Arbitrum (ARB) runs the risk of a significant price decline due to its upcoming token unlock on April 16. These token unlock events are known to be a recipe for high volatility because of what could happen in the aftermath of their occurrence. $107 Million Arbitrum Tokens Set To Be Unlocked Data from TokenUnlock shows that 92.65 million Arbitrum tokens (3.49% of its circulating supply) are set to be unlocked on April 16. 56.13 million ($65.10 million) of these tokens will be distributed to the team, future team, and advisors,…

Day: April 16, 2024

Imminent BTC Supply Squeeze: Bybit Report Suggests Bitcoin Exchanges to Run Dry in 9 Months

As the crypto landscape evolves, a significant tightening in bitcoin’s available supply on exchanges has emerged, hinting at just nine months of reserves left. Bybit’s latest halving report unveils the reasons behind this tightening grip, indicating a looming scarcity that could reshape market dynamics. Bitcoin Faces Unprecedented Supply Squeeze as Exchange Reserves Plummet According to […] Original

OG Bitcoin L2 Stacks Is Getting a Major Overhaul

Alongside BTC’s dramatic 50% rise since the launch of spot bitcoin exchange-traded funds (ETFs) in the U.S. in January, Stack’s native token, STX, has risen over 70%. The token has gained over 250% since the launch of the Ordinals Protocol, pushing it into the ranking of the top 30 largest tokens. Source

Tokenized RWA Firm PV01 Completes Proof-of-Concept With Bond Issuance on Ethereum

Tokenization company PV01, helmed by founders of crypto market maker B2C2, has completed its first tokenized bond sale under English law, the team said Tuesday, marking a crucial step towards a goal of creating a bond market on blockchain rails – including corporate debt. Source

Bitcoin (BTC) Bulls Should Pay Attention to Gold

Mostly thanks to boosted demand from the spot ETFs, bitcoin by mid-March had risen nearly 70% for 2024 to a new record above $73,000. The rally has stalled since, with the price now more than 15% below that all-time high. The reasons for the pullback are up for debate, but for the last month, sellers have overwhelmed a modestly slowed but still quick pace of buying by the ETFs. Source

