“Our bitcoin holdings increased to 152,800 bitcoins as of July 31, 2023, with the addition in the second quarter of 12,333 bitcoins being the largest increase in a single quarter since Q2 2021,” said Andrew Kang, Chief Financial Officer, in a statement. “We efficiently raised capital through our at-the-market equity program and used cash from operations to continue to increase bitcoins on our balance sheet. And we did so against the promising backdrop of increasing institutional interest, progress on accounting transparency, and ongoing regulatory clarity for bitcoin.” Original

Day: August 1, 2023

Curve liquidation risk poses systemic threat to DeFi even as founder scurries to repay loans

On July 30, Curve Finance, a decentralized exchange on Ethereum, suffered a hack due to a vulnerability in certain pools built using the Vyper programming language. The price of Curve DAO (CRV) dropped 20.91% on the day of the hack, falling to a two-month low of $0.58. The next day, the decline in CRV continued to a seven-month low of $0.48 amid fears of liquidation of hefty loans worth $100 million taken by Curve Finance founder Michael Egorov against CRV as collateral. However, positive developments such as partial repayment of…

Was Sam Bankman-Fried behind a scam project?

In the latest episode of “The Market Report,” analyst and writer Marcel Pechman discusses the BALD token rug pull and the allegations pointing toward FTX founder Sam “SBF’ Bankman-Fried as the culprit. The token launched on Coinbase’s Base network, which is currently under development, and witnessed incredible gains between July 30 and 31. Pechman notes that it is impossible to know how much fake volume and how many trades involving the same entity or small groups were used to prop up BALD’s price on decentralized exchanges (DEXs). Further evidence for…

Why MiCA Is Overly Burdensome Regulation for Ukraine’s Crypto Industry

Despite Ukraine being the birthplace of numerous crypto startups, such as Bitfury, Hacken, Everstake, Matter Labs, GlobalLedger, and Crystal Blockchain, none of them are registered in Ukraine. The reason is simple: crypto companies cannot legally obtain authorization in the country, even if they desired to do so, because there is still no workable legal framework. Source

Dark Days Ahead As $29,200 Support Fails

In his recent report, Charles Edward, a prominent crypto market analyst, released an update on the state of the Bitcoin (BTC) market. The report highlights the continuation of the downtrend for Bitcoin, which has been losing its key support, the 50-day Moving Average (MA). The bearish trend has been confirmed by technical indicators and the pure fundamental Bitcoin Macro Index algorithm, which has seen an increasing rate of contraction over the last week. Is Bitcoin Headed For $25,000? The report provides insights into both high and low timeframe technicals, with…

Bitcoin Bollinger Bands Are The Tightest Ever, What Happens Next?

Last week, the 1W Bollinger Bands in Bitcoin reached its tightest level ever. The volatility measuring tool typically doesn’t give any indication of direction, however. Using historical data, we’ve taken all previous instances of extreme lows and the resulting direction — up and down — and discovered the success rate of the signal. Bollinger Band Width Reaches Historical Lows: What Does It Mean? The Bollinger Bands are a complete trading system, designed by John Bollinger in the 1980s — an avid Bitcoin speculator. The tool uses a 20-period simple moving…

GameStop to Remove Crypto Wallets Citing 'Regulatory Uncertainty'

Leading game retailer GameStop will suspend its crypto wallets due to regulatory uncertainty in the United States, just one year after launching, the company announced Tuesday. Source

