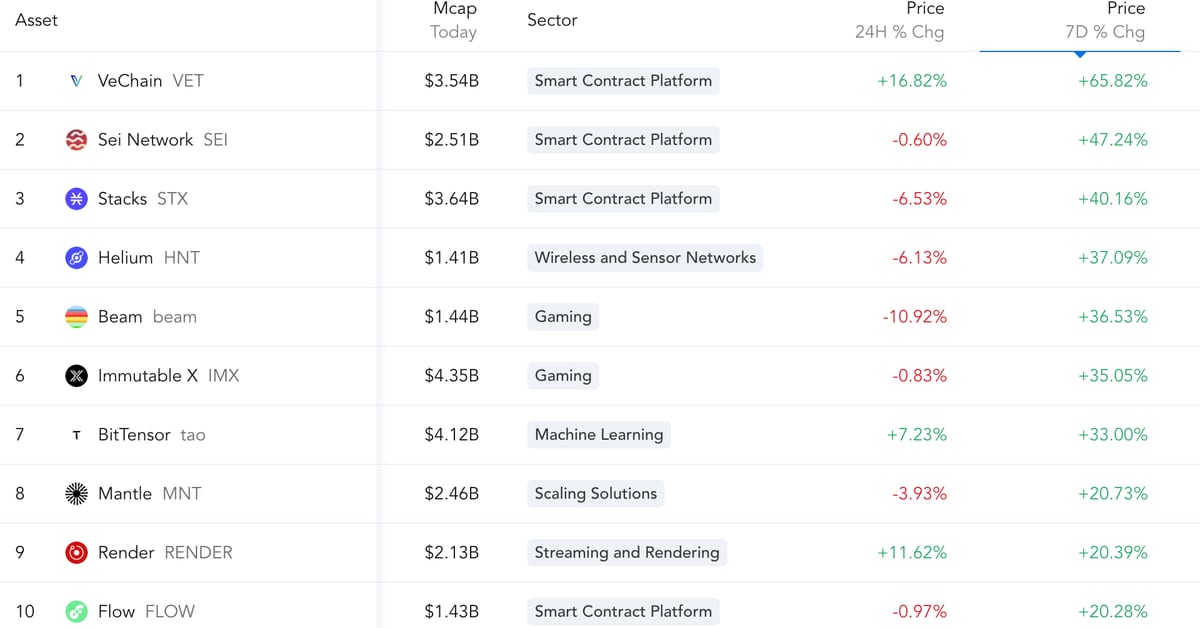

Bitcoin (BTC) had a strong week, adding 11% in the past seven days, but altcoins surged even more, with some rallying in excess of 50%. The top gainer was VeChain’s VET, which climbed some 65%. VeChain is a blockchain that aims to improve supply-chain management and business processes for enterprises. Besides following bitcoin’s pump, the catalyst for VET’s surge is unclear, though the company announced earlier in the week that “Account Abstraction” had gone live, improving interoperability and unlocking programmable smart contract wallets. According to Kenny Hearn, chief investment officer…

Day: February 16, 2024

Bitcoin Technical Analysis: BTC Consolidates Gains as Traders Eye $53K Resistance Level

As bitcoin weaves through its dynamic trading patterns, its valuation on Feb. 16, 2024, reveals pronounced bullish indicators. Floating within a 24-hour trading window of $51,364 to $52,884, the digital currency’s market worth firmly grips the $1.02 trillion mark. Bitcoin The volume of bitcoin’s global trades is cruising at $29.86 billion, showcasing a medium-to-high engagement […] Original

MicroStrategy’s bitcoin success sparks speculation on potential S&P 500 entry

MicroStrategy, the leading corporate holder of Bitcoin, has seen its investment in the cryptocurrency exceed $10 billion, with profits soaring above $4 billion as Bitcoin’s price approached $53,000. Since commencing its Bitcoin acquisition in 2020, MicroStrategy has accumulated 190,000 bitcoins at an average cost of $31,224 per coin, totaling $5.93 billion. This bold move has not only resulted in substantial profits but also positioned the company as a significant influencer in the cryptocurrency domain. The recent surge in Bitcoin’s price, exceeding 20% since the start of 2024, has doubled MicroStrategy’s…

