In a recent report released by Matrixport, a digital assets financial services platform, the spotlight shifts beyond Bitcoin (BTC) as the eagerly anticipated approval of a Bitcoin spot Exchange-Traded Fund (ETF) by the US Securities and Exchange Commission (SEC) could have far-reaching effects. According to the analysis, not only could the Bitcoin market experience a significant boost, but Tether (USDT) and the broader crypto market could also see positive outcomes. Potential Impact On Bitcoin Matrixport’s foresight, outlined in their 2023 outlook report published on December 9, 2022, projected a substantial…

Day: October 19, 2023

Universal Music Group sues Anthropic AI over copyright infringement

Universal Music Group (UMG), Concord Publishing and ABKCO Music & Records have filed a lawsuit against the artificial intelligence (AI) startup Anthropic, accusing the latter of committing copyright infringement when training its AI chatbot, Claude. The lawsuit was filed on Oct. 18 and claims that Anthropic “unlawfully” copied and disseminated “vast amounts of copyrighted works – including the lyrics to myriad musical compositions” that are under the ownership or control of the publishers. It called Anthropic’s use of the works “widespread and systematic infringement” and said the defendant cannot reproduce,…

DCG, Genesis Were the ‘Adults in the Room’ but Didn’t Behave Like It

In crypto, companies are often more intertwined and dependent than you would suspect, and, after a while, all of the schemes that brought down firms like Three Arrows Capital, Celsius Network and BlockFi begin to rhyme. Lied and lied to. Genesis’ hole appeared after the collapse of 3AC, itself brought down by the implosion of Do Kwon’s UST stablecoin. Source

Binance Q3 report appraises crypto market as ‘challenging’ amid high interest rates

It’s been a challenging quarter for crypto, Binance has confirmed in its Q3 market pulse report. The market was down in many sectors, the report found, although the entry of institutional players such as Deutsche Bank, Sony and PayPal helped offset some of the pain. The global crypto market capitalization was down 8.6% quarter-on-quarter (QoQ) “with the ‘higher for longer’ interest rate rhetoric set to persist.” Fundraising was at its lowest since Q4 2020 and down 21.4% QoQ, with infrastructure doing significantly better than other sectors. Activity was down slightly…

Bitcoin Eyes $29K, Defying Fresh Crypto Lawsuit, Rate Fears

The New York Attorney General filed early Thursday a lawsuit against Genesis, Gemini and DCG for allegedly defrauding investors of $1 billion. Original

Crypto Mixers Targeted by U.S. Over Money Laundering Concern

FinCEN said that mixing services, which seek to allow users to conduct transactions with anonymity, are used by a “variety of illicit actors throughout the world,” referring by name to Hamas, Palestinian Islamic Jihad and the Democratic People’s Republic of Korea (DPRK). The agency said this proposed rule is a “key part” of the ongoing effort to boost transparency in the crypto markets. Source

DTCC acquires blockchain startup Securrency in a $50 million deal

The Depository Trust & Clearing Corp. (DTCC) has acquired blockchain startup Securrency Inc. for an estimated $50 million, marking its first buyout in a decade and signaling a significant push into blockchain-based financial services. In a strategic initiative to enhance its blockchain technology offerings, the Depository Trust & Clearing Corp. (DTCC) has confirmed its acquisition of Securrency Inc., a Maryland-based blockchain startup. Reports from Bloomberg suggested that the deal is valued at approximately $50 million. This marks DTCC’s first acquisition since 2013. Frank La Salla, CEO of DTCC, highlighted that…

FinCEN proposes designating crypto mixers as money-laundering hubs

The United States Treasury Department’s Financial Crimes Enforcement Network, or FinCEN, has proposed designating cryptocurrency mixing as an area of “primary money laundering concern” following Hamas’ attack on Israel. In an Oct. 19 notice, FinCEN said it had assessed that “the percentage of CVC [convertible virtual currencies] transactions processed by CVC mixers that originated from likely illicit sources is increasing.” FinCEN proposed requiring domestic financial institutions and agencies to “implement certain recordkeeping and reporting requirements” for transactions involving crypto mixers. “FinCEN considered issuing a rule pursuant to section 311 [of the U.S.…