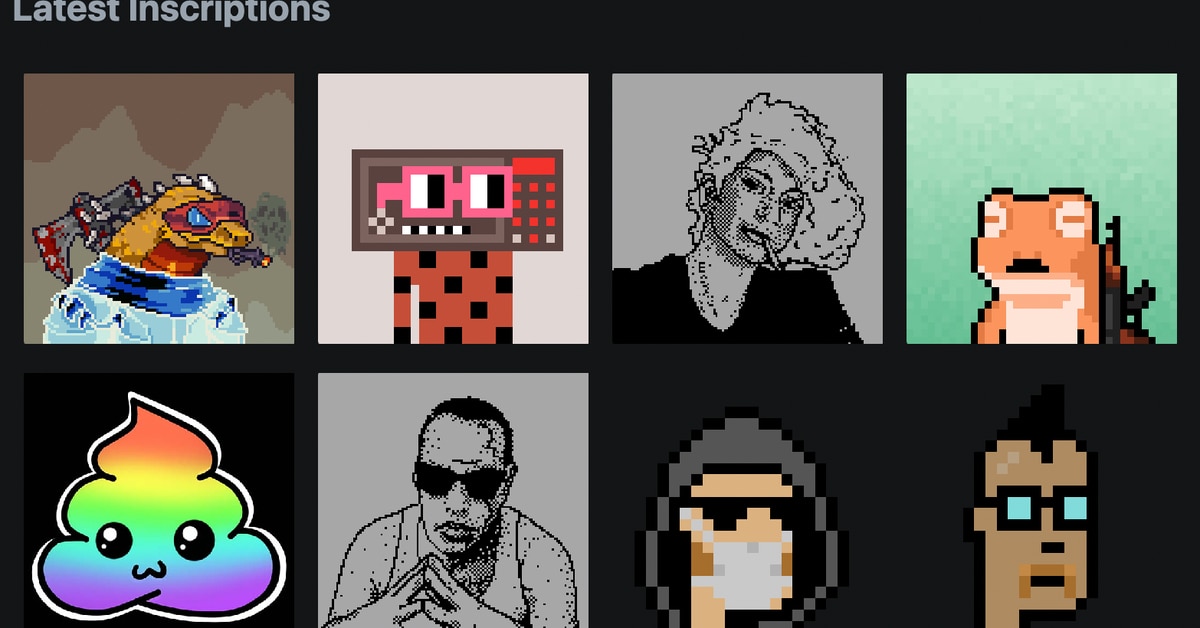

The Team Behind Ordinals is Creating a Non-Profit to Grow its Ecosystem

“Companies across Web3 ecosystems – including Ethereum, Solana, Stacks, and others – are quickly building Ordinals infrastructure after previously believing NFT-functionality ‘wasn’t possible’ on native Bitcoin,” said Redwin. “Given Ordinals’ unprecedented pace of adoption and real-world implications for various crypto-economies, we believe it is crucial to fund a strong team of non-corporate funded developers to ensure the security and neutrality of this open-source protocol.” Source

European digital asset manager CoinShares’ revenue up 33% in Q2

CoinShares, a manager of Bitcoin (BTC), Ether (ETH) and various altcoin crypto exchange-traded products (ETPs) in Europe, reported total revenue of 20.3 million pounds ($25.9 million) in the second quarter of 2023, a 33% increase compared wit the prior year’s quarter. According to the Aug. 1 announcement, the firm’s 25% year-over-year decline in asset management fees to 10.6 million pounds ($13.52 million) was offset by a 10 million pound ($12.76 million) gain in capital markets operations, such as trading. CoinShares’ profits for the quarter were 5.3 million pounds ($6.76 million),…

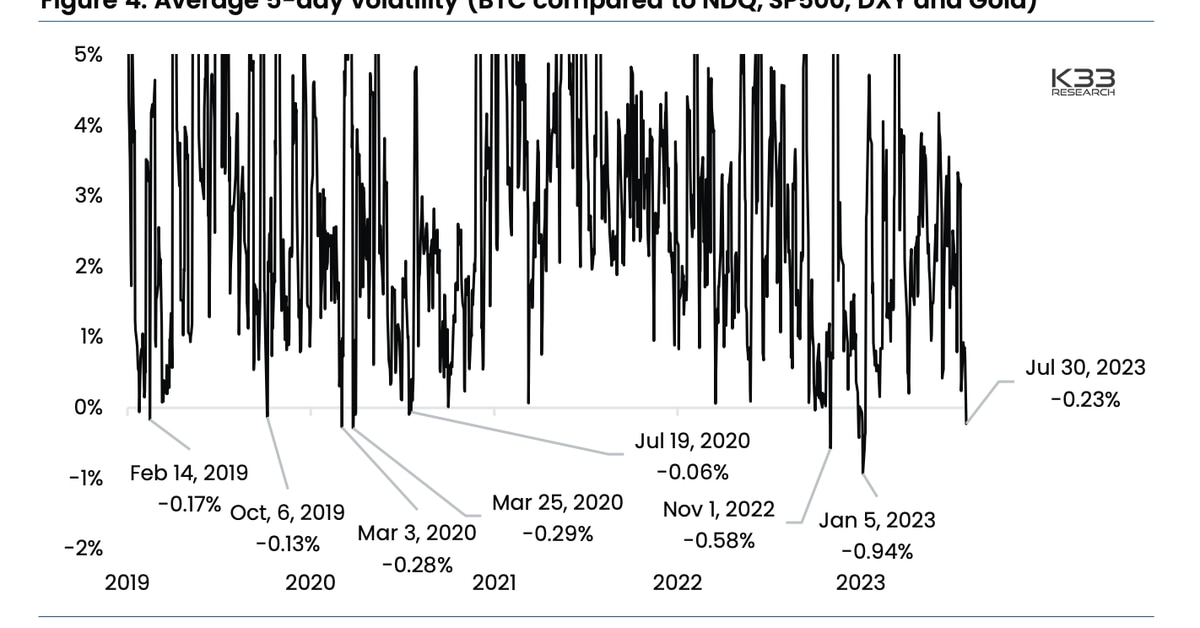

Bitcoin (BTC) Price Is Less Volatile Than Gold (GLD) and Stocks, Hinting at Violent Price Action Coming: K33 Research

With the exception of a brief, Ripple-related, mid-July move up to $31,800, bitcoin has traded in an increasingly tighter range for the past six weeks, its price mostly sticking between $29,000-$30,000, and then for the past few days rarely moving out of the $29,000-$29,500 area. At press time, it was changing hands at $29,100. Original