The latest price moves in bitcoin (BTC) and crypto markets in context for April 16, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets. Source

Day: April 16, 2024

How Much Did Dogecoin Gain From it Today?

The cryptocurrency market tends to thrive on a blend of innovation, utility, and sometimes, just a good meme. This week, the spotlight shone brightly on Dogecoin (DOGE), the Shiba Inu-themed meme coin, after a characteristically playful tweet from tech billionaire Elon Musk sent prices soaring. While the tweet itself referenced a scene from Monty Python and didn’t directly mention Dogecoin, its timing, with DOGE hovering near the cusp of the top 10 cryptocurrencies by market cap, proved to be enough to ignite a firestorm of trading activity. This latest episode…

Umoja Partners With Merlin Chain to Launch Bitcoin’s First High-Yield Synthetic Dollar

The smart money protocol Umoja has joined forces with the Bitcoin layer two (L2) initiative, Merlin Chain, to roll out a Bitcoin-based high-yield synthetic dollar. The newly introduced stablecoin is engineered to uphold a self-sustaining peg via transparent, onchain trading techniques developed by Umoja. Merlin Chain and Umoja Reveal USDb: The New High-Yield Synthetic Dollar […] Original

Can Hong Kong’s spot Bitcoin ETFs boost BTC price?

How do Hong Kong’s spot Bitcoin ETFs compare to their dominant U.S. counterparts, and could their introduction influence Bitcoin’s price upward? On Apr. 15, China Asset Management, Bosera Capital, and other firms announced on social media that they received conditional approval to launch spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) in Hong Kong. The Securities and Futures Commission (SFC) has not yet confirmed the list of approved issuers. This development follows closely spot BTC ETF approvals in the U.S. earlier this year. This contrasts with the situation in…

Solana DEX Drift to Airdrop 100M Tokens in Weeks

The new token follows a three-month points program that enticed traders, borrowers, lenders—and, of course, airdrop farmers—into Drift, one of the largest venues for trading perpetuals in Solana DeFi. But contributors to the protocol said most of the 100 million tokens earmarked for this airdrop will go to longtime Drift users. Source

Bitcoin (BTC) Could Surge to $120K on ‘Doomsday Rally,