Bitcoin (BTC) has been consistently rising over the past few days and has just surpassed the $59,000 mark. BTC is up by 4.3% in the past 24 hours and is trading at $59,100 at the time of writing. The flagship asset’s market cap just surpassed the $1.15 trillion mark with a daily trading volume of $45 billion. BTC price, whale activity, RSI and social volume – Feb. 28 | Source: Santiment According to data provided by Santiment, Bitcoin investors are taking over the crypto social media talking about the asset’s…

Month: February 2024

Aleksandr Li: Understanding Pik-Swap and the Hybrid Decentralized Wager Platform

N-PIK is an online gambling platform that utilizes its own PIK token, PLYP token to enable players to join raffles, as well as a comprehensive token-based economy to allow players to bet, wager, and win in the best games of skill and chance. The ecosystem’s platforms are already licensed in Uganda and Kenya. Li Aleksandr […] Source CryptoX Portal

Bitcoin (BTC) Smashes Past $59K, Traders Target $69K by March

The price spike came as spot bitcoin exchange-traded funds (ETFs) recorded over $3 billion in cumulative trading volumes on Tuesday, contributing to demand. Some traders also pointed to the bitcoin halving event, expected in April, as a new narrative that causes a pre-halving rally. Source

Expert Eyes Bitcoin At $750,000 As Fidelity Advises 1-3% Allocation

In a major shift within the financial industry, Fidelity Investments, with its colossal $12.6 trillion in assets under administration, is now recommending that the traditional 60/40 portfolio model should evolve to include a 1-3% allocation to crypto, specifically through its spot Bitcoin ETF (FBTC). This groundbreaking move is not just a nod to the burgeoning crypto market but a potential catalyst for unprecedented demand, potentially channeling hundreds of billions of dollars into Bitcoin. Fidelity recommends crypto allocation in a 60/40 portfolio | Source: Fidelity Matt Ballensweig, Head of Go Network…

Strike launches Bitcoin payment services in seven African nations

Strike, a Bitcoin-focused payments application, has announced the launch of its services in seven African countries, signaling its expansion into the continent. The countries included in this initial rollout are Gabon, Ivory Coast, Malawi, Nigeria, South Africa, Uganda, and Zambia. The company, founded by CEO Jack Mallers, aims to extend its reach to more African markets in the future. All of our services are rolling out to Africa, not just our app. Strike for Businesses, the Strike API, and Strike Private are all now available in the supported African markets.…

QCP Capital explains when to expect Bitcoin’s all-time high

Amid Bitcoin’s (BTC) rally, experts at QCP Capital wondered whether BTC could hit all-time highs sooner than the end of March. At the time of writing, BTC is trading at $58,300, up 4% in 24 hours and 13% in the last seven days, according to CoinMarketCap data. Following the rapid growth of the first cryptocurrency, analysts at QCP Capital wondered whether BTC would reach all-time high earlier than the end of March 2024. Source: CoinMarketCap In their latest analysis, experts presented bullish and bearish scenarios for Bitcoin. The first is…

XRP Sinking? A Series Of Underperformance And Address Exodus

Ripple’s XRP has been struggling to regain its momentum, as its performance continues to lag behind that of its competitors in the crypto market. Recent data from CoinMarketCap reveals that XRP has been the most underperforming large-cap cryptocurrency over the past month, with gains of just over 4%. This stands in stark contrast to the significant increases seen in cryptocurrencies such as Bitcoin, Ethereum and Solana, to name a few, leaving investors disappointed and questioning the future of the digital asset. Are Whales Slowly Losing Appetite For XRP? Adding to…

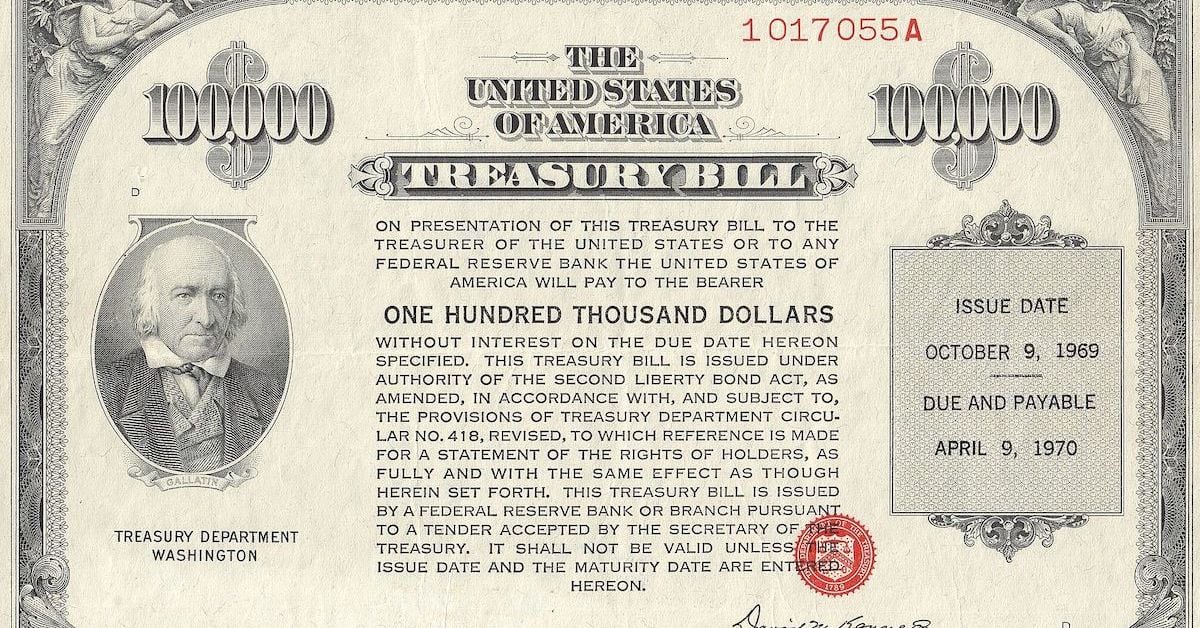

Crypto Custodian Finoa Offers Centrifuge’s Tokenized T-Bill Fund

“I would argue traditional finance’s message for the future that trillions of dollars will be tokenized is completely disconnected from firms that are innovating with RWAs,” Quensel said in an interview. “TradFi’s understanding of a token as a database record doesn’t make any sense to DeFi. A token is not a database record; it’s code running on its own that’s executable, transferable, has its own logic, rights and possibilities.” Source

Bitcoin (BTC) Price Prediction: $69K Ahead of Halving

“With 54 days left before the bitcoin halving and the expectation of the Fed’s interest rate cut in the middle of the year, bitcoin prices have a support level at $50,000 and may fluctuate to hit historical highs in March,” Ryan Lee, chief analyst at Bitget Research, told CoinDesk in a message. Original

Falling Bitcoin-Ether Spread is Music to Altcoin Traders' Ears

The funding rate spread has collapsed, indicating increased appetite by traders to speculate further out on the risk curve, one analyst said. Original