Tether (USDT) is scaling new heights InQubeta is currently surpassing key milestones amid a firm crypto market. This article dives into InQubeta and Tether, examining their trajectories and how they can shape the crypto landscape. InQubeta opens up access to AI-startup investment At the junction of AI start-up investment and blockchain technology lies InQubeta. The platform provides fractional investment in AI start-ups, empowering investors. It also aims to democratize the AI investment landscape, opening up access. The InQubeta presale has raised over $2 million, pointing to support from the crypto community. QUBE prices…

Day: August 7, 2023

China’s risky Bitcoin court decision, is Huobi in trouble or not? Asia Express – Cointelegraph Magazine

Our weekly roundup of news from East Asia curates the industry’s most important developments. Chinese man’s $10M loss as court says Bitcoin lending not protected by law A man in China’s Jiangsu province, identified as Mr. Xu, appears to be out of luck after a court ruled that his 341 Bitcoin loan ($9.9 million) to counterparty Mr. Lin is not protected by law according to local news reports on August 3. Some time ago, Mr. Xu lent 341 Bitcoins to Mr. Lin after the latter approached him for a peer-to-peer…

Why Low Volatility Bitcoin Could Last A Lot Longer

Much has been said in recent weeks regarding how uncharacteristically calm Bitcoin has been. On weekly timeframes, volatility measures are at their lowest ever. Unfortunately, despite the record-setting lull, directionless sideways price action could continue for a lot longer. Record-Breaking Low Volatility State Could Continue Longer Bitcoin price is at a standstill compared to its usually explosive self. It’s remained locked in a tight trading range, to the point where even a $300 move to either side might feel like a major breakout. Few points throughout history on lower timeframes…

BlackRock’s misguided effort to create ‘Crypto for Dummies’

BlackRock, a multinational investment company, shocked many in the cryptocurrency industry in June when it filed an application for an exchange-traded fund (ETF), the iShares Bitcoin Trust. It’s seeking to overcome 10-year-long opposition from United States regulators to cryptocurrency ETFs. A spot Bitcoin ETF would be tradable on a traditional stock exchange and track with the market. While supporters argue that ETFs are tax-efficient, easy to trade and cheap, BlackRock’s approach is arguably misguided. It is important to keep in mind that ETFs do not have the same focus or…

TRON’s Justin Sun’s Reassures Crypto Community That Huobi Exchange Is Solvent

In a recent development, Justin Sun, founder of popular blockchain Tron, has urged people to disregard speculations that the crypto exchange Huobi is facing severe challenges following news of the alleged detention of some of the platform’s officials. The rumors appear to be a major contributing factor to why the firm experienced multi-million withdrawals during the weekend, while Tron’s Total Value Locked (TVL) has fallen below $2.5 billion. Trouble In Paradise? Over the past weekend, cryptocurrency exchange Huobi experienced massive outflows worth about $64 million amid reports that Chinese authorities…

Solana-Based Cypher Protocol Experiences Exploit, Freezes Smart Contract

The protocol’s contracts are now frozen as contributors attempt to make contact with hackers to negotiate a return of funds. Source

