Eighteen leading venture capital (VC) investment firms, including Temasek, Sequoia Capital, Sino Global and Softbank, have been named as defendants in a class-action lawsuit filed in the United States District Court for the Northern District of California for their links to the now-bankrupt crypto exchange FTX. The lawsuit, filed on Aug.7, alleged that the investment firms were responsible for “aiding and abetting” the FTX fraud. The suit claims that the defendants used their “power, influence and deep pockets to launch FTX’s house of cards to its multibillion-dollar scale.” A snippet of Cabo…

Day: August 9, 2023

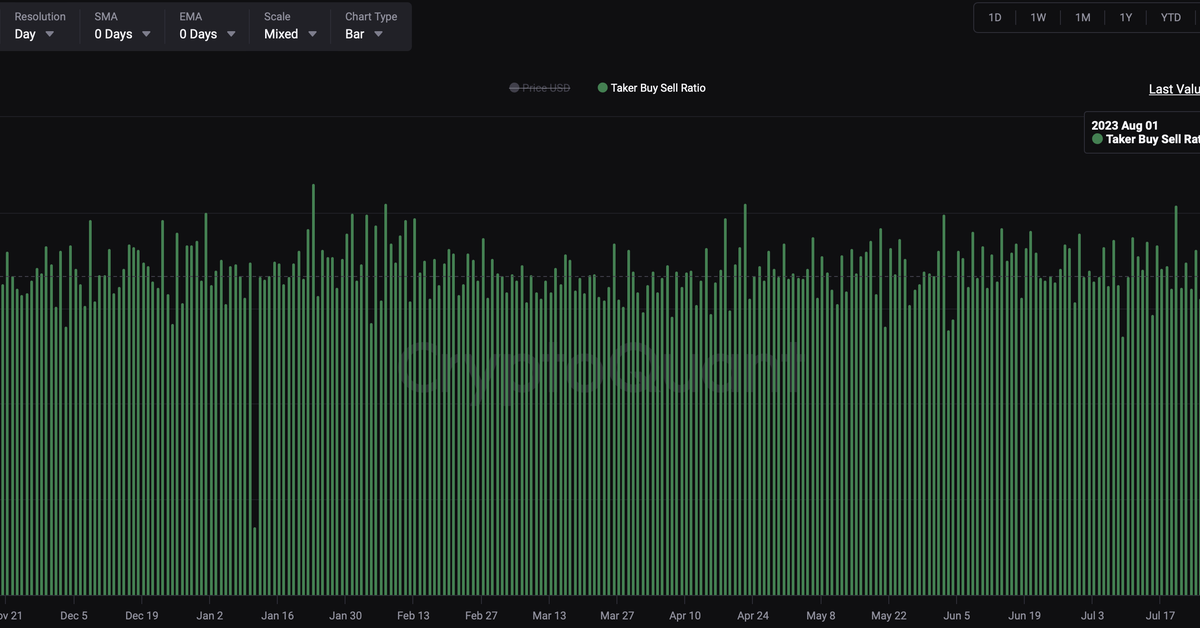

Bitcoin's 'Taker Buy-Sell Ratio' Surges Signals Renewed Bullish Vigour

The taker buy-sell ratio measures the buy volume divided by the sell volume of takers in perpetual swap trades. Source

Solana and Cardano navigate through market turbulence, Borroe registers growth

As Solana (SOL) and Cardano (ADA) struggle to gain momentum, stage 1 of the Borroe presale is ongoing after completing its beta phase. Experts retain a bullish outlook on ROE, saying it could outperform the market, driven chiefly by its use case. Solana breaks above $23 Solana’s performance is mixed. It recently broke above $23 but is down 6.5% in the past week. Nevertheless, experts believe SOL is oversold and may recover in sessions ahead. Some investors are convinced that the release of Solang, a software for developers to build apps on…

DEX MuesliSwap Will Refund Users Due to Misunderstanding Around Slippage

“To make amends, we will be refunding affected users who encountered high slippage on the MuesliSwap pools in the last 12 months from our project funds,” developers said. “Additionally, immediate action has been taken to remedy the slippage issue in the MuesliSwap order book” Source

Why Is Bitcoin And Crypto Surging Today?

In the last 24 hours, Bitcoin has experienced a 2% surge, pulling the broader crypto market along with it into a bullish trajectory. Leading the charge among altcoins are PEPE with an 8% gain, followed closely by SHIB and HBAR both at 6.3%, TON at 5.6%, SNX at 5.4%, and SOL at 5.3%. The overall crypto market capitalization has swelled to $1.18 trillion(+1.63%), while Bitcoin’s dominance in the market has edged up to 50.63%. Why Is Bitcoin And Crypto Up Today? The market’s euphoria was initially triggered by a news…

Tesla and other top companies capitalize on bitcoin portfolio

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied Top publicly traded firms reveal their Bitcoin (BTC) portfolios. MicroStrategy leads the list, showcasing the fusion of traditional finance and digital assets. Crypto analytics website CoinGecko has analyzed the top 10 publicly traded companies with the largest Bitcoin portfolios. The report provides a detailed account of their BTC holdings and associated performance. The list includes MicroStrategy, Block, Tesla, and other moguls that keep investing in crypto despite the bear market. Top 5 companies holding Bitcoin |…

Cypher Protocol freezes smart contract amid $1m exploit

Cypher Protocol, a decentralized futures exchange on the Solana (SOL) blockchain, has halted its smart contract in the wake of an estimated $1 million exploit. On Aug. 7, Cypher Protocol announced on X that it had frozen its smart contract following a security incident involving an estimated $1 million exploit. The team is investigating the cause and has initiated negotiations with the suspected hacker to potentially recover the stolen funds. Cypher has has experienced an exploit/security incident. The smart contract has been frozen. The team is currently working with individuals…

FTX’s former law firm hit with lawsuit alleging it set up ‘shadowy entities’

FTX’s former primary counsel Fenwick & West LLP has been hit with a class action suit claiming it aided the crypto exchange’s alleged multi-billion dollar fraud. An Aug. 7 filing by a group of FTX customers in a California District Court alleged the law firm set up several “shadowy entities” allowing FTX co-founder Sam Bankman-Fried and other executives to adopt “creative but illegal strategies” to perpetuate fraud. The suit claims Fenwick & West provided services to FTX that “went well beyond those a law firm should and usually does provide”…

Curve Finance CEO sued, crypto whales participate in DigiToads presale

ParaFi Capital, Framework Ventures, and 1kx have jointly filed a lawsuit against Curve Finance CEO Michael Egorov, asserting claims of misappropriation of trade secrets and confidential information. The case was filed in the Superior Court of California, San Francisco. The venture capital (VC) firms allege that Egorov used the information to develop a competing project, CRV.finance, without their permission. They also claim that Egorov tried to prevent them from investing in CRV.finance by misrepresenting the project’s risks. This is the latest in a series of legal troubles for Curve Finance. In…

Trader Who Placed $10 Million Bet Against LUNA Loading Up Reddit’s Moons

In a new development, a trader who placed a substantial $10 million bet against LUNA in May 2022 before the then native currency and UST—the algorithmic stablecoin, collapsed is now setting his sight on Reddit Moons. Going by the moniker “GCR,” on-chain data on August 8 showed the trader moved 450,000 MOON from MEXC Exchange to Kraken. Moons Rallying Moons, the ERC-20 token associated with the r/CryptoCurrency forum on Reddit, is firm and on an uptrend, looking at current price action. At spot rates, the token is up 400% from…