“Victims of these crimes are placed into forced labor, slavery, involuntary servitude, peonage, and/or forced to engage in commercial sex acts,” the report said. And the use of crypto was on a sharp rise, with 1,975 reports in 2021 eclipsing the 336 in 2020. Source

Day: February 13, 2024

Umoja Launches Beta Hedging Service to Bolster Crypto Investment Safety

On Tuesday, the crypto platform Umoja unveiled its beta version of hedging-as-a-service, designed to shield users from crypto losses. Umoja’s mission is to enhance the safety and accessibility of crypto investments, opening up hedging opportunities in a market valued at $500 trillion. Umoja Debuts Beta Hedging Platform The crypto platform Umoja has announced the beta […] Source CryptoX Portal

The SEC Takes on Dealer Definitions

If the agency sticks to dismissing arguments from crypto businesses that say they’re being put in impossible positions, the SEC will be approving rules that the firms contend will push them into existential crisis or inability to comply. As a result, the companies will surely keep doing what they’ve been doing: challenging the regulator in court. It’s possible that, beyond the current dispute over what makes a security, the digital assets sector will be arguing in court over what makes an exchange, a dealer and a qualified custodian. Source

Open Interest Hits $1.75 Billion, Price Up 8% Today

Solana (SOL), a leading cryptocurrency known for its fast transaction speed, is currently experiencing a surge in investor confidence. According to recent market data, the open interest in Solana has increased by over 108%, reaching a new high of $1.75 billion. This surge indicates a significant rise in investor activity and market participation across major exchanges such as Binance, Bybit, and OKX. In addition, Solana’s price has risen by over 8% in a single day, reaching $114, accompanied by an 88% increase in trading volume, which has reached nearly $3…

UniLend V2 Launched on Mainnet: First-Ever Permissionless Lending and Borrowing Protocol for All Digital Assets

PRESS RELEASE. February 13, 2024. UniLend Finance, a leading decentralized finance protocol, has launched its revolutionary new version UniLend V2 on the Ethereum Mainnet. UniLend V2 marks a significant milestone as the first-ever permissionless lending and borrowing protocol for all ERC20 tokens, opening doors to DeFi for everyone and revolutionizing the digital asset landscape. Being […] Source CryptoX Portal

Robinhood's Higher Crypto Revenue Could be Positive for Coinbase Earnings

The shares of the popular trading platform rose 15% after beating earnings and revenue estimates. Source

Billionaire Peter Thiel’s VC Firm Bought BTC and ETH Worth $200 Million in Latter Half of 2023

Founders Fund, a venture capital (VC) firm founded by the billionaire Peter Thiel, is believed to have acquired bitcoin and ethereum worth $200 million sometime in the second half of 2023. The VC firm reportedly began purchasing bitcoin when its price was still under $30,000. Founders Fund’s Renewed Interest in Crypto In the latter half […] Source CryptoX Portal

As EtherRocks Hit Sotheby’s, Who Is Laughing Hardest?

Literally clipart of rocks, the NFTs are a popular joke on digital art. Now the storied auction house is selling them, they may become even more collectible, says Daniel Kuhn. Source

Craig Wright questioned on Tulip Trust, denies Kleiman’s role in court

Craig Wright’s sixth day of cross-examination saw the judge delve deeper into his connections with David Kleiman and the complex details surrounding the Tulip Trust. According to the courtroom conversation noted by BitMex Research, today’s session was marked by intense scrutiny of Wright’s past declarations and his relationship with the late Kleiman, shedding light on the complexities of their partnership and the foundational days of Bitcoin. The court pressed Wright on Kleiman’s involvement in the Tulip Trust, a series of trusts that Wright previously claimed were established to manage a…

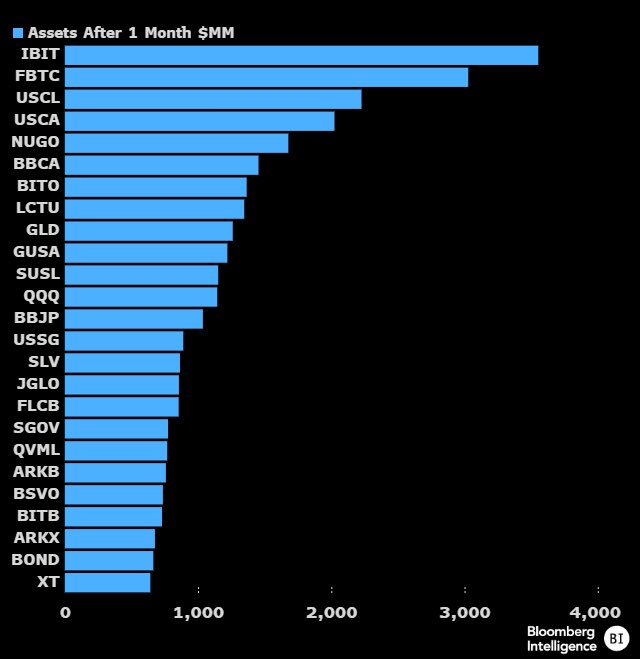

Bitcoin Continues To Break Wall Street Records: The Whales Are Here

Bitcoin is making waves on Wall Street, with BlackRock and Fidelity, two of the popular spot Bitcoin exchange-traded funds (ETF) issuers shattering records. Looking at recent trends, spot Bitcoin ETFs are surging in popularity, indicating that institutional investors, or “whales,” are diving headfirst. Fidelity And BlackRock Spot Bitcoin ETFs Break Wall Street Record Mark Wlosinski, a crypto commentator, took to X on February 12, highlighting the meteoric rise of BlackRock (IBIT) and Fidelity (FBTC) Bitcoin spot ETFs. Both have amassed a staggering $3 billion in assets under management (AUM) within 30…