Argentina-based Num Finance has announced it has gone live with a n stablecoin pegged to the Colombian peso, the company announced Aug. 24 in an X post. The stablecoin — called nCOP — is an overcollateralized, Polygon-based stablecoin and is aimed at the remittance market. Colombia receives over $6.5 billion a year in remittances, Num stated in a blog post. Remittances are one of the key use cases for stablecoin. The nCOP logo. Source: Num Finance The nCOP incorporates the “Num yield feature,” which allows user rewards to be paid…

Day: August 24, 2023

PancakeSwap V3 Takes The Stage On Ethereum’s Layer 2 Linea Mainnet

PancakeSwap, a leading decentralized finance (DeFi) platform, has officially launched its anticipated Version 3 (V3) on the Linea Mainnet. According to the announcement, the collaboration between PancakeSwap and Linea aims to provide a seamless trading experience with lower fees, increased liquidity provider returns, and enhanced capital efficiency. PancakeSwap V3 On Linea Linea, formerly known as ConsenSys zkEVM, stands as Layer 2 scaling solution powered by ConsenSys. Linea achieves faster transaction speeds and reduced gas costs while ensuring security by utilizing zero-knowledge proofs and maintaining full Ethereum Virtual Machine (EVM) equivalence. Developers…

Weird PEPE Transfers Spook Investors and Prompt 12% Plunge

Millions of dollars worth of the PEPE meme coin flooded crypto exchanges Thursday, spooking investors who drove its price down and drawing attention to spooky action in the project’s multisig, among the single-largest holders of the joke cryptocurrency. Source

Why Nvidia 20% Rise Ignited Rally In Crypto AI Tokens

Crypto tokens with Artificial Intelligence (AI) applications have outperformed other assets as chipmaker Nvidia reached an all-time high. The legacy company’s stock price saw important gains as its bet on the AI sector paid off. As of this writing, crypto market tracker Coingecko data records double-digit gains for AI-based cryptocurrencies. Render (RNDR) and Akash Network performed best in the last 24 hours and the previous week, respectively, with the former recording a 6% profit and a 10% gain. NVDA’s price trends to the upside on the daily chart, leading to…

Resource Extraction, Social Media Monetization and Real World Connections

The Story: Esteemed science journal Nature published a paper all about the coming wave of decentralized social media, or DeSo, and the implications of “tokenizing” user engagements. Authors Meysam Alizadeh, Emma Hoes and Fabrizio Gilardi argue that social media companies like Streemit, Reddit and Twitter are announcing plans to help users monetize their activity, which would bring financial and reputational incentives for engagement that “might lead users to post more objectionable content.” Source

Bitcoin options data points to an interesting outcome after this week’s $1.9B expiry

The upcoming $1.9 billion Bitcoin monthly options expiry on Aug. 25 is key to defining whether the $26,000 support level will hold. One could pin the recent cryptocurrency market sell-off on the United States Securities and Exchange Commission (SEC) delaying its decision on spot Bitcoin exchange-traded funds, but there’s also the macroeconomic perspective. If the Federal Reserve’s efforts to curb inflation work, it’s probable that the trend of a stronger U.S. dollar will persist. This was evident as the U.S. Dollar Index (DXY), a measure of the dollar against other currencies,…

Colombian Peso Stablecoin Goes Live on Polygon, Aiming for $10B Remittances Market

Num Finance already issues stablecoins pegged to the Argentine and Peruvian local currencies. Source

Tornado Cash Devs Are Caught in a U.S. Dragnet

Tornado Cash Devs Are Caught in a U.S. Dragnet Source

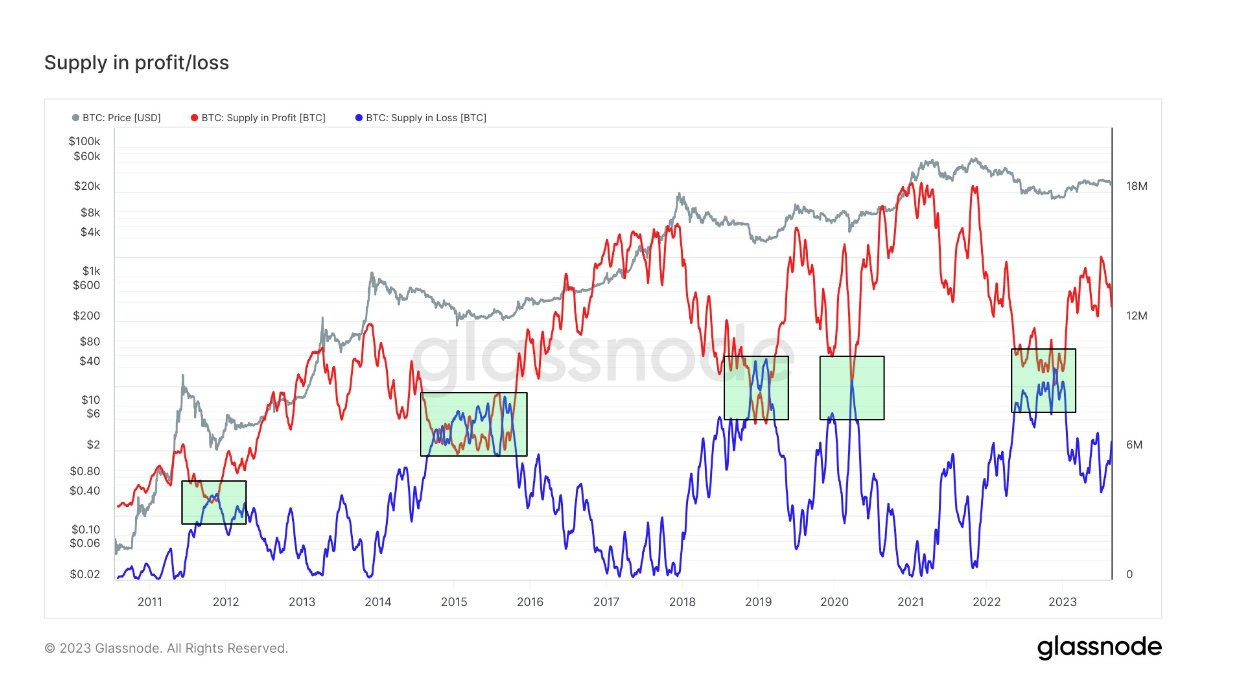

BTC Not Fulfilling This Historical Pattern Yet

On-chain data shows Bitcoin is currently not satisfying a condition that has historically occurred alongside major bottoms in the price. Bitcoin Supply In Profit Is Still Greater Than Supply In Loss In a new post on X, James V. Straten, a research and data analyst, has pointed out how BTC isn’t fulfilling the bottom condition for the supply in profit and loss metrics. The “supply in profit” here naturally refers to the total amount of Bitcoin supply currently carrying an unrealized profit. Similarly, the “supply in loss” keeps track of…

Coinbase (COIN) Is Talking With Canadian Banking Giants to Promote Crypto

In an interview with CryptoX, Lucas Matheson, the director of Coinbase’s Canada operations, said that he’s been having conversations with Canada’s tier one banks. He didn’t identify them by name, but Canada’s largest banks are collectively known as the Big Five: Royal Bank of Canada, Toronto-Dominion Bank, Bank of Nova Scotia, Bank of Montreal and Canadian Imperial Bank of Commerce. Source BankingCanadianCoinCoinbaseCryptoGiantsPromoteTalking CryptoX Portal