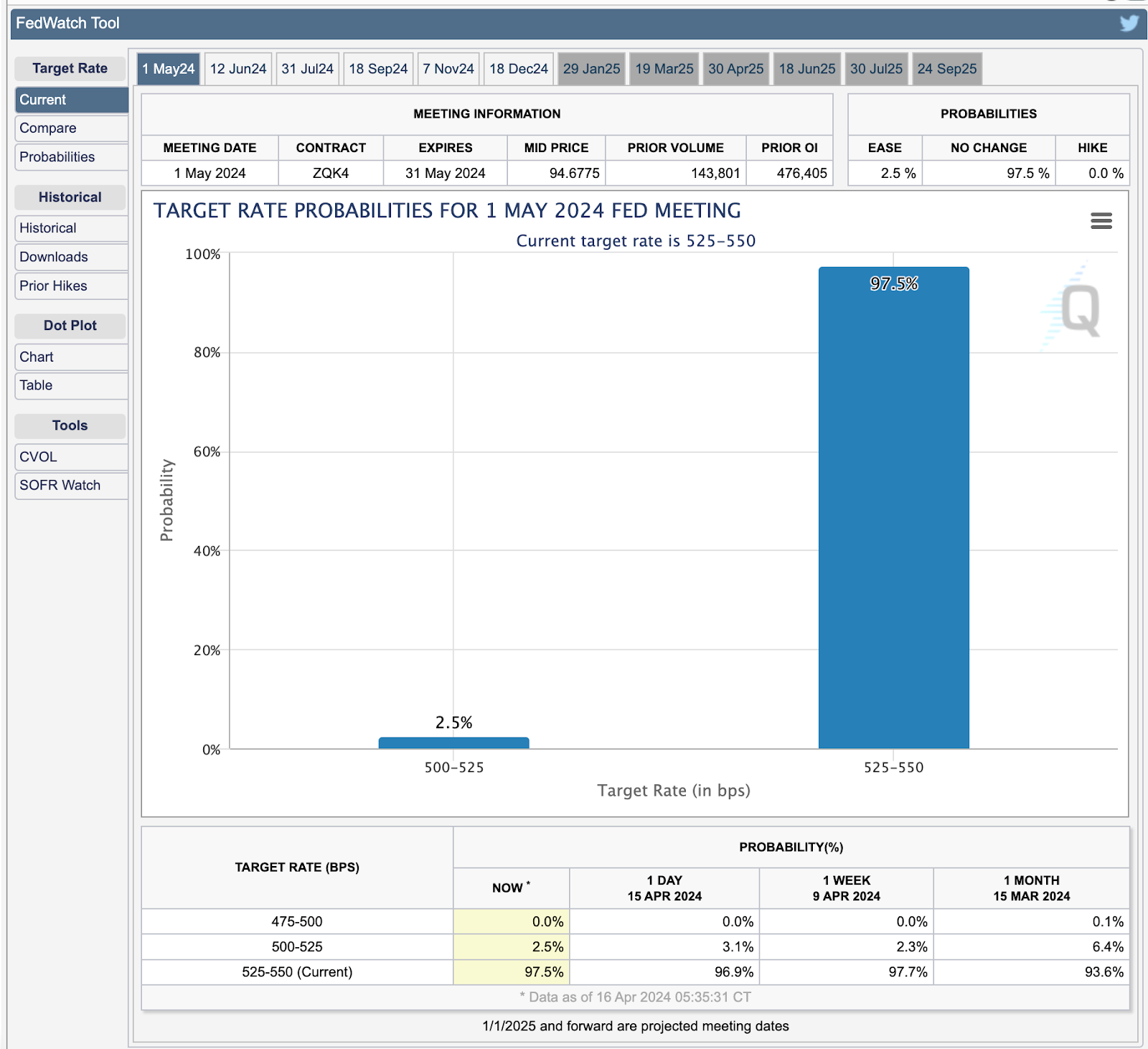

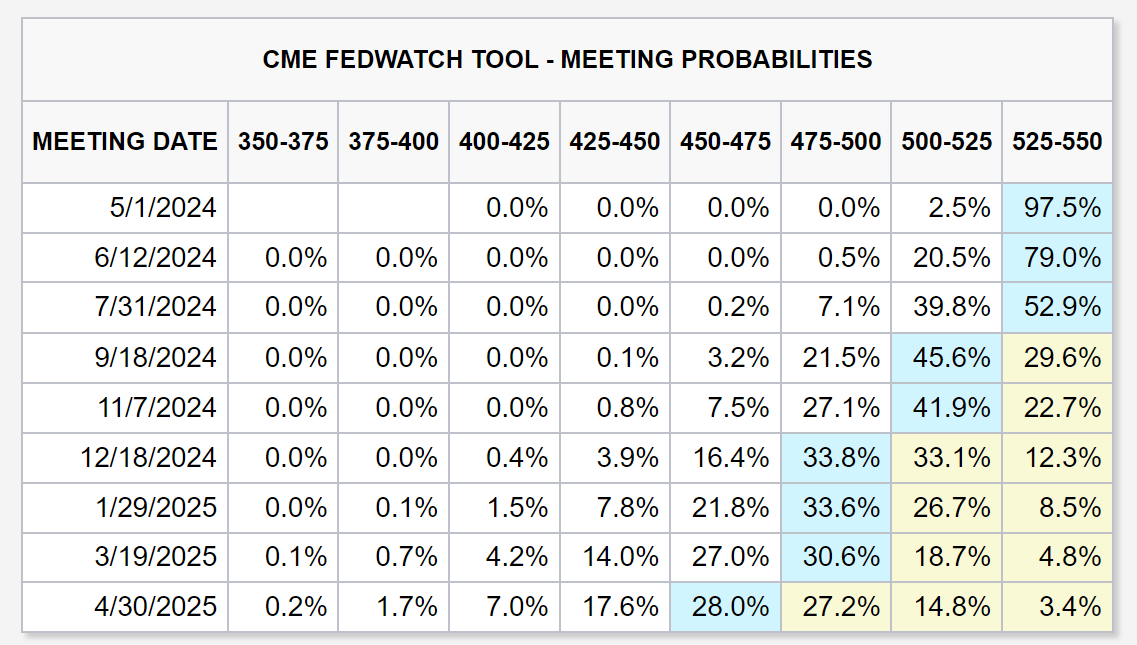

10X Research anticipates significant correction for crypto and stocks

According to Markus Thielen, head of research at 10x Research, risk assets like crypto and stocks could see a “significant price correction” in the coming weeks. Sharing his insights in an April 16 investor note, Thielen wrote that the cryptocurrency market is moving towards a “crucial tipping point,” which could lead to a notable correction in prices. The analyst revealed that his firm has sold all tech stocks in anticipation of this bearish event. “We sold everything last night,” wrote Thielen. The founder cited decreasing rate cuts, rising bond yields,…

‘We Sold Everything Last Night’, Reveals Crypto Research Firm

Markus Thielen of 10x Research unveiled a significant shift in his crypto strategy in response to mounting financial pressures and market instability, as detailed in an investor note released earlier today. Thielen, an influential figure in the analysis sector, cited a concerning outlook on risk assets, which encompasses both technology stocks and cryptocurrencies, primarily driven by unanticipated and ongoing inflation rates. According to projections from Bank of America, US CPI headline inflation is expected to reach 4.8% by the November 2024 election. Over the past three months, month-over-month CPI inflation…

Tokenzation Comes to HELOCs From Homium

The Homium loans are currently live in Colorado, with plans to expand to other states. As part of securing the loan, homeowners commit a portion of their home’s price appreciation. For investors, i.e., those funding the loan, they receive a tokenized asset tracking the price appreciation of a pool of shared appreciation home loans issued on Homium. Source

Binance.US Taps Former New York Fed Compliance Chief for Board Role

“It’s, of course, true that our our trading volumes took a significant hit following the SEC’s case and in our transition to a crypto only exchange,” Binance.US COO Chris Blodgett said, adding that, “the last two quarters have seen very strong rebounds in volume, revenue and user engagement across the platform, due in part to the “broader market recovery.” Source

DWF Labs Renews Collaboration with DMCC to Propel MENA Blockchain Ecosystem Forward

. . . DWF Labs is committed to investing in 50 startups operating in the web3 space, with a significant investment of USD $500,000 reserved for the most promising business. The partnership builds upon the foundation laid by the previous agreement, which included the establishment of a $5 million growth platform for Web3 businesses at the DMCC Crypto Centre. The collaboration centers around the DWF Venture Studio, which offers a range of benefits to startups based in DMCC, such as consultancy services, market-making services on tier one and two exchanges,…