In earnings calls for the second fiscal quarter for major tech companies, the mention of artificial intelligence (AI) has skyrocketed compared to the previous quarter, according to a report on the topic from Reuters. The S&P 500 companies that took the lead in discussions surrounding AI included Google’s Alphabet, Intel, Microsoft and Meta platforms, along with others who increased talks around AI such as Cadence Design, IBM, ServiceNow, Moody’s and Omnicom. In Intel’s second-quarter call, AI was mentioned 58 times compared to 15 times in its first-quarter call. Alphabet’s call…

Day: August 1, 2023

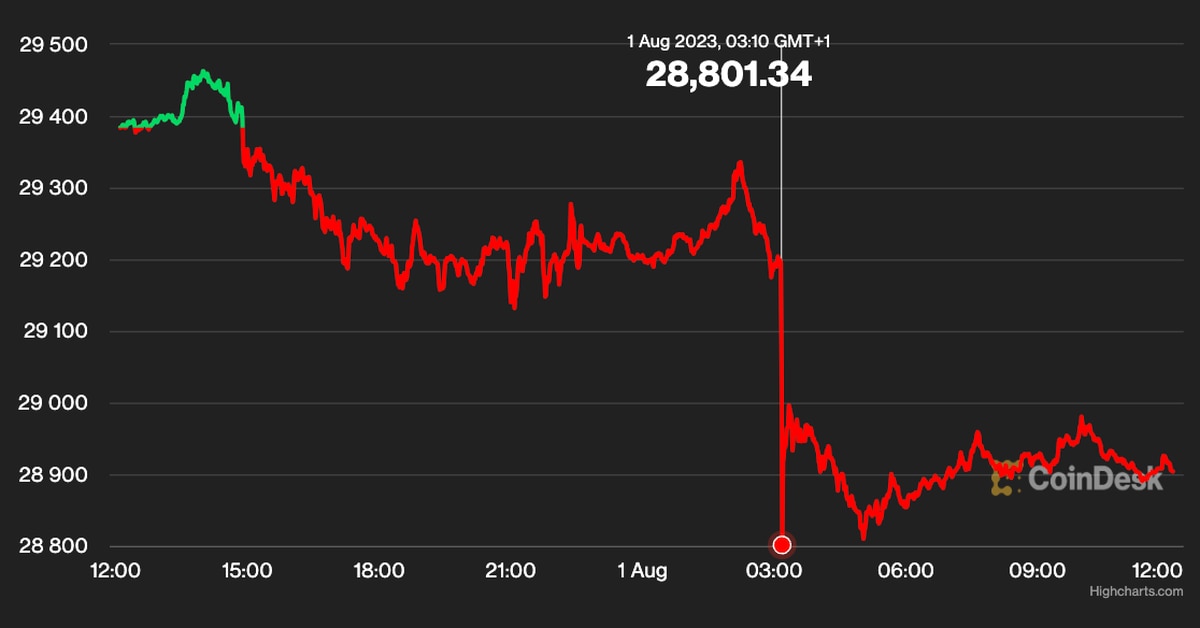

Bitcoin loses $29K as traders flag key BTC price levels to watch next

Bitcoin (BTC) shed 2% into the start of August as traders’ expectations of further downside slowly came true. BTC/USD 1-hour chart. Source: TradingView Bitcoin short-term holder breakeven point in focus Data from Cointelegraph Markets Pro and TradingView showed BTC’s price trajectory leaning lower at the July monthly close. Volatility was already anticipated, and BTC/USD did not disappoint after a week of barely any movement whatsoever. Bulls, however, were left in the cold. For popular trader and analyst Rekt Capital, the close price was significant but demanded that buyers now step…

First Mover Americas: Bitcoin Starts August in the Red After Losing Ground in July

The latest price moves in bitcoin (BTC) and crypto markets in context for August 1, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets. Original

FTT Token Surges 17% After FTX Confirms Rumors Of Relaunch

Bankrupt crypto exchange FTX has submitted a proposal that may result in the relaunch of its international arm FTX.com. On August 1, the company’s bankruptcy administrators confirmed rumors of a relaunch by filing a draft plan of reorganization in which it proposes the kick-off of a “rebooted” offshore exchange exclusive to non-US users only. FTT Gains By 17% Amidst Plans To Terminate Claims FTT, the native token of the FTX exchange, recorded a significant boost in its price on the emergence of the exchange’s proposal to relaunch in the international…

InQubeta finds support, QUBE can flip BTC, BNB, and XRP

InQubeta is popular in the crypto market and getting support for its fundamentals and growth potential. Industry experts predict InQubeta’s utility token, QUBE, to outgrow established coins like Bitcoin (BTC), Binance Coin (BNB), and XRP. This article examines InQubeta’s features and why it is garnering market-wide support. InQubeta has market-wide support InQubeta is a crowdfunding platform for crypto artificial intelligence (AI) startups aiming to capture the attention and imagination of investors. Its token presale has raised over $1.9 million, intending to create a mutually beneficial ecosystem where AI startups can raise funds…

