South Korea has delayed its efforts to relax its crypto regulations and the prohibition on spot bitcoin exchange-traded funds (ETFs). This development follows closely behind the People Power Party’s contemplation of removing certain regulations and the ETF ban before the commencement of South Korea’s general election. South Korea Holds Back on Crypto Regulation and Reported […] Source CryptoX Portal

Day: February 29, 2024

StarkWare Plans New ‘Stwo’ Cryptographic Prover for Cheaper Transactions

A prover is a key component for layer-2s, since they generate proofs that are then posted to the base layer blockchain – a crucial process in linking the networks and sharing the security. With a faster prover, processing transactions costs should be lower, which in effect then will also lower fees for users and speed up transactions, according to the StarkWare team. Source

Memecoins thrive in bull market as BONK, SHIB lead daily gains

Memecoins Shiba Inu and Bonk have rallied thanks to a recent run that has seen the two coins notch over 30% gains within the last week. The crypto market has entered a long-awaited bull market, with Bitcoin and Ethereum reaching prices not seen since December 2021. The overall crypto market cap has reached $2.4 trillion for the first time since the FTX crash. However, the top memecoins have returned the most gains in this rallying market. Despite falling 30% from its all-time high, Bonk has surged over 100% in February,…

Bitcoin (BTC) Price Gained 45% in a Month. It Could Run Higher, Analysts Say

“We haven’t even begun to reach the heights this is likely to go.” Alex Thorn, head of firmwide research at Galaxy, said in a market analysis posted on X (formerly Twitter) Thursday. He argued that the U.S. spot bitcoin ETFs are a “game changer,” providing steady – and recently accelerating – demand for BTC. Meanwhile, some 75% of bitcoin’s supply is owned by long-term holders, who have been unwilling to sell so far at recent price levels. Original

FOMO Fuels Bitcoin Price 35% Jump, Options Flow Hints At Bigger Upswing

The price of Bitcoin seems on the brink of blasting past its all-time high (ATH) at the high area of its current levels. The cryptocurrency has been on a bull run due to the launch of spot Bitcoin Exchange Traded Funds (ETF), which officially onboarded institutions to the nascent sector. As of this writing, Bitcoin (BTC) trades at around $62,900 with a 3% profit in the last 24 hours. In the previous week, the cryptocurrency recorded a critical 22% profit. It stood as one of the three top gainers in…

Retiring CEO of Giant Asset Manager Vanguard Shunned Bitcoin ETFs

Whether it even needs to bother is another question. Bloomberg analyst James Seyffart noted Thursday that one of Vanguard’s ETFs, VOO, which tracks the S&P 500 Index, has attracted $15.7 billion in net new money so far this year, double what BlackRock’s spot bitcoin ETF, IBIT, has collected. Source

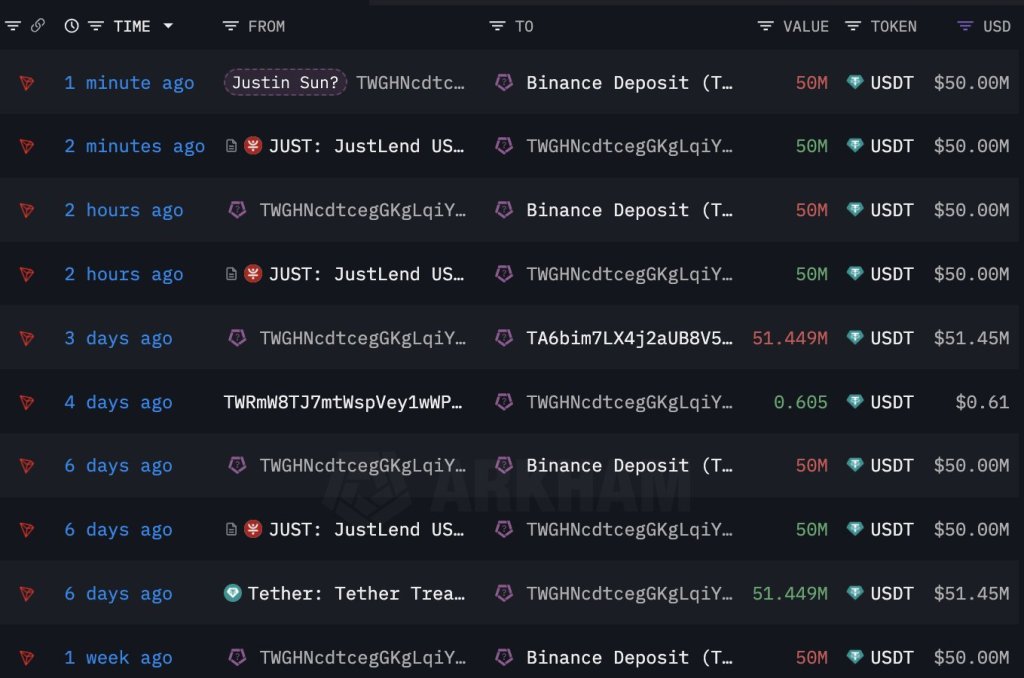

Justin Sun Moves $100M To Binance, Stacking Ethereum?

Justin Sun, the co-founder of Tron–a smart contracting platform for deploying decentralized applications (dapps), is once again moving and shuffling millions of dollars. According to Lookonchain data on February 29, Sun reportedly transferred 100 million USDT to Binance, days after moving huge sums earlier this week. Justin Sun moves $100 million USDT to Binance | Source: Lookonchain via X Justin Sun Holds Millions Of ETH: Will The Co-founder Buy More? From February 12 to 24, a wallet associated with Sun acquired 168,369 ETH for an average price of $2,894. This purchase, valued…

Crypto Analyst Predicts Push To $600

Like almost every other crypto token in the market, Solana (SOL) is enjoying a rally of its own, rising to nearly $125 in the last 24 hours. Interestingly, this looks like only the beginning of good things to come for the crypto token, as crypto analyst Hansolar predicts that it could run massively in this bull cycle. SOL To Rise To $600 Hansolar mentioned in an X (formerly Twitter) post that SOL will rise to $600. This “fun” target was laid on the premise that SOL could be the new…

Bank of America, Wells Fargo add spot Bitcoin ETFs to offering

Two wealth managers on Wall Street will support spot Bitcoin ETFs nearly two months after the products debuted on major U.S. exchanges. Bank of America’s Merrill Lynch and Wells Fargo will allow clients with brokerage accounts to trade spot Bitcoin (BTC) ETFs following billions in demand eight weeks after it became available. Bloomberg first reported the news, citing unnamed sources with intimate knowledge of the matter. Spot Bitcoin ETF issuers include some of the largest asset managers in the U.S., such as BlackRock and Fidelity. However, wirehouses and traditional banks…

BitTorrent Chain Spotlighted in Reports by CoinMarketCap and Reflexivity Research

PRESS RELEASE. Singapore / February 29th, 2024 / – BitTorrent Chain (BTTC), a pioneering force in blockchain interoperability and scalability, has been featured in recent reports by CoinMarketCap (CMC) and Reflexivity Research, highlighting its growing influence in the blockchain sector. CoinMarketCap’s report offers a deep dive into the cross-chain interoperability sector, where BTTC stands out […] Source CryptoX Portal