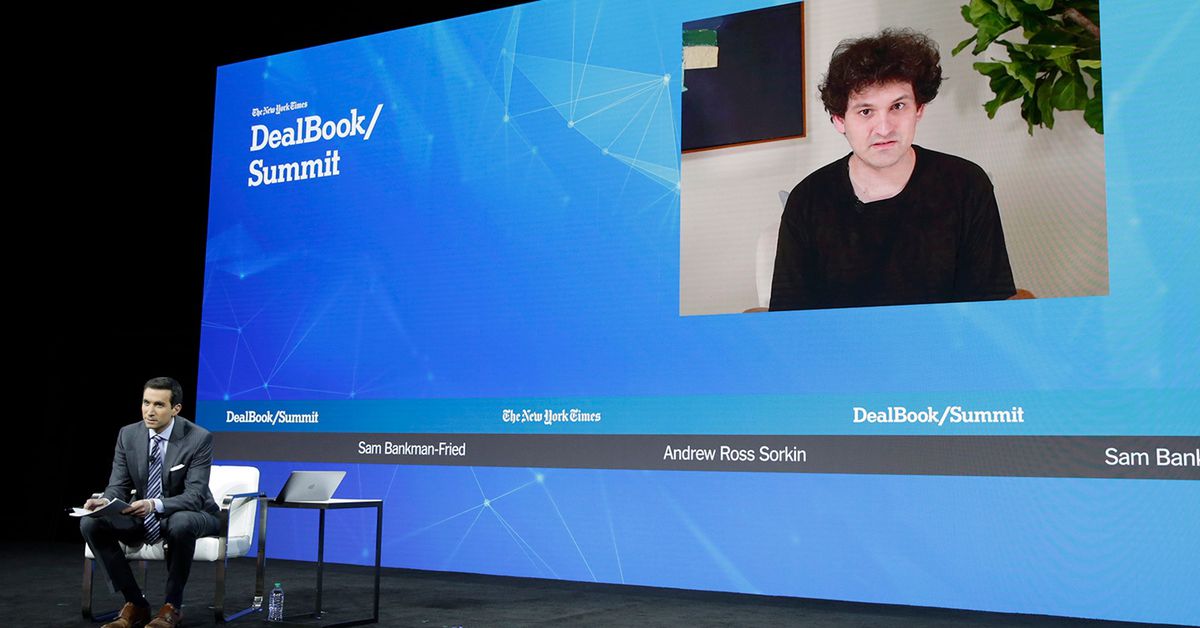

The FTX founder was grilled Monday by a prosecutor, who used the many words he said to journalists after his crypto company’s collapse against him. Source

Day: October 30, 2023

Shiba Inu Burn Rate Nosedives Following 7,700% Jump, What Happened?

The Shiba Inu burn initiative continues this week but with a drastic decline in volume. The latest figure which shows a decreased participation from investors could have long-running significant implications for the SHIB price. SHIB Burn Rate Drops From 7,700% Spike Over the last 24 hours, Shibburn has shown that the SHIB burn rate has been less than encouraging. The burn tracker revealed a total of 106.72 million tokens burned in the 23-hour period, which is a significant decline of almost 60% from the prior day’s figures. Now, the interesting…

dYdX chain goes live, unveils Bridge UI for token conversion

The dYdX Foundation announces the launch of its mainnet and a new Bridge User Interface. The dYdX Foundation announced a series of pivotal updates that signal a new phase for the dYdX ecosystem. Most notably, the mainnet genesis of the dYdX Chain is now live, with Genesis Validators having participated in the creation of its first block. This news comes on the heels of the release of dYdX Chain’s open-source software on Oct. 24, and a newly deployed Bridge User Interface. The next generation of the dYdX protocol and the…

