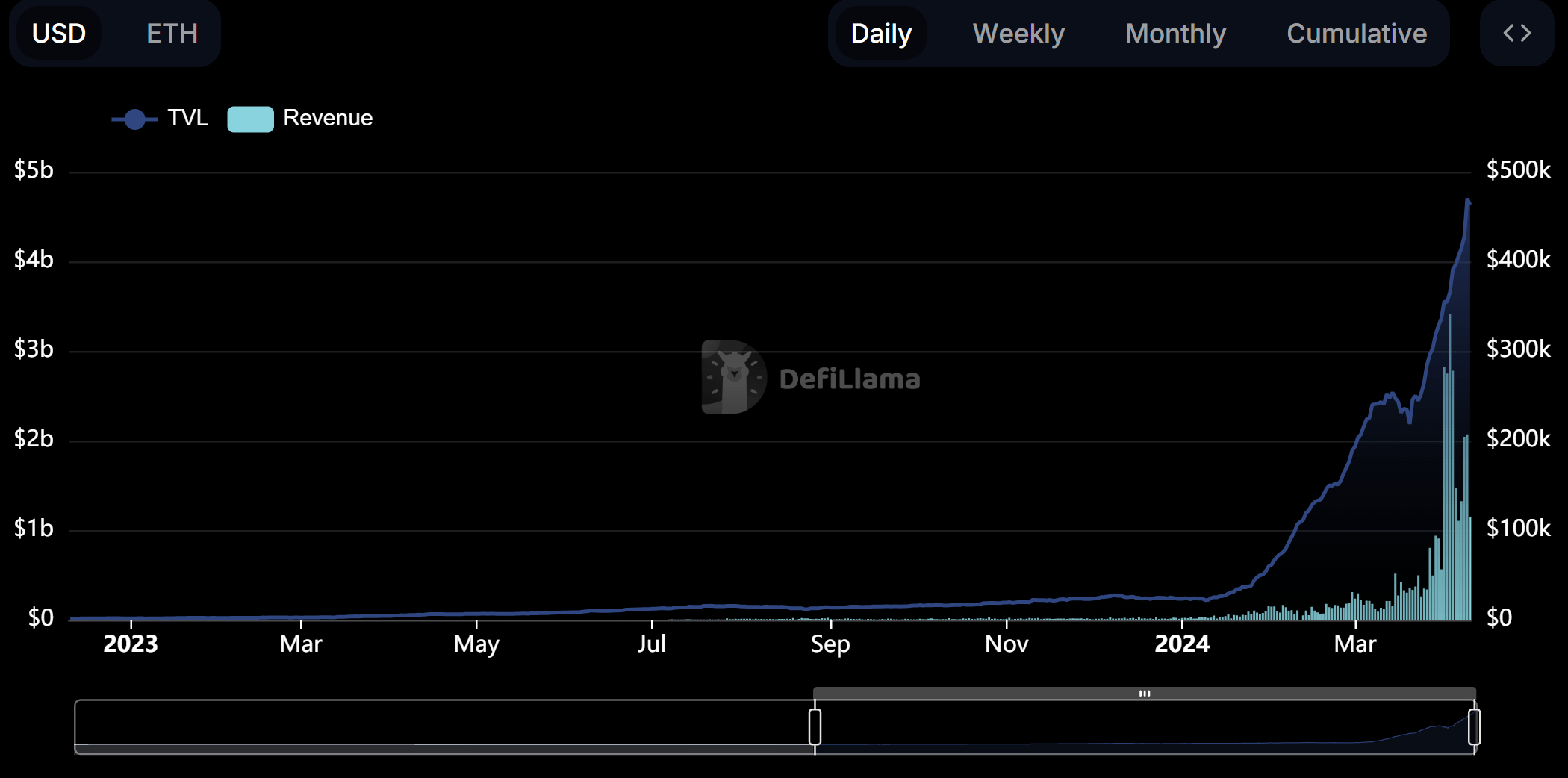

Charles Edwards, the founder of crypto hedge fund Capriole Investments, spotlighted what he believes to be the most undervalued altcoin at the moment. Via a statement on X, Edwards pointed to PENDLE, a token operating within the DeFi space, citing its exceptional total value locked (TVL) and market cap as primary indicators of its undervaluation. “Perhaps the most undervalued alt right now is PENDLE. Massive $4.6B TVL (about 5% of entire crypto world’s TVL) and market cap just 14% of its TVL. Huge flywheel effects with Ethena also. Ludacris growth,”…

