The latest price moves in bitcoin (BTC) and crypto markets in context for March 12, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets. Source

Day: March 12, 2024

This German Exchange Opened the Floodgates for Institutional Crypto

Germany’s leading stock exchange operator, Deutsche Börse, has successfully launched its regulated crypto spot trading platform, DBDX. This marks a significant milestone in the growing institutional adoption of digital assets. The platform has already facilitated its first transactions, with ICF Bank and Bankhaus Metzler trading and settling the cryptocurrency Ethereum against euros. Initially, DBDX will offer trading in Bitcoin and Ethereum on a request-for-quote (RFQ) basis, with multilateral trading to follow. “We have processed the first cryptocurrency trades on the T7 trading architecture of Deutsche Börse Digital Exchange DBDX and…

Economic Intelligence Unit: Nigerian Central Bank Lacks Capacity to Defend Local Currency

The Economic Intelligence Unit has stated that the Central Bank of Nigeria cannot halt the rapid depreciation of the local currency. The continued volatility of the naira is expected to result in erratic regulation, primarily affecting businesses that hold foreign exchange. Nigeria Presses Ahead With Reforms The Economic Intelligence Unit (EIU) has stated that the […] Source BitcoincryptoexchangeExchanges CryptoX Portal

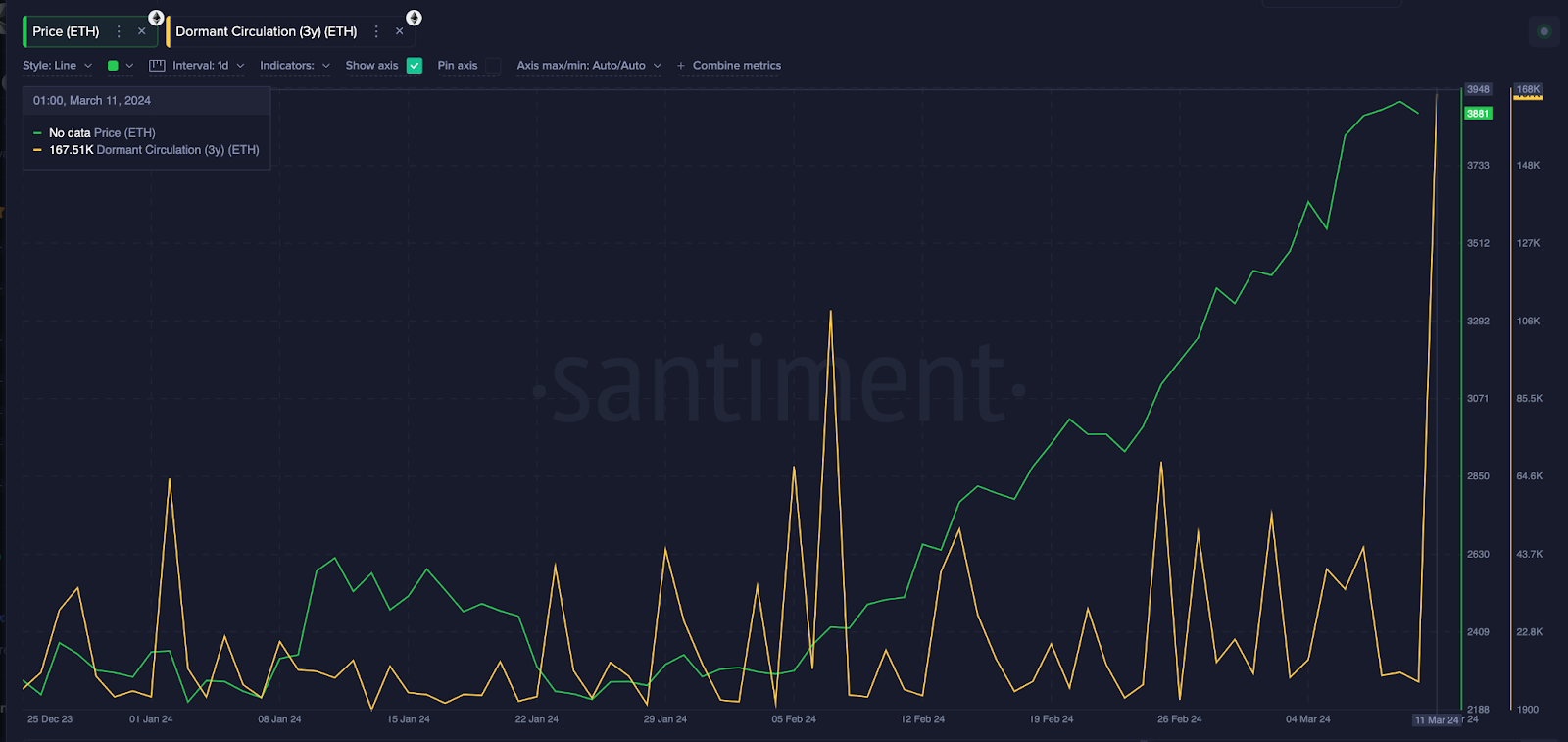

Ethereum price rally at risk amid $900M Profit-taking spree

Ethereum price grazed $4,100 territory in the early hours of March 12, but a profit-taking wave observed among long-term holders threatens to scuttle the rally. After a blistering 73% rally over the last 30-days, Ethereum price rally has hit a brick wall at $4,100 mark. Can the bulls regroup for another brazen attempt at the $4,500 milestone or will ETH price surrender the $4,000 support. Long-term investors traded 167,500 ETH within the last 24 hours Unlike Bitcoin (BTC), which has entered the price discovery phase, Ethereum is still about 22%…

Grayscale outflows continue as Bitcoin Trust sees $494 million withdrawal

On March 11, Grayscale Bitcoin Trust (GBTC) saw a substantial withdrawal, with $494 million worth of Bitcoin, approximately 6,850 BTC, leaving the fund. BitMEX Research initially labeled this exodus a record outflow. However, they later clarified that it was a historic high in terms of the Bitcoin price. The assertion from BitMEX faced scrutiny as GBTC had previously seen outflows surpassing $500 million during five days in January and again on February 29. These figures are part of a broader trend of diminishing holdings for Grayscale, which have declined by…