2 Key Factors Behind The Momentum

Bitcoin has been the buzz of the town lately as it continues to push past key price levels, leaving many to wonder how high it can go. Current technicals and fundamentals indicate that the latest rally has solid foundations, and there are good reasons to think there’s more upside ahead for the leading cryptocurrency. The latest rally has been fueled by different on-chain sentiments ranging from whale accumulation to the increase in Bitcoin whales. Two of the most important market factors fueling this rally are spot Bitcoin exchange-traded funds (ETFs)…

ZK Proofs Enable Defi Platforms to Meet Regulatory Requirements Without Compromising User Data, Says Ex-FCA Regulator

Diana Tlupova, Head of Compliance at Nexera ID, has argued players in the decentralized finance (defi) space can stay ahead of regulators who might want to impose stringent Know-Your-Customer (KYC) rules by using zero-knowledge (zk) proofs to authenticate user credentials. Tlupova contends that, in addition to allowing users to maintain control over their KYC data, […] Source CryptoX Portal

Bitcoin's Latest Rally is Different as BTC Rises Alongside U.S. Dollar and Treasury Yields

Bitcoin has managed to chalk out a double-digit rally recently, ignoring the strength in the dollar index and Treasury yields. Source

BONK Up 30% As Robinhood Listing Speculations Gain Traction

The crypto world is always buzzing, and this week, it’s the Shiba Inu-inspired BONK, built on the Solana blockchain, making the headlines. Its price has experienced a remarkable jump, exceeding 30% in just the past week, fueled by whispers of potential listings on two major platforms: Revolut and Robinhood. The Spark That Ignited The Frenzy Rumors emerged suggesting BONK could soon become available to Revolut’s staggering 38 million user base. The speculation didn’t stop there, with talk of a “Learn and Earn” campaign potentially adding another half a million to…

European asset management firm’s team blocked crypto ETP investment

Jupiter Asset Management (JUN) is withdrawing its investment in one of its exchange-traded cryptocurrency products (ETPs). JUN, a London-listed firm with more than $65.8 billion in assets under management, has pulled out of the investment due to compliance issues, the Financial Times (FT) reported. Jupiter Gold & Silver fund invested $2.58 million in the Ripple (XRP) 21Shares ETP in the first half of 2023. However, the investment was flagged by the company’s regular oversight process and was later canceled at a loss of $834. The FT cites differences in the…