Day: April 11, 2024

Bitfinex Securities Introduces El Salvador’s First Tokenized Debt to Fund New Hilton Hotel

The construction project consists of 4,484 square meters across five levels with 80 rooms, including a swimming pool, restaurants and commercial spaces. Hilton Hotels has not endorsed any offering, is only a franchisor, and takes no responsibility, according to the press release. Source

Bitcoin (BTC) Prices Above $70,500 as Grayscale’s GBTC Records Lowest Outflows

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Luno, Zignaly Among First Crypto Firms to Receive South Africa License

“This is a positive step for both the cryptocurrency industry and South Africans. Compliance, safety and security for our customers have driven our growth since the beginning and will continue to be priorities as we expand our offering to introduce more features and products for financial institutions,” Christo de Wit, Luno’s country manager for South Africa, said in the statement. Source

Stablecoins Are Beneficial to U.S. Economy, Cantor Fitzgerald CEO Howard Lutnick Says

Cantor Fitzgerald is a custodian for Tether Holdings, the issuer of the world’s largest stablecoin, tether (USDT). As of writing, USDT boasted a market cap of $107 billion, while second-ranked Circle’s USDC had a market value of $32.25 billion, according to CoinGecko. Source

Coinbase, A16z-Backed Web3 Ad Network Everyworld to Begin Community Airdrop

Everyworld, the Coinbase and A16z-backed Web3 advertising network, is set to start its community airdrop on April 15. Users who wish to participate in the airdrop must not be U.S. citizens or residents of 25 other countries, including Australia, China, and Russia. The Web3 rewarded ads protocol follows a similar model by rewarding users directly […] Source CryptoX Portal

How to Profit From Bitcoin (BTC) Halving? Traders Say ORDI, STX and RUNE May Gain

“Ethereum’s high costs and significant network congestion will cause it to take a backseat as Bitcoin-based projects, like Rune, will redirect meme coin hype to the Bitcoin ecosystem because of the novelty,” Lipinski said. “The BRC-20 (Ordinals NFT) standard is likely to be overtaken by Runes, which is expected to launch on the day of the halving.” Original

90% of Crypto Trades Handled by Just 10 Exchanges, ESMA Warns

In a comprehensive analysis of the cryptocurrency market, the European Securities and Markets Authority (ESMA) has revealed the highly concentrated nature of crypto trading and the potential risks it poses to the broader financial ecosystem. The report, released on Wednesday, comes as the European Union prepares to implement the world’s first extensive regulatory framework for cryptoassets, dubbed MiCA. ESMA’s findings reveal that a mere ten exchanges oversee approximately 90% of all cryptocurrency trades, with Binance leading the pack with an astonishing 50% share in the market. The recent Finance Magnates…

Uniswap Price Crashes 16% On SEC Lawsuit Fears

The US Securities and Exchange Commission (SEC) has served a Wells Notice to Uniswap, a leading decentralized exchange (DEX). This pre-enforcement notice, a precursor to potential legal action, triggered a plunge in Uniswap’s native token, UNI. At the time of writing, UNI was trading at $9.37, down 16.2% in the last 24 hours, data from Coingecko shows. The crypto has also sustained a 15% loss in the last seven days. Uniswap Whales Seek Safer Shores The news of the SEC’s looming action acted as a fire alarm for Uniswap’s biggest…

Bitcoin price surges amid declining whale activity

The Bitcoin (BTC) price gained bullish momentum again, surpassing the $70,000 mark, while whale activity around the asset declined. BTC is up by 2.2% and is trading at around $71,000 at the time of writing. The flagship asset’s market cap is getting close to the $1.4 trillion mark — currently sitting at $1.398 trillion. BTC price, whale activity, RSI and active addresses – April 11 | Source: Santiment Moreover, Bitcoin’s daily trading volume increased by 5% and is hovering around $37.5 billion at the reporting time. The upward momentum comes…