Zimmerman explained that Chainlink positioned itself as a key piece of infrastructure to connect blockchains with the outside world via its system of oracles and wide range of partnerships. “It will certainly not be the biggest gainer, but few projects are better positioned to benefit from the narrative,” he added. Source

Day: October 11, 2023

Stars Arena Exploiter: ‘I Want to Cooperate’

The social app on Avalanche was drained for $3 Million last week. Source

Sam Bankman-Fried considered selling FTX equity to Saudi crown prince, says Caroline Ellison

Former Alameda Research CEO Caroline Ellison claimed in court that Sam “SBF” Bankman-Fried attempted to raise equity for FTX by considering an investment from Saudi Crown Prince Mohammed bin Salman, or MBS. Addressing the court at SBF’s criminal trial on Oct. 11, Ellison reportedly said she had discussed ways of hedging Alameda investments with Bankman-Fried in 2022. According to the former Alameda CEO, Bankman-Fried said that MBS was a potential investor in the crypto exchange prior to its collapse in November. The potential investment by MBS was one of the…

Real Estate-Backed Stablecoin USDR De-Pegs After Treasury Was Drained of Liquid Assets

On-chain data suggests that USDR’s treasury was drained of liquid assets, leading to a run on the stablecoin. Source

Bitcoin Mining Industry Is at a ‘Crucible Moment,’ JPMorgan Says

The bank initiates research coverage of CleanSpark (top pick), Marathon Digital, Riot Platforms and Cipher Mining. Source

Bitcoin Could See A 50% Rise Based On This, Analyst Explains

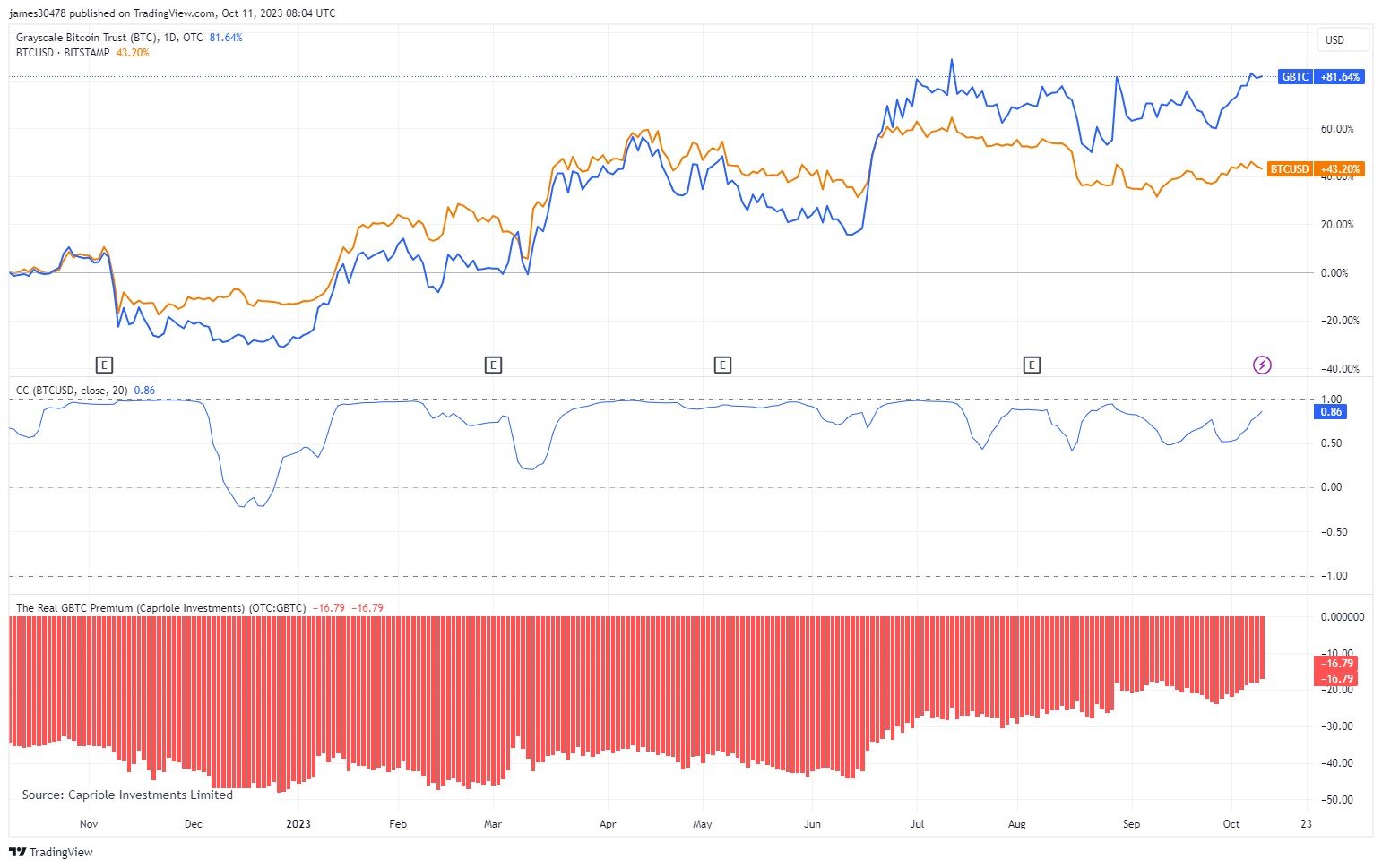

An analyst has explained that a pattern in Grayscale Bitcoin Trust (GBTC) could suggest a potential 50% rise for BTC may be ahead. Bitcoin & GBTC Have Seen A Decoupling In Recent Months In a new post on X, analyst James V. Straten has discussed the correlation between GBTC and BTC that has been present over the years. The Grayscale Bitcoin Trust is an investment vehicle that holds Bitcoin and allows exposure to these holdings through its shares. The chart below shows the trend in the percentage performance of Bitcoin…

Less than 50% of Hong Kong retail crypto investors aware of relevant regulations: Survey

Just 47% of retail crypto investors in Hong Kong are aware of the Virtual Asset Trading Platform Regulatory Regime, a piece of legislation that went into effect this June to protect the interests of retail investors in digital assets in the region. That’s according to an Oct. 11 report by the Investor and Financial Education Council (IFEC) of Hong Kong. In its survey, the IFEC noted that nearly 25% of Hong Kong adults ages 18–29 have invested in crypto within the past year, three times the demographic average and a…

Ether Could Hit $8K by End of 2026: Standard Chartered

Emerging uses for the Ethereum network in gaming and tokenization should help drive a 5X in ether’s price over the next three years, said the bank. Source

Tools for Humanity’s Tiago Sada Discusses Relationship Between Blockchain and Worldcoin Orb $WLD

But you’re building a platform that is going to be incumbent on there being use cases in the future. And Ethereum, you mentioned, that’s also a platform, but it’s not itself a use case. So I wonder without being too prescriptive, and just spinning up dapps and programs yourself, what kinds of use cases do you expect to really see take off on Worldcoin or using WorldID as an authentication method? Source

Mark to market accounting meets crypto: New FASB changes

In early September 2023, the US Financial Accounting Standards Board (FASB) finally approved the commonly accepted accounting practice of mark to market accounting to apply to corporations and businesses holding crypto digital assets. Previously, companies like Microstrategy and Tesla needed to file crypto digital assets as intangible assets like goodwill and Intellectual Property (IP). If the value of these intangibles went down, they needed to declare a loss. However, if the value of the intangible went up, these companies were not allowed to declare a gain of asset values. Michael Saylor…