Second, the amount of assets Tether shows in its attestation report exceeds $86 billion which is a few billion higher than USDT’s market capitalization right now. It is worth mentioning that $2.4 billion of that is “Other Investments,” which could literally be anything. In any event, assets exceed liabilities for Tether which means it’s running an equity surplus. Original

Day: August 3, 2023

SEC Charges Utah-Based DEBT Box, Other Defendants With $50M Crypto Fraud Scheme

The SEC charged Draper, Utah-based DEBT Box, as well as the company’s four principals and 13 other defendants, with operating a scheme that began in March 2021 to sell unregistered securities called “node licenses.” Defendants told investors that the licenses would mine cryptocurrency that would increase in value, when in reality, defendants were creating the crypto instantaneously using code on a blockchain, according to the SEC. Source

Solana Tokens or: How I Learned to Stop Worrying and Love the Points

Could loyalty programs and token airdrops embiggen Solana DeFi? Danny Nelson heads to Utah to find out. Source

NFT Sales Have Dropped by Nearly 50% Since January: DappRadar Data

The DappRadar report also noted that the shifts in trading volume and network activity may be partially attributed to “the emerging popularity of ‘low barrier entry’ NFTs. These assets, smaller in individual value, cater to a wider audience,” and “a broader shift in the NFT market towards platforms that offer more affordable and accessible NFT options.” Source

Crypto Custody Firm BitGo Hires Former Genesis Exec Matthew Ballensweig to Lead Go Network

“This next era of institutional adoption has to be done via a tech-focused mindset first; you can’t just throw a balance sheet at it,” Ballensweig said in an interview with CoinDesk. “When I heard [BitGo CEO] Mike Belshe’s vision for this, it was precisely how I would have designed this next institutional trading phase, with the separation of custody and trading and settlement.” Source

