Bitcoin (BTC) has been trading in a tight range for quite some time now, with bulls and bears engaged in a tug-of-war over key support and resistance levels. The recent move above $29,500 has provided some hope for the bulls, but so far, they have been unable to gather enough momentum to push prices higher. Bitcoin Struggles To Break Above Key Moving Average According to Material Indicators, a leading market analysis firm, the key to a bullish breakout in the BTC market is for the coin to print candles above…

Month: July 2023

German government watchdog launched Worldcoin probe in November 2022: Report

The Bavarian State Office for Data Protection Supervision, or BayLDA, reportedly began an investigation into human identity verification project Worldcoin based on concerns over biometric data. According to a July 31 Reuters report, the German data watchdog launched a probe into Worldcoin’s activities starting in November 2022. Worldcoin, a project started with the intention of distinguishing real people from bots by providing retinal scans for identity verification, had more than 2 million sign-ups prior to the launch of its token in July. This retinal scan data reportedly drew the attention…

Price analysis 7/31: SPX, DXY, BTC, ETH, XRP, BNB, ADA, DOGE, SOL, LTC

Bitcoin’s record low volatility is also a sign that the next price breakout will be volatile, but everyone is guessing which direction the price will go and how it will impact altcoins. The S&P 500 Index continued its march toward its all-time high with a 3% gain in July. Signs of receding inflationary pressures and expectations of an end to the Federal Reserve’s tightening cycle are the factors that boosted risk-on sentiment. However, this bullish mood did not benefit Bitcoin (BTC) as it largely remained range-bound in July and is…

What is Worldcoin, and how does it help preserve World ID?

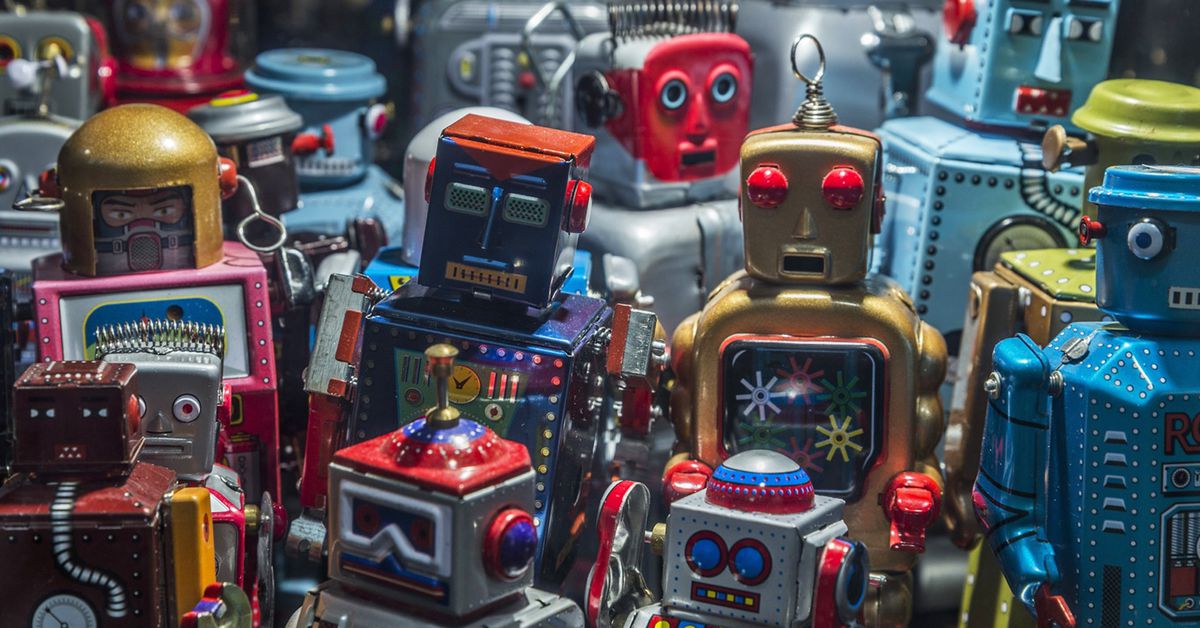

WLD token is listed and available via various avenues allowing people to choose the option of purchasing that best suits their needs. Prices are subject to market trends. WLD is available for purchase on all major centralized exchanges (CEXs), such as Binance, KuCoin, OKX, Bybit and Huobi. CEXs, such as Binance, offer multiple purchase options via credit card or bank deposit, or buying a stablecoin like Tether (USDT) or Binance USD (BUSD), and then using that coin to buy WLD. It is also available for swaps on decentralized finance (DeFi)…

Curve Debacle Triggers Transaction Frenzy, Sending Ethereum ‘MEV’ Rewards to Record High

On July 30, over 6,000 ETH ($11M worth) in so-called Maximal Extractable Value rewards were paid out to Ethereum validators, the most ever for a single day. Source

Digital Currency Group Appoints Mark Shifke as Chief Financial Officer

“DCG has long stood out to me as the leading and most well-respected operator, investor, and backer of the brightest minds in the digital asset space,” Shifke said in a statement. “As the industry matures and digital assets continue to gain momentum from institutional stalwarts, I can’t think of a more exciting opportunity.” Source CryptoX Portal

After the Curve Attack: What's Next for DeFi?

The $70 million weekend exploit of major platforms, including Curve, come at a time when developers are discussing changes to the prevailing AMM liquidity model. Source

BALD token developer denies rug pull as price falls 85% post-launch

A new memecoin on Coinbase’s Base network fell 85% after its developer allegedly pulled 1,034 Ether in liquidity, worth approximately $1.9 million, from the market, according to social media reports and blockchain data. The developer for Bald (BALD) denied making any market sales of the coin, stating, “[I] just added/removed 2 sided liquidity and bought.” Watching the $BALD chart pic.twitter.com/2lc0HEVlNu — Whale (@WhaleChart) July 31, 2023 Coinbase’s Base network was launched for builders on July 13. However, its development team has urged ordinary users not to use the network, as…

DCG Says It Sees Resolving Genesis Chapter 11 Bankruptcy Soon

The Genesis lending business froze withdrawals last year in the aftermath of FTX’s collapse, which, among other things, affected customers of a lending product from the Gemini exchange. The led to a public war of words between the two sides, and this remains one of the more contentious issues to iron out in the Genesis restructuring. Source

Why Congress Should Pass the H.R. 4766 Stablecoin Bill Now

After the financial crisis, there was a significant period of reform in financial markets, where we gave preference to price stability products that worked properly, such as government money market funds or stable value funds, and penalized, restricted, or increased capital for those which did not work properly, such as deposits at highly leveraged banks, prime-money market funds, or securitizations. This means we know how to define safe, stable reserves for a stablecoin that are not a threat to financial markets, and H.R. 4766 does this. Source