Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied Filbfilb analyzes Bitcoin’s halving pattern to predict an explosive Q4 for BTC price action. The familiar Bitcoin halving cycle has turned heads again, hinting at a significant shift in BTC price behavior as the final quarter of 2023 approaches. With industry experts closely monitoring the trend, many smart investors are taking advantage of the situation, positioning themselves for a notable surge in value. Bitcoin’s price seems destined to remain rangebound until at least the fourth quarter…

Day: August 25, 2023

Sam Bankman-Fried’s lawyers push for temporary release, object to prosecutors’ proposed deal

Lawyers representing former FTX CEO Sam Bankman-Fried, or SBF, have claimed the “extraordinary accommodations” offered by authorities were insufficient in order for him to prepare for his criminal trial in October. In an Aug. 25 filing in United States District Court for the Southern District of New York, SBF’s legal team said the plan proposed by prosecutors to allow the former FTX CEO access to discovery materials before trial were inadequate. Lawyers said the U.S. Justice Department produced roughly 4 million pages worth of discovery materials on Aug. 24 and…

Accumulation Surge Paves The Way For Imminent Price Blast

After a highly anticipated partial victory for Ripple Labs and XRP investors, the fifth-largest cryptocurrency has succumbed to the overall market downward trend, dampening the excitement following its July 13 triumph against the US Securities and Exchange Commission. Over the past 30 days, XRP has retraced by more than 26%. Despite experiencing significant price fluctuations since its 16% drop on August 16, the token has recovered 4% of those losses within the past seven days. As the market approaches the monthly close and witnesses liquidity re-entering, there is a growing…

Coinbase-Circle re-alignment, Binance fiat hurdles, and USDC at Shopify

Global regulatory landscapes are once again proving to be a turning point for crypto companies, demanding constant adaptation to navigate shallow regulatory waters across the world, particularly in the United States. In the latest developments, Coinbase and Circle decided to dissolve the Centre Consortium in a strategic realignment driven by demand for regulatory clarity on stablecoins, possibly as an anticipation of upcoming legislation coming from the U.S. Congress. A legal alternative to remaining operational was also sought by Binance.US this week. The exchange announced a partnership with MoonPay featuring the…

Alleged former Worldcoin employee says they’re in contact with authorities

An individual calling themselves Nadir Hajarabi, who claimed to have previously worked for Worldcoin, has alleged the human identity verification project may have committed illegal acts during their employment. In an Aug. 23 YouTube video, Hajarabi said they witnessed “very questionable” activities at Worldcoin including “sloppy and/or illegal things” prior to quitting the project before its token launch on July 24. They claimed the organization was holding some of their pay, and were speaking with authorities in different jurisdictions as part of probes into Worldcoin. According to Hajarabi, the Worldcoin…

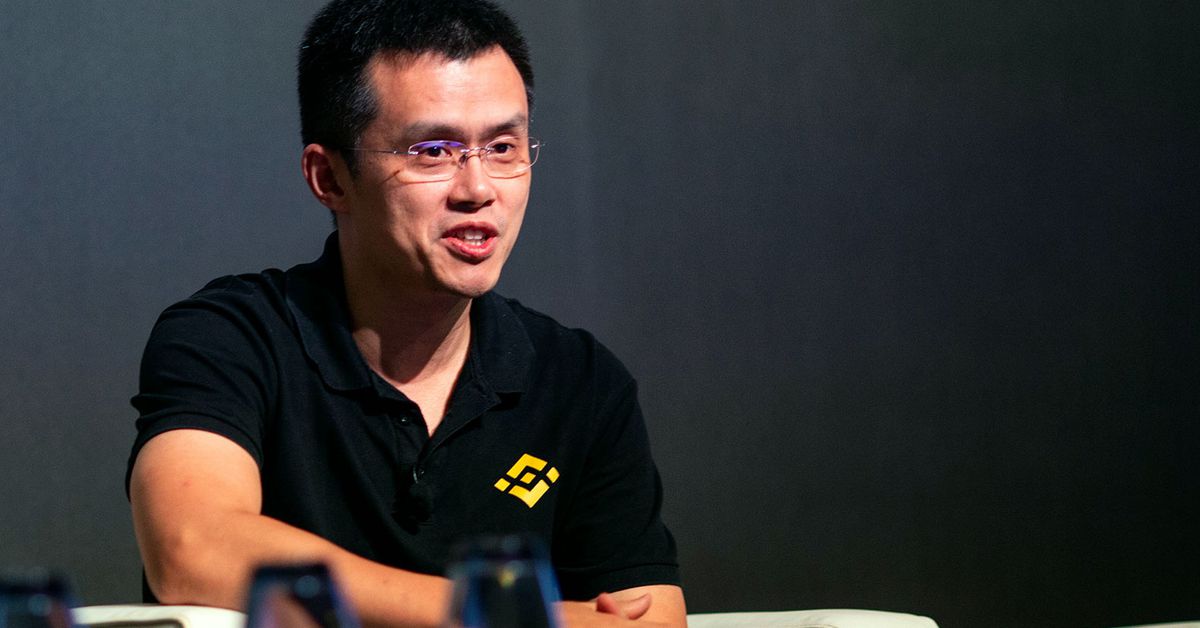

Visa And Mastercard Distancing Themselves From Binance Unlikely to Hurt the Crypto Exchange, Experts Say

However, the move is unlikely to hurt the crypto exchange’s market share, given its extensive global footprint. “It’s difficult to assess the impact of this on Binance, which is still a leading exchange from a liquidity point of view,” Weisberger said. “Until that changes, people will continue to trade there,” he added. Source

Robinhood accumulated $3B in Bitcoin in 3 months — What does this mean for markets?

In a swift and intriguing turn of events, a previously enigmatic Bitcoin (BTC) address managed to catapult itself to the esteemed position of the third-largest holder of BTC. As reported by Cointelegraph on Aug. 22, the address in question accumulated a staggering 118,000 BTC. While its identity has now been attributed to Robinhood, questions still linger, as the financial giant has neither confirmed nor denied these allegations. Some on-chain analysts posit that the stash actually belongs to MicroStrategy, the U.S. business intelligence and analytics software firm, which holds 152,800 BTC,…

Spanish central bank official talks about private payment services in era of digital euro

Deputy Governor of the Bank of Spain Margarita Delgado spoke to university students and others about the introduction of the digital euro in Pamplona on Aug. 25. Looking into a future through the lens of the European Commission’s recently proposed digital euro legislative plan, she spoke at length about how private payment solutions will interact with the digital euro and its infrastructure. The digital euro can help the European Union overcome challenges such as cross-border payment barriers, the costs to businesses of using private payment service providers (PSPs) and the…

The Government Cabined Privacy Tech Long Before Tornado Cash

More recently, the government has gained much more insight and powers of preemptive surveillance into our financial lives. For example, with the enactment of the Bank Secrecy Act in 1970, financial institutions have to engage in record-keeping and reporting in order to assist the government in its efforts to prevent money laundering, and as a result, most of the information we provide to our banks can easily be viewed by the government. Source

Price analysis 8/25: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, TON

Bitcoin and altcoins lose more ground after comments from the Federal Reserve suggest that the regime of interest rate hikes could continue into 2024. Federal Reserve Chair Jerome Powell spoke today and in his Jackson Hole speech he cautioned that inflation remains too high and that the central bank remains open to raising rates further if needed. The remarks by Powell strengthen the narrative that interest rates are likely to remain higher for longer. However, a positive sign is that after a brief sell-off, the United States equities markets have recovered from…