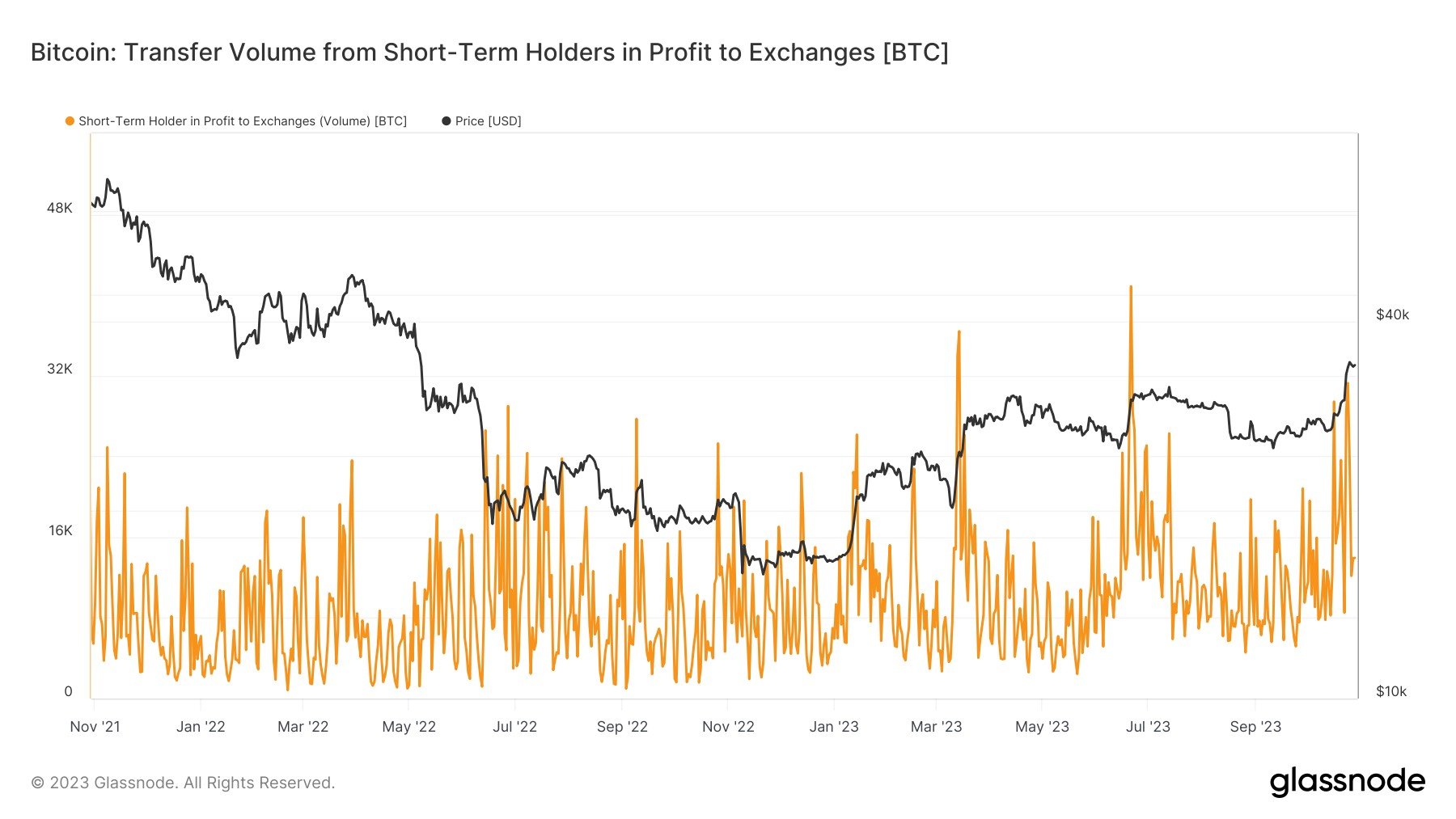

Bitcoin Solid Above $34,000 Despite High Short-Term Holder Profit-Taking

Bitcoin has shown some impressive strength above the $34,000 mark despite a high amount of profit-taking from short-term holders. Bitcoin Short-Term Holders Are Selling, While Long-Term Holders Are Still Quiet As explained by analyst James V. Straten in a new post on X, the short-term holders are currently participating in one of the strongest profit-taking events of the past couple of years. The “short-term holders” (STHs) here refer to all those Bitcoin investors who have been holding onto their coins since less than 155 days ago. This group comprises one…

Ethereum Has Layer 0 Power. But It Could Still Blow It

Before it becomes foundational infrastructure for the next stage of the internet, there are three risks that the blockchain needs to avoid, says Paul Brody, head of blockchain at EY. Source

Analyst Forecasts Surge Past $2,000 On One Condition

Ethereum (ETH), the second-largest crypto by market capitalization, has been in the spotlight due to its price action. A notable crypto analyst, Pentoshi, shed light on the asset’s price trajectory, suggesting a possible uptick in value if current conditions prevail. It is worth noting that this analyst’s predictions come at a time when Ethereum trails behind Bitcoin’s recent price rally. Notably, while Bitcoin has recorded a 12.5% increase over the past week, Ethereum’s gains are modest, rising by 8.4% during the same timeframe. Ethereum Price Bracket Significance According to the analyst’s…

Bitcoin options data highlights traders’ belief in further BTC price upside

The recent gains are a rare sight in 2023, even considering Bitcoin’s impressive 108% year-to-date performance. Notably, the last instance of such price action occurred on March 14 when Bitcoin surged from $20,750 to $26,000 in just two days, marking a 25.2% price increase. Deribit BTC options daily volume, in BTC. Source: Deribit It’s worth noting the significance of the fact that a staggering 208,000 contracts changed hands in a mere two days. To put this into perspective, the prior peak, which occurred on August 18, saw a total of…

Bitcoin’s weekly surge could be driven by liquidity shortage

Analysts suggest that Bitcoin’s recent surge could be driven by an ongoing liquidity shortage and declining stablecoin market cap. The ongoing liquidity shortage in the cryptocurrency market has been significantly impacting Bitcoin’s price, which has experienced dramatic fluctuations of over 10 percent in recent weeks. According to research from FalconX, the average volume of Bitcoin trades within a 1 percent price range from its current value has been at its lowest for the year. This comes despite a renewed surge in trading activities, partially ignited by market speculation surrounding the…