Zero Transfer scammer steals $20M USDT, gets blacklisted by Tether

A scammer using zero transfer phishing attack managed to steal $20 million worth of USDT stablecoin on Aug. 1, before getting blacklisted by the stablecoin issuer Tether. According to an update from on-chain analytic firm Peckshield, A zero transfer scammer grabbed 20 million USDT from the victim address 0x4071…9Cbc. The intended address that the victim planned to send money to was 0xa7B4BAC8f0f9692e56750aEFB5f6cB5516E90570, however, it was sent to a phishing Address: 0xa7Bf48749D2E4aA29e3209879956b9bAa9E90570. The zero transfer phishing scam. Source: Etherscan The victim’s wallet address first received 10 million USD from a Binance…

Justin Sun Buys CRV to Ease Curve Finance’s Looming Bad Debt Situation

“Our joint efforts will introduce an @stusdt pool on Curve, amplifying user benefits. Together, we aim to empower the community and forge decentralized finance,” Sun added. stUSDT is described as the “first real-world asset protocol on the Tron Network.” Source

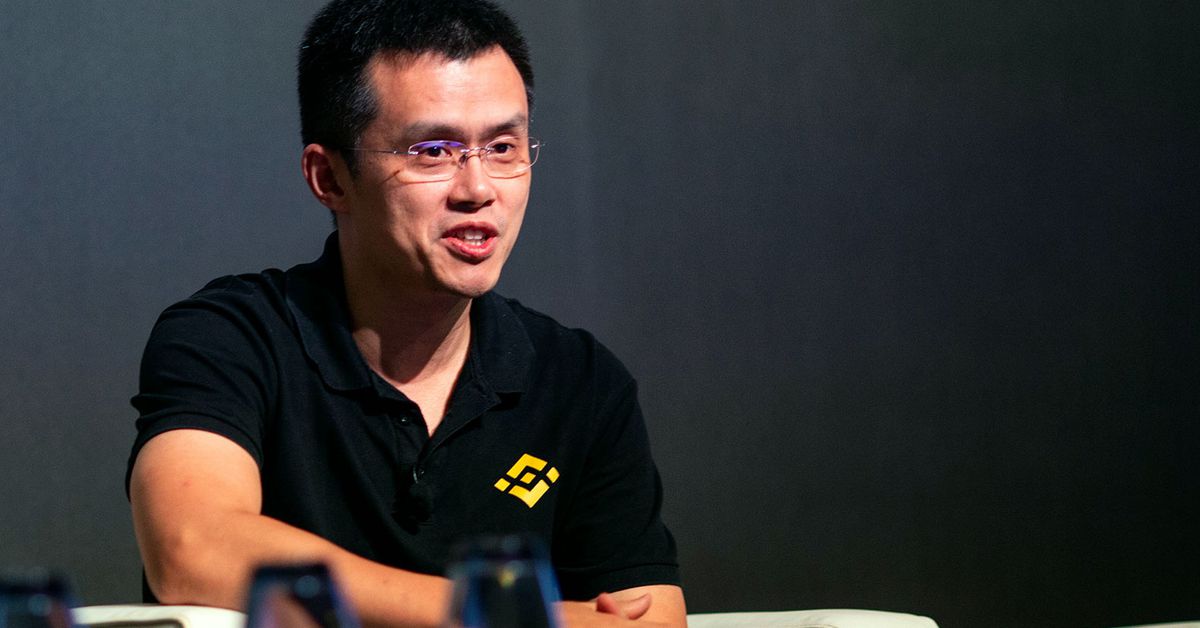

Binance Japan Starts Onboarding Users

Two years earlier, the exchange was warned by Japanese regulators that it was operating in the country without permission. Source

Curve Finance founder’s $100M debt could trigger a DeFi implosion: Report

While Curve Finance is still weathering the aftermath of a recent $47-million hack, another issue concerning holders of the decentralized finance (DeFi) protocol’s token has surfaced on the internet, sparking theories on how a massive dump can potentially happen. On Aug. 1, crypto research firm Delphi Digital published a Twitter thread detailing the loans taken by Curve Finance founder Michael Egorov that are backed by 47% of the circulating supply of Curve DAO (CRV). According to the research firm, Egorov has around $100 million in loans across various lending protocols…

Curve’s New Liquidity Pool Could Prevent Liquidation of CRV Token

“He [Erogov] borrowed FRAX using CRV as collateral on Fraxlend. However, because people are withdrawing FRAX from the pool, fearing bad debt in the event of CRV liquidation, the APY has significantly increased,” Ignas explained. “He now needs more FRAX deposited to that CRV/FRAX lending pool. That’s why the introduction of a new pool on Curve, equipped with CRV incentives.” Source