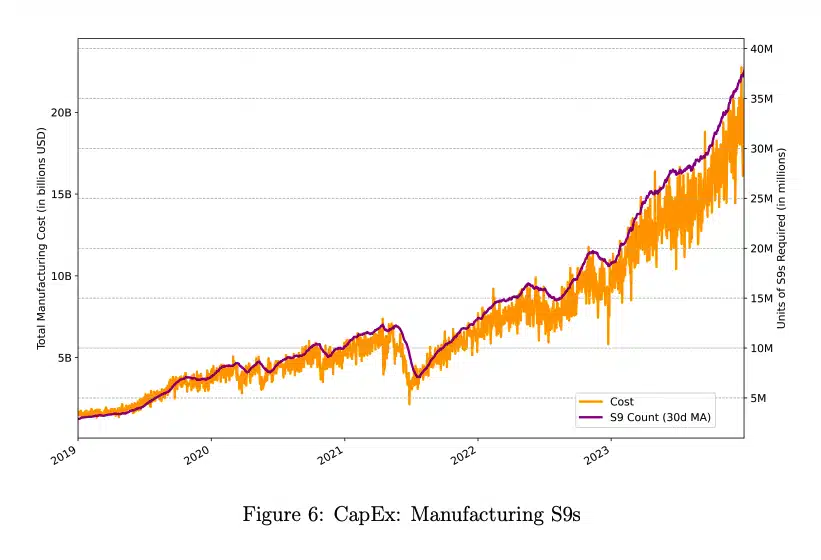

BTC and ETH safe from 51% attacks, Coin Metrics cites using cost barriers

Crypto intelligence firm Coin Metrics has revealed in its latest research that it has become impractical for nation-states to dismantle the BTC and ETH network through 51% attacks, given the prohibitive expenses involved. A 51% attack involves gaining majority control over a network’s hash rate in proof-of-work systems like Bitcoin or staking in proof-of-stake networks such as Ethereum, allowing for possible manipulation of the blockchain. The study, conducted by Lucas Nuzzi, Kyle Waters, and Matias Andrade of Coin Metrics, introduces the “Total Cost to Attack” (TCA) metric to estimate the…

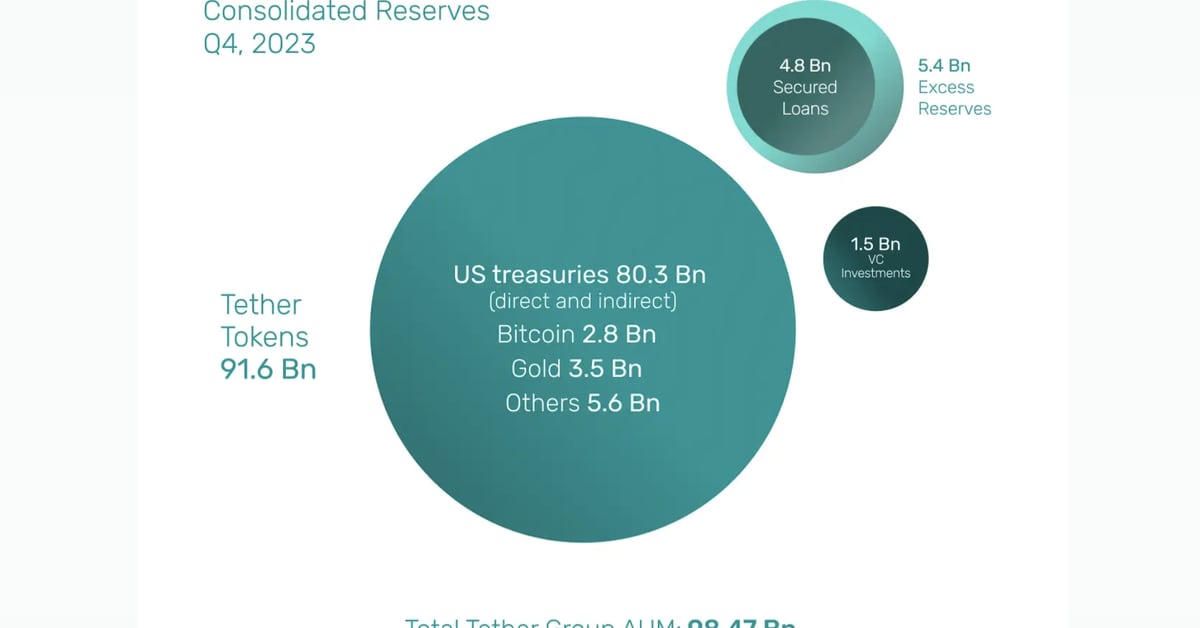

U.S. Regulators Do Have Some Control Over Stablecoin Tether: JPMorgan

“Stablecoin regulations, in particular, are set to be coordinated globally via the Financial Stability Board (FSB) across the G20, further constraining the usage of unregulated stablecoins such as tether,” the report added. Tether has come under pressure to be more transparent about how its reserves are invested, and has been working toward publishing real-time data. Still, JPMorgan says the latest disclosures by the stablecoin issuer are not enough to reduce concerns. Source