The price of bitcoin experienced a decline on Monday, near 10:00 p.m. Eastern Time (ET), tumbling to a position slightly over the $66,000 mark. By 6:30 a.m. the following day, it had edged down further to reach its intraday low of $65,480 per unit. In the wake of this downturn, the crypto derivatives markets saw […] Original

Day: April 2, 2024

How China’s Belt And Road Initiative Leverages Blockchain Technology

China has unveiled plans for a blockchain infrastructure project aimed at bolstering trade and economic ties across continents. The initiative, dubbed the “Ultra-Large Scale Blockchain Infrastructure Platform,” is poised to play a pivotal role in powering the Belt and Road Initiative, China’s ambitious global trade network. China Taps Blockchain For Its Infra Projects Announced through a major partnership between the Shanghai Tree-Graph Blockchain Research Institute and the Chinese government, the project aims to leverage blockchain technology to establish a robust and scalable infrastructure that will facilitate cross-border trade and commercial…

Inflows Surge To $1.1 Million

Cardano (ADA) has recently emerged as a focal point of investor attention, experiencing both a surge in inflows and mounting concerns over its performance. According to the latest data from CoinShares, Cardano-centric investment products witnessed a staggering $1.1 million influx over the past week, marking a notable reversal from the $3.7 million outflows recorded just a week prior. Cardano Sees Massive Inflows This sudden influx catapults Cardano to the forefront of investor interest in similar products, reflecting a growing prominence for the cryptocurrency within the crypto investment landscape. Despite experiencing…

DeFi Project Ethena Labs’ ENA Token Starts Trading at 64 Cents

The USDe token, which is referred to as a “synthetic dollar,” offers yields to investors by pairing ether liquid staking tokens with short ether (ETH) perpetual futures position in the derivatives market to maintain a “rough target” of $1 price. Source

TRON Foundation, Justin Sun Ask U.S. Court to Dismiss SEC Lawsuit

The TRON Foundation and Justin Sun asked a New York court to dismiss an SEC lawsuit, arguing that the regulator failed to establish that the court has jurisdiction over the foreign defendants. Source