Wait For Bitcoin At $20,000? This Analyst Says No

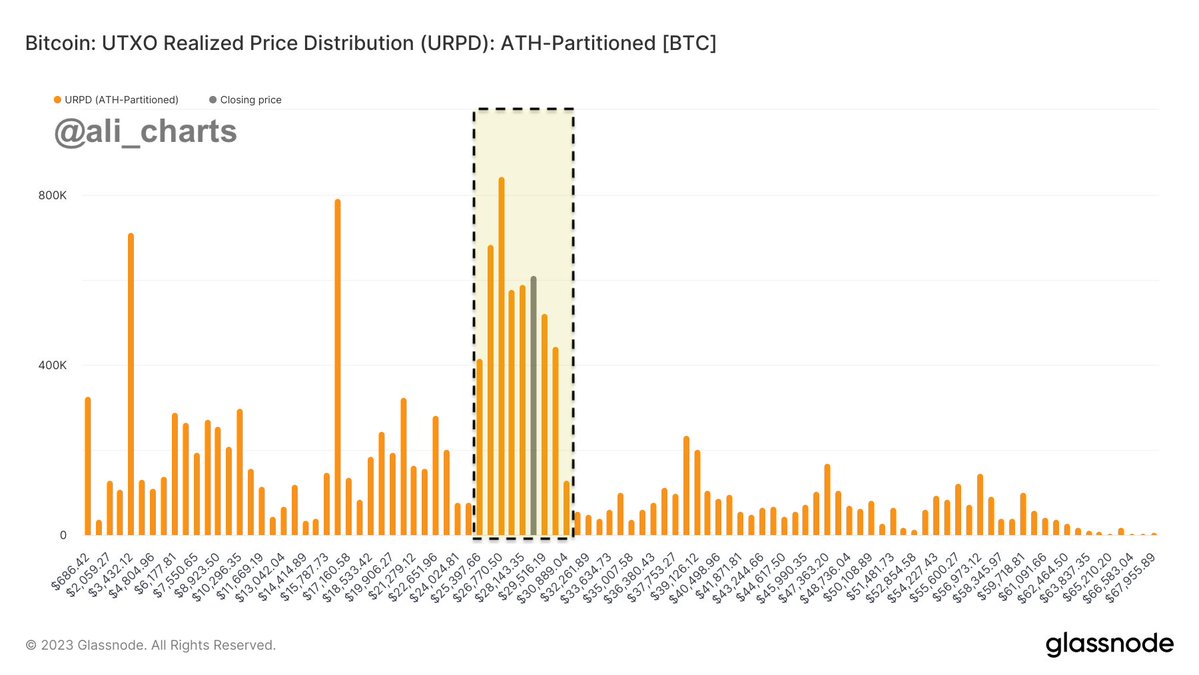

An analyst has explained using on-chain data that Bitcoin has a major demand bucket at the current price levels, so it won’t hit $20,000 anytime soon. Huge Bitcoin Buying Occurred Inside The $25,000 To $30,000 Range In a new post on X, analyst Ali has explained that some large entities accumulated at the $25,000 to $30,000 range. The indicator of interest here is the “UTXO Realized Price Distribution” (URPD), which, in short, tells us about the amount of Bitcoin that was acquired at the different price levels of the cryptocurrency.…

Grayscale’s GBTC Spot Bitcoin (GBTC) ETF Conversion in Question After New York Suit

“I am neither an attorney nor legal expert, but I don’t think there’s any scenario in which Grayscale will sell their bitcoin and dissolve their trusts, regardless of this lawsuit,” said Weisberger. “Even if DCG is forced to sell the trust, it would just come under operational management by a different entity. As a result, this case seems unrelated to the likelihood of the Greyscale trust conversion to an ETFs being approved.” Original