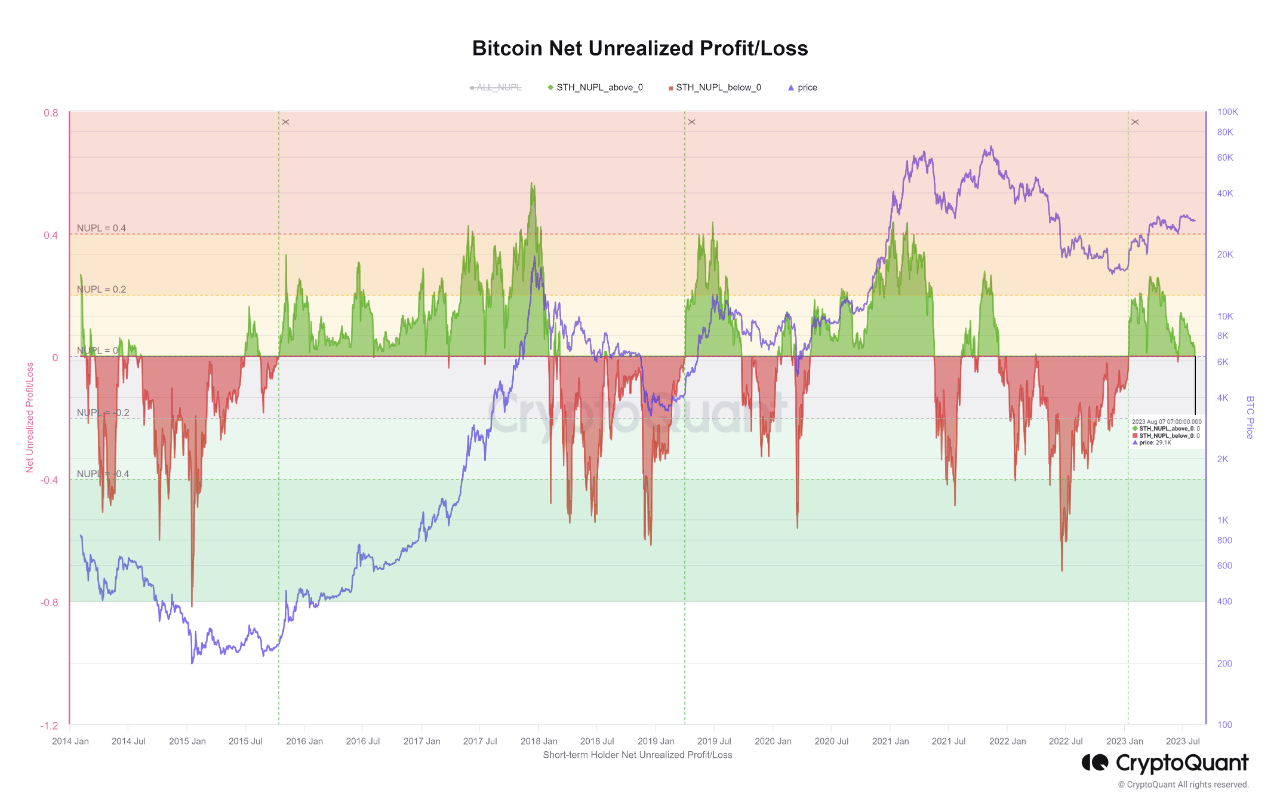

These Bitcoin Metrics Are At Important Retests, Will Bullish Trend Prevail?

On-chain data shows two Bitcoin indicators are currently retesting levels that have historically been relevant for the market’s course. Bitcoin NUPL For Both Short-Term & Mid-Term Holders Is Neutral Currently As pointed out by an analyst in a CryptoQuant post, the BTC NUPL has been retesting crucial levels recently. The “Net Unrealized Profit/Loss” (NUPL) is a metric that keeps track of the net amount of profit or loss that investors are holding currently. This indicator works by looking through the on-chain history of each coin in circulation to see what…

Bitcoin funds see weekly outflows of $111M, most since March: CoinShares

Weekly cryptocurrency asset flows for the week ending Aug. 4 reconciled at $107 million in outflows, continuing a three-week negative trend totaling $134.8 million. Once again, the lion’s share of movement was attributed to Bitcoin (BTC). With $111 million in outflows, Bitcoin funds negated the majority of inflows for the week. According to CoinShares’ Digital Asset Fund Flows weekly report, this indicates further “profit taking” on the heels of the previous cycle’s gains. For the month leading up to the recent spate of outflows, inflows of $742 million into crypto funds were…

Mango Markets, Crypto Exchange Atop Solana Blockchain, Sees Legal Bills Swell a Year After Alleged $116M Heist

According to the website Realms, there’s about $89 million in the Mango DAO treasury, but most of that is denominated in MNGO tokens, and the market for those might not be liquid enough to sell them quickly and easily. Project insiders say that the main source of funding would likely come from a $15.3 million stash of dollar-linked stablecoins within the Mango Dao treasury, primarily denominated in USDC. Source

Price analysis 8/7: SPX, DXY, BTC, ETH, BNB, XRP, ADA, DOGE, SOL, LTC

Bitcoin’s failure to rebound off strong support may open further downside, as bears may be tempted to sell. Bitcoin has been trading near the $29,000 level for the past few days. This suggests a lack of strong demand at higher levels, but the only solace for the bulls is that they have managed to sustain the price above the immediate support. The uncertainty about the next directional move may have tempted short-term traders to book profits. CoinShares said in its latest weekly report that Bitcoin (BTC) investment products witnessed $111 million in…