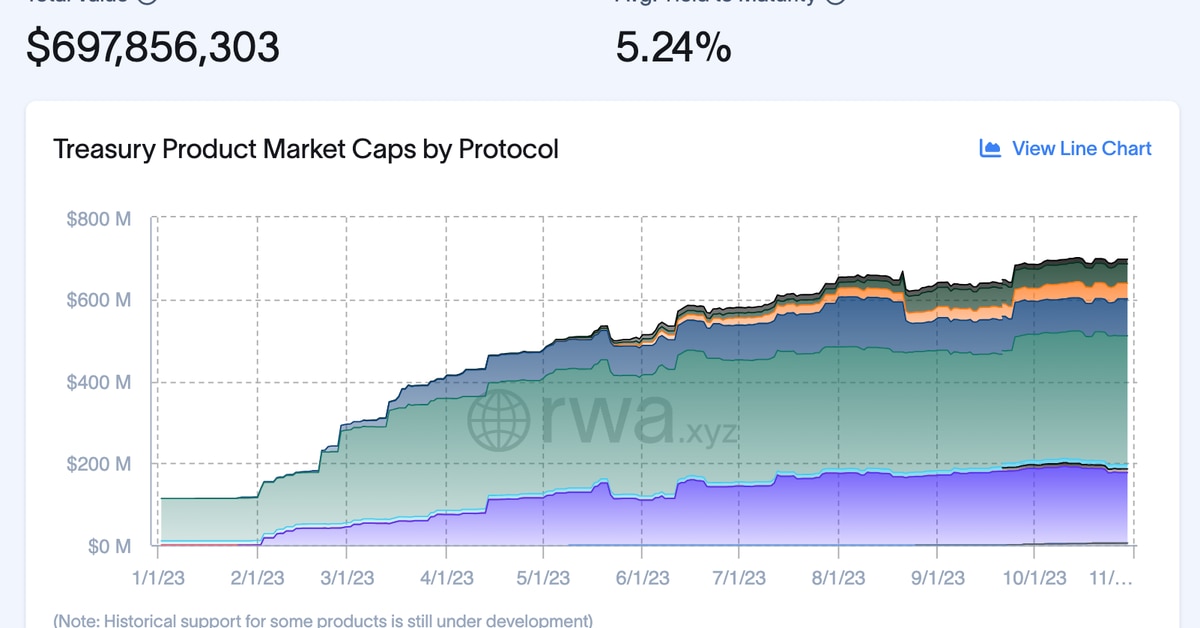

RWA Race Sees Tokenized Treasury Market Grows Nearly 600% as Ethereum (ETH) Overtakes Stellar (XLM)

According to real-world asset (RWA) monitoring platform RWA.xyz, the tokenized Treasury market surged to $698 million as of Monday from around $100 million at the start of the year. The expansion was spurred by new entrants into the space as well as from existing platform growth, Charlie You, co-founder of RWA.xyz, noted in the Our Network newsletter. Source

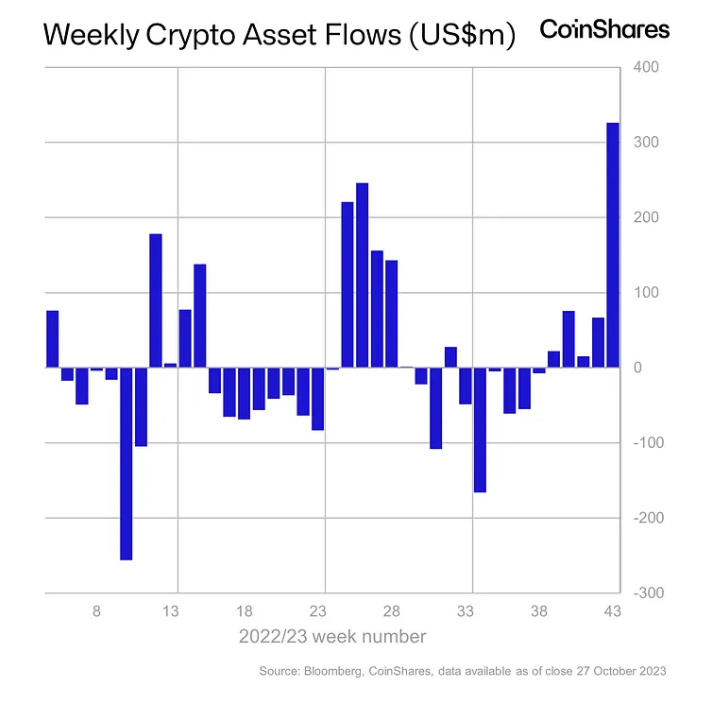

Crypto funds see largest weekly inflows in more than a year: CoinShares

Crypto exchange-traded products (ETPs) saw their largest weekly inflows in more than a year, according to an Oct. 30 report from asset management platform CoinShares. Inflows were $326 million for the week ending Oct. 27, dwarfing the $66 million recorded over the previous week. Digital asset investment products saw inflows of US$326m, the largest single week of inflows since July 2022! These numbers are due to what we believe was rising optimism from investors that the US SEC is poised to approve a spot-based Bitcoin ETF in the US. –…