Bitcoin rallied to $30,000 on rumors that the Securities and Exchange Commission (SEC) has approved the iShares Bitcoin spot ETF. The price of Bitcoin (BTC) skyrocketed in a flash on Oct. 16 following speculations that the SEC approved the first spot Bitcoin ETF in the U.S. Crypto news site CoinTelegraph was the first to report the news, however, ETF analysts like James Seyffart clarified that approval has yet to be confirmed. Seyffart also debunked the news that BlackRock’s filing was approved by the SEC. Okay. Have a few different sources…

Day: October 16, 2023

Crypto Shorts See Carnage As Bitcoin Surges Towards $28,000

Data shows the crypto futures market has observed large liquidations in the past day as Bitcoin has recorded a sharp surge towards $28,000. Crypto Futures Observed $78 Million In Liquidations In Last 24 Hours A crypto futures contract is said to be “liquidated” when the derivative exchange with which said contract is open forcefully closes it up. This happens when the contract has accumulated losses of a certain percentage, the exact value of which may differ between platforms. In this sector, it’s not too rare to see a flood of…

Bitcoin Jumps to $30K, Then Dumps, as False Spot ETF Approval Report Circulates

More than $80 million in derivatives positions have been liquidated in the past hour as bitcoin (BTC) surged from $27,900 to $30,000 following an unverified about a spot ETF approval. Source

How Clear and Effective Crypto Regulations are Born

Now, the SEC is taking a beating, both in the court of law, and the court of public opinion. After a massive Ripple victory against the SEC in summary judgment, the SEC filed an appeal that was broadly rejected by the court. This pair of losses essentially guts the SEC’s legal strategy and is a clear sign to the agency that their philosophy is misguided at best, or malicious at worst. Source

Tether freezes $873K USDT linked to terrorist activity in Ukraine, Israel

Stablecoin issuer Tether has moved to freeze 32 addresses linked to terrorist activity in Israel and Ukraine in collaboration with local law enforcement agencies. $873,118 worth of Tether (USDT) linked to illicit activity in Israel and Ukraine have been frozen, according to an announcement from the company. The action was taken in collaboration with Israel’s National Bureau for Counter Terror Financing. Paolo Ardoino, who was appointed as Tether CEO in October, highlighted the fact that cryptocurrency transactions are easily traced on blockchain platforms, enabling Tether to assist in blocking the…

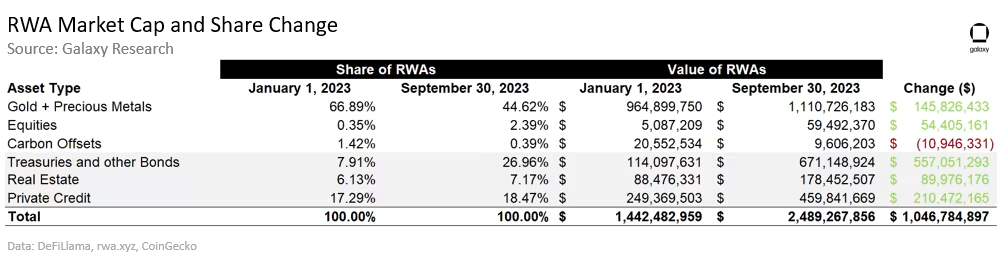

Token adoption grows as real-world assets move on-chain

While critics wrote off much of the initial hype surrounding the tokenized real-world asset (RWA) market, the sector has been on a tear over the past year or so. In fact, Boston Consulting Group expects the tokenization of global illiquid assets to be a $16 trillion industry by the end of the decade. A variety of asset categories are actively being tokenized and garnering investments, with recent data suggesting that the total value of tokenized real-world assets reached an all-time high of $2.75 billion in August. And while the metric…

How Has Its 84 Million Supply Been Distributed Over Time?

Much has changed since Litecoin launched in 2011 with a maximum supply of 84 million LTC as a silver to Bitcoin’s gold. The crypto recently completed its third halving in August, finally reducing the number of LTC miners receive as a reward for mining a block from 12.5 LTC to 6.25 LTC. Over the past 12 years, much of this supply has been distributed to miners as block rewards for verifying Litecoin transactions. At the time of writing, there are 73.76 million LTC in circulation, with data showing this supply…

Tether Freezes 32 Addresses Linked to Terrorism and Warfare in Israel and Ukraine

“Tether remains committed to promoting responsible blockchain technology use and standing as a robust defense against cybercrime,” said newly-appointed Tether CEO Paolo Ardoino. “We eagerly anticipate continued collaboration with global law enforcement agencies as part of our commitment to global security and financial integrity.” Source

Where Is Crypto Policy Heading in a Post-FTX World?

Among some crypto journalists, there is a sense the ongoing criminal trial of disgraced FTX founder Sam Bankman-Fried may be the last great crypto trial. FTX’s implosion, and the subsequent market contagion and negative feedback loop of media coverage it kick started, has done the blockchain industry irreparable damage. The size of the estimated losses to FTX investors and users would, if convicted, place Bankman-Fried among the largest financial frauds in history. And, as many said, for better or worse, crypto is on the stand alongside him. Source

U.S. government is now largest Bitcoin whale with $5b in BTC

The U.S. government is one of the world’s largest holders of Bitcoin (BTC), storing about 200,000 BTC in hardware wallets. The Wall Street Journal (WSJ) reported that the U.S. Department of Justice, the Internal Revenue Service and other departments control a number of encrypted hardware wallets. Most of the assets held in government accounts have been confiscated from cybercriminals. According to public records provided by research firm 21.co, the last three seizures brought approximately 215,000 BTC into the U.S. government treasury. Source: Dune In 2020, the Department of Justice confiscated approximately…