The development follows the default of a $5 million loan on Goldfinch made to an African robotaxi company. Source

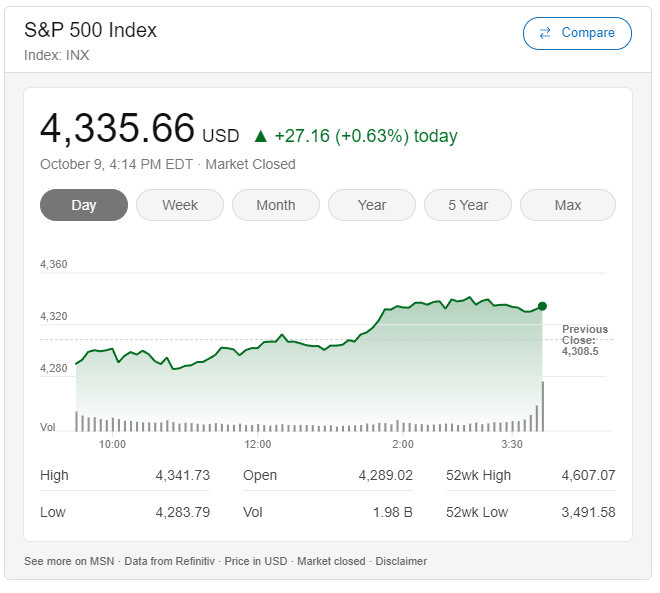

Day: October 9, 2023

US Stocks Overcome Early Decline Amid Israeli-Gaza Tensions to Close Higher

October 9, 2023 US markets demonstrated resilience on Monday, initially succumbing to concerns over the escalating Israeli-Gaza conflict, but rebounding later to close in the green. The Dow closed up 0.5%, at 33,604.65. The S&P 500 rose by 0.6%, reaching 4,335.66. The tech-heavy Nasdaq went to 13,484.24, a gain of 0.4%. The S&P was down slightly at 10:50 a.m. ET, having fallen from 4281.91 to 4285.73, a loss of 3.852 points, but this loss was erased by the end of the day. The other two indices made similar moves down,…

Is It Time To Doubledown?

Bitcoin is 200 days before halving, a supply shock that historical patterns show that prices tend to rally, even clearing previous all-time highs once it happens. In a price chart shared by the “thescalpingpro” on X on October 9, the analyst appears to suggest that the world’s most valuable coin is in the early stages of not only breaking above 2021 highs but registering new highs after the network halves in 2024. Bitcoin cycles after halving| Source:: thescalpingpro on X Early Signs Of Bull Rally: 200 Days Before Halving Thus…

Pro-crypto RFK Jr. leaves Democrats to campaign for U.S. president as independent

Pro-crypto candidate for the United States presidency Robert F. Kennedy, Jr., often known simply as RFK Jr., announced on Oct. 9 at a rally in Philadelphia that he was dropping his bid for nomination in the Democratic primary to run as an independent instead. “I’m here to declare myself an independent candidate,” he said. Kennedy has been a supporter of crypto, and he stated that one of the goals of his administration would be “making America the global hub of cryptocurrency, particularly Bitcoin.” He revealed plans in July to back…

Brazilian securities regulator plans sandbox for tokenization in 2024

The Comissão de Valores Mobiliários (CVM) of Brazil is planning to start a second regulatory sandbox program in 2024. Speaking at Rio Innovation Week on Oct. 4, the superintendent of institutional investor supervision with the CVM, Daniel Maeda, said the regulator will be exploring a regulatory sandbox for use cases of tokenization potentially starting in 2024. According to Maeda, the regulator’s efforts to launch the second sandbox followed positive experiences tokenizing roughly $36 million in assets. “We do not define specific cases, because we want to let innovation reach the…

What to Expect When Caroline Ellison Takes Stand in FTX Founder’s Sam Bankman-Fried’s Trial

Ellison was far from an unwitting front-person during her time at Alameda, said Mark Cohen, Bankman-Fried’s lead attorney, in his opening argument in defense of Bankman-Fried. Instead, she was firmly in control of the reins at the trading fund – and her poor leadership, according to Bankman-Fried’s lawyers, is what ultimately placed the firm into dire financial straits. At one point, “as the majority owner of Alameda, Bankman-Fried spoke to Ms. Ellison, the CEO, and he urged her to put on a hedge,” Cohen told the jury. “She didn’t do…

Blocknative Reduces Headcount by Third, After Suspending Work on Relay Project

The company completed a restructuring in the wake of its decision to exit services related to its MEV-Boost Relay, a type of software used by Ethereum network validators. Source

Shock $8 Trillion Predicted Amid US Dollar ‘Collapse’

Despite initial expectations of a robust rally, major cryptocurrencies Bitcoin (BTC), Ethereum (ETH), and XRP have encountered a slowdown in momentum following a promising start in 2023. However, a prominent tech company’s leaked disclosure can alter this trajectory. With the Federal Reserve (Fed) grappling with a staggering $33 trillion US “debt death spiral,” investment banking firm Jefferies analysts have warned that the Fed may be compelled to restart its money printing presses. This move could trigger the collapse of the US dollar and ignite a significant price boom for Bitcoin,…

Judge sides with Ripple again, denies SEC appeal: Law Decoded

On Oct. 3, United States District Court Judge Analisa Torres rejected the U.S. Securities and Exchange Commission’s (SEC’s) motion to appeal its loss against Ripple Labs, the company behind the XRP (XRP) cryptocurrency. Torres denied the SEC’s motion, claiming the regulator failed to meet the burden to show that there were controlling questions of law or substantial grounds for differences of opinion on the matter. The regulator appealed against the court’s July decision declaring that retail sales of the XRP token did not meet the legal definition of a security.…

These Bullish Factors Prove XRP Price Rally Is Not Over Yet

The XRP price has retraced a good portion of its gains following its surge above $0.54 last week. Naturally, this could signal that the end is in sight for an XRP rally but this is not necessarily the case when you look at the altcoin’s metrics and performance even amid its price decline. XRP Daily Transaction Count Remains Above 1 Million The XRP daily transaction count first skyrocketed above 1 million back in July when Judge Analisa Torres ruled that programmatic XRP sales did not constitute investment contracts. The XRP…