Most crypto exchange tokens lag behind Bitcoin, data shows

According to a study done by TokenInsight, most exchange tokens underperformed compared to Bitcoin performance. Despite the growing popularity of crypto exchange tokens like Binance Coin (BNB) and Bitget Token (BGB), particularly amid the rise of decentralized finance and non-fungible tokens, Bitcoin (BTC) has proven to be a superior investment choice, analysts at TokenInsight revealed in a recent research report. Yet, not all tokens demonstrate the same level of profitability, with some facing side effects due to regulatory pressure. “Affected by regulations, BNB experienced a significant decline in the second…

Analyst Predicts 60% Rally In Next 7 Days

Optimism surrounds Cardano (ADA) despite some recent hiccups. ADA stands resilient, maintaining a positive outlook despite a 5% decrease over the past week. Currently priced at $0.75, ADA demonstrates a robust stance with a 24-hour trading volume of $1.14 billion and a market capitalization of $24 billion. Analyst Points To Promising Weekly Chart Trends Renowned crypto analyst Sssebi is charting an optimistic course for ADA, emphasizing the significance of the weekly chart in understanding the broader context. Nestled above its 200-week moving average, ADA shows promise with significant green candles…

Hong Kong’s Central Bank Starts Regulatory Sandbox for Stablecoin Issuers

“Applicants should have genuine interest in developing a stablecoin issuance business in Hong Kong with a reasonable business plan, and their proposed operations under the sandbox arrangement will be conducted within a limited scope and in a risk-controllable manner,” the HKMA notice said. Source

Ether (ETH) Puts In Demand After $4K Price Breakout

Ether’s one-month call-put skew, an options market measure of sentiment, has turned negative, hinting at the relative richness of puts, or options used to protect against bearish price trends. The 60-day guage has also flipped in favor of put options, while the 90-day and 180-day metrics remain positive. Source

Meme Coin Rally Eases as Bitcoin (BTC) Bullishness Remains ‘Elevated’

“The volatility market continues to express bullishness in BTC as volatility remains very elevated for the calls, particularly in the backend of the curve,” QCP said. “We are wary of another washout with funding rates reaching elevated levels again, although we still expect dips to be bought up very quickly,” the firm added. Original