Bitcoin Price Tumbles Below $66,000: 4 Major Reasons

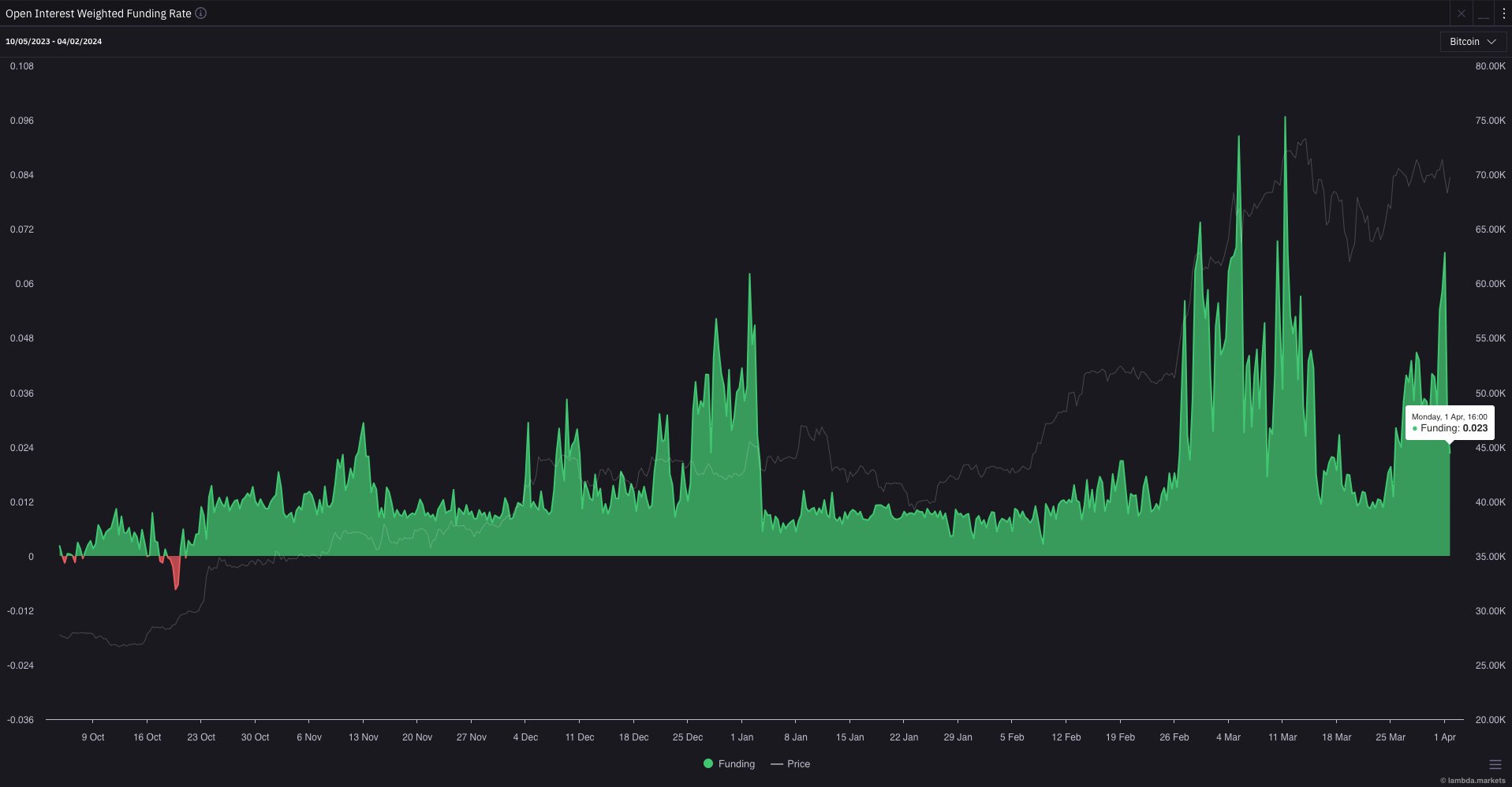

The Bitcoin market has witnessed a significant downturn, with prices plummeting below the $66,000 mark. This abrupt -5.6% price movement can be attributed to four major factors: a long liquidation event, a rising US Dollar Index (DXY), profit-taking by investors, and spot Bitcoin ETF outflows. #1 Long Liquidations The main force leading to today’s downturn in Bitcoin’s price was a significant deleveraging event characterized by an unusually high level of long liquidations. Before the downturn, Bitcoin’s Open Interest (OI) Weighted Funding Rate was unusually high, indicating that leveraged traders were…

Crypto Market Setup Looks Positive for Second Quarter: Coinbase

The bitcoin halving, expected in mid-April, remains the main supply-side event, the report said. Source

Crypto Exchange Deribit’s Dubai-Based Entity Wins Conditional VASP License

The VASP license is mandatory and a prerequisite for conducting virtual asset business in Dubai. According to White & Case, the license, once obtained, is valid for one year and must be renewed annually. The exchange said it will soon announce plans, terms, and the exact time to start operating under the new licensed entity. Source

Ethereum Q2 Potential Promises Double-Digit Gains

Ethereum investors are navigating the second quarter of 2024, cautiously embracing optimism, leveraging insights from historical trends and market data to anticipate potential gains. Santiment’s recent analysis reveals that the number of Ethereum addresses holding coins has reached highs of more than 118,000, with midterm MVRV suggesting a mild bullish signal. These indicators, combined with past data indicating Ethereum’s tendency for robust performance during Q2, fuel hopes for another season of positive returns. Ethereum: Historically Strong Q2 Performance Crypto analyst Ali Martinez recently shared a screenshot of Ethereum’s quarterly returns…

Solana (SOL), Dogecoin (DOGE) Slide as Trader Warns of Further Bitcoin (BTC) Correction

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…