of scam where developers of a cryptocurrency project unexpectedly pulls liquidity from a pool, leading to sharp losses. German blockchain security firm, SolidProof, audited Kannagi’s smart contract. However, it has…

Alibaba, silver, gold, Bitcoin, Ethereum: Mike Novogratz’s ideal portfolio

Galaxy Digital’s founder Mike Novogratz shared what an ideal investment portfolio would look like for a young and high-risk tolerance investor during an interview with Bloomberg Wealth, saying that he’d invest in the Chinese giant Alibaba, silver, gold, Bitcoin (BTC), and Ethereum (ETH). “If they were young and had a high-risk tolerance, I’d be buying Alibaba stock. I’d be buying silver, gold, Bitcoin and Ethereum. That’d be my portfolio,” he said in allusion to someone investing $100,000. For those with lower risk tolerance, he recommended allocating only 30% of a…

SEC Chair Gary Gensler Blasts Crypto Exchanges, Avoids Issue of Appeal in Landmark Ripple Ruling

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler is once again sounding the alarm on crypto exchanges, saying that the platforms are not working in the best interests of their users. In a new Bloomberg interview, Gensler says that companies issuing crypto tokens are not being 100% honest with their investors. The SEC chair zeroes in on crypto exchanges, saying that the centralized platforms are operating in an unacceptable manner by taking advantage of their users. “A lot of investors should be aware, it’s not only a highly speculative…

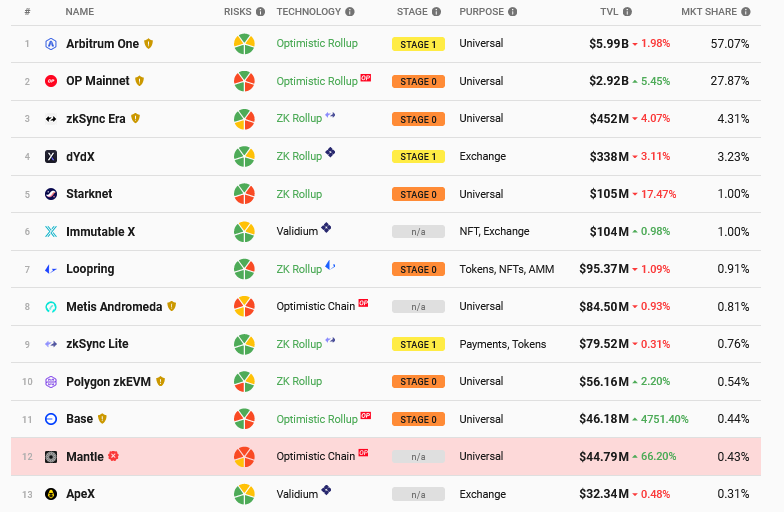

Base’s TVL spikes 48X on BALD meme coin frenzy

The total value locked (TVL) of Base, an Optimism-based layer-2 platform for Ethereum, is surging, increasing by 48X, partially attributed to the frenzy surrounding the BALD meme coin. As of July 30, Base’s TVL stands at $46.18 million, surpassing competitors Mantle and Apex, and closing in on Polygon’s zkEVM, which has a TVL of $56 million. Base TVL: L2Beat The BALD meme coin, inspired by Brian Armstrong, the founder of Coinbase, has played a significant role in driving the transaction count on Base. Since launching on July 29, BALD prices have…