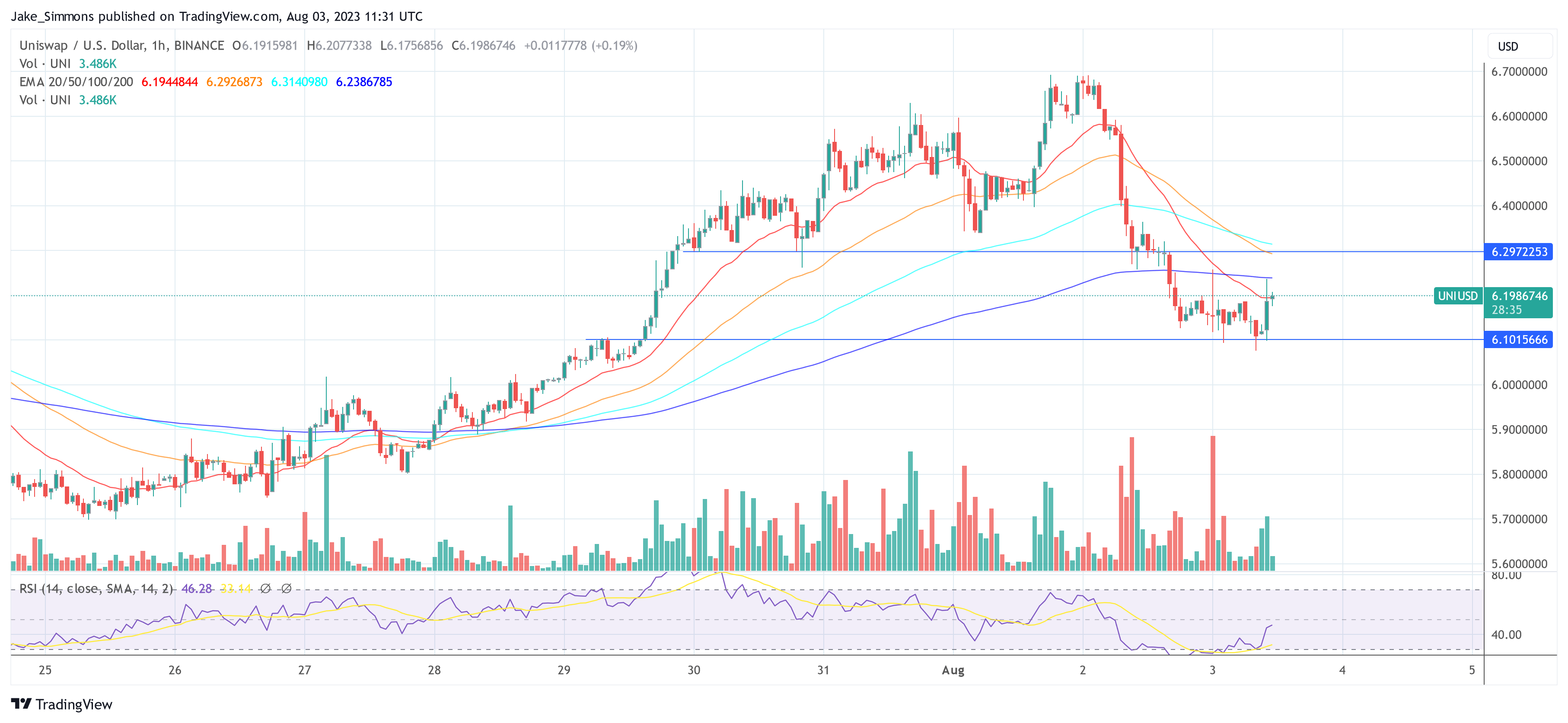

Why The Uniswap (UNI) Token Is Almost Worthless: Researcher

In an analysis, Anders Helseth, Vice President at K33 Research, has mounted a strong case against the viability of the Uniswap (UNI) token. His analysis pivots on the intriguing dynamics of the decentralized finance (DeFi) market, fundamentally challenging the current valuation and future potential of UNI. Helseth begins his argument with a seemingly straightforward question: “The Uniswap protocol generates significant trading fees, but will the UNI token ever capture its (fair) share?” His conclusion is emphatically negative. Is The Uniswap (UNI) Token Worthless? For context, UNI is a governance token…

BTC price risks new sub-$29K dip as Binance fears test Bitcoin bulls

Bitcoin (BTC) dipped below $29,000 on Aug. 3 as market concerns over largest global exchange Binance reignited BTC price downside. BTC/USD 1-hour chart. Source: TradingView BTC price analysis “expects” support retest Data from Cointelegraph Markets Pro and TradingView showed BTC price action heading lower before a modest comeback into the Wall Street open. Rumors over new United States legal action against Binance made for a disappointing 24 hours for Bitcoin bulls after a brief trip above $30,000. With the trading range still firmly in place, monitoring resource Material Indicators forecast…

$50M Web3, Metaverse Venture Fund Started by Futureverse Co-Founders Shara Senderoff, Aaron McDonald

The Born Ready fund will cut checks between $250,000 and $1 million per project, the team told Fortune in an interview. It has already deployed capital into a variety of companies, including high-tech sneaker startup FCTRY Lab, Web3 startup Power’d Digital, and blockchain gaming companies Polemos and Walker Labs. Born Ready will announce an accelerator program with funding opportunities at a later date. Source

Direxion files for Bitcoin and Ether ETFs

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied The daily leveraged and inverse exchange-traded fund (ETF) issuer, Direxion, has filed for Bitcoin (BTC) and Ether (ETH) futures products with the US SEC. The company follows some other prominent industry players that have filed to launch futures ETFs in recent months, including BlackRock and Valkyrie. Citing its search for capital appreciation, the filing reveals Direxion wants to achieve its investment goal through crypto futures contracts traded on the Chicago Mercantile Exchange (CME). As stated earlier,…

What bitcoin investors can learn from Litecoin’s halving this week

Traders have been looking to next spring’s Bitcoin halving as a beacon of hope while regulatory uncertainty weighs on the industry and trading volumes remain suppressed. The halving is a market moving event that typically happens every four years when the reward for mining bitcoin is cut in half, as designed in the Bitcoin code, to reduce the supply of the cryptocurrency. Historically, it has set the stage for new bull runs, and the next one is expected to come in May 2024. Meanwhile, Litecoin – an offshoot of Bitcoin that…