“I really do believe PayPal grows the pie for us,” McDonnell said in an interview with CoinDesk. “Crypto is so small today compared to the overall financial world. And, so, getting a lot of people in, whether they come through the PayPal door, or some other door, a lot of them eventually will find their way to other things in crypto, including us at Coinbase.” Source

Day: August 21, 2023

Bitcoin (BTC) Price Bulls Mull Meaning of Federal Reserve Messaging Before Jerome Powell’s Jackson Hole Speech

Stuck in a tight range roughly between $29,000 and $30,000 for several weeks, bitcoin (BTC) Thursday afternoon dropped to the low $28,000 area thanks to the economic news. That, in turn, triggered a chain of stops and liquidations that sent bitcoin quickly plunging below $25,000. A very modest recovery since has brought the price back to $26,000 at press time. CryptoX Portal

Bitcoin price holds $26K as derivatives data hints at end of volatility spike

In the past few months, Bitcoin traders had grown used to less volatility, but historically, it’s not uncommon for the cryptocurrency to see price swings of 10% in just two or three days. The recent 11.4% correction from $29,340 to $25,980 between Aug. 15 and Aug. 18 took many by surprise and led to the largest liquidation since the FTX collapse in November 2022. But the question remains: Was this correction significant in terms of the market structure? Certain experts point to reduced liquidity as the reason for the recent…

Bitcoin Price Follows This 1930’s Chart, Why BTC Could Keep On Falling

Volatility is back for the Bitcoin price and the crypto market, but it currently favors the bears as value tumbles in the past few days. The nascent sector was moving sideways, but a liquidation cascade forced prices into critical support levels, but the worse might yet come if BTC fulfills a prophecy. As of this writing, the Bitcoin price trades at $26,100 with sideways movement in the last 24 hours. Over the past week, the price of BTC corrected back to $26,000 after its lost support at the high of…

Friend.tech Attracted NBA Influencers. So Why Does Everyone Think Crypto’s Latest Trend Will Die?

Despite its initial success in attracting celebs, the portents aren’t good for the latest “Twitter-killer.” Source

Bitcoin (BTC) Mulls Meaning of Federal Reserve Messaging Ahead of Jerome Powell’s Jackson Hole Speech

Stuck in a tight range roughly between $29,000 and $30,000 for several weeks, bitcoin (BTC) Thursday afternoon dropped to the low $28,000 area thanks to the economic news. That, in turn, triggered a chain of stops and liquidations that sent bitcoin quickly plunging below $25,000. A very modest recovery since has brought the price back to $26,000 at press time. Original

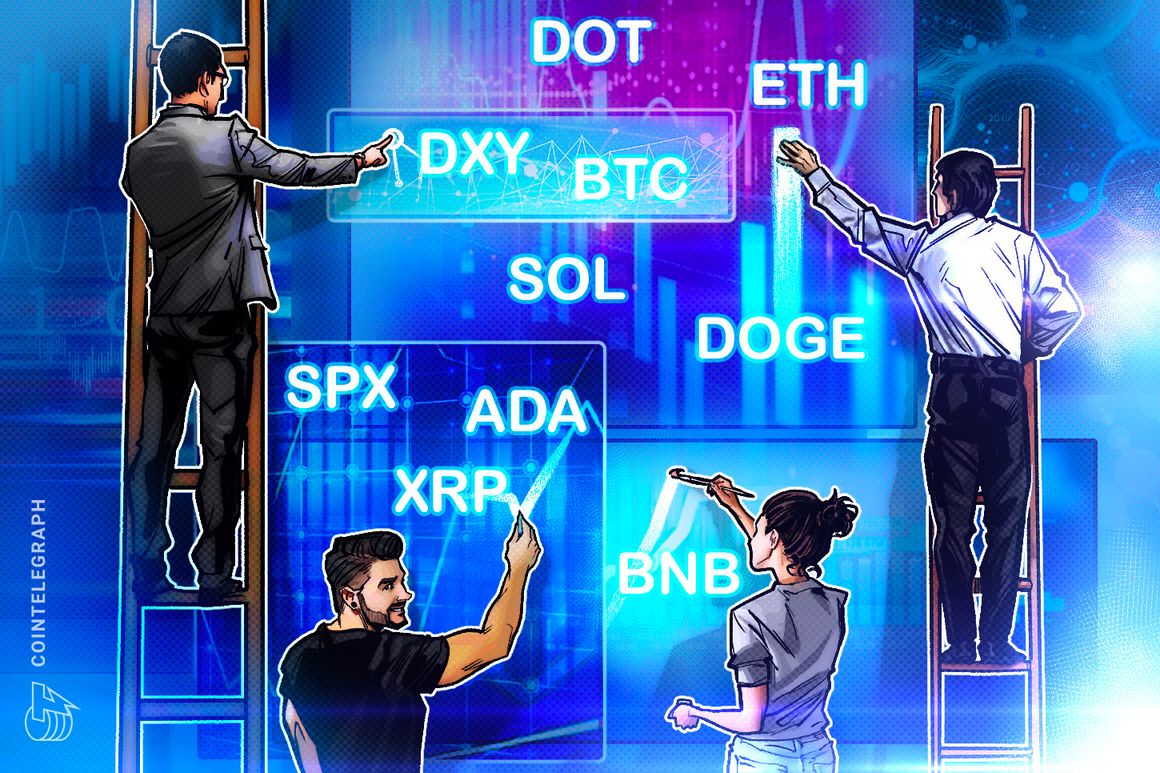

Price analysis 8/21: SPX, DXY, BTC, ETH, BNB, XRP, ADA, DOGE, SOL, DOT

Bitcoin and select altcoins are starting to recover, but selling at the top of each price breakout suggests that bears remain in control. After the sharp fall on Aug. 17, Bitcoin (BTC) remained stuck inside a tight range over the weekend. This suggests indecision between the bulls and the bears about the next directional move. After the latest fall, about 88% of Bitcoin held by Short-term Holders (STHs), owning Bitcoin for 155 days or less, has plunged into loss, according to Glassnode’s weekly newsletter, “The Week On-Chain.” Glassnode warns that…

Will Bitcoin Retest $20,500 Again? This Pattern May Suggest So

Bitcoin is forming a pattern that has historically led to the asset retesting a specific line. At present, this level would be found at $20,500. Bitcoin Has Dropped Below The 200-Day SMA With The Recent Crash A few days back, Bitcoin observed a sharp crash that took the cryptocurrency’s price toward the $26,000 mark. As this plummet was already significant, many have wondered whether this was it or if the drawdown will continue. An analyst on X, Ali, shared a chart that may provide hints about where the asset could…

Recur announces phased shutdown of NFT platform

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied NFT platform Recur has revealed plans to cease operations less than two years after securing $50 million in a Series A funding round. The company has detailed a structured shutdown of the platform, commencing with the suspension of primary and secondary sales from Aug. 18, 2023. Today, with heavy hearts, we must share some difficult news. After much contemplation and consideration, we’ve decided to deprecate the RECUR platform, effective November 16, 2023. Learn more: https://t.co/5NbiTQSAGo —…

SEC charges crypto investment manager with misleading advertising, custody claims

Fintech investment adviser Titan Global Capital Management has agreed to a cease-and-desist order by the United States Securities and Exchange Commission (SEC), along with censure and penalties after the agency pressed charges against it relating to advertising and compliance failures. According to the SEC, the New York-based firm made misleading claims on its website that were based on “hypothetical performance” in violation of the SEC’s amended marketing rule of December 2020. This was the first case of charges made under that rule. SEC senior enforcement officer Osman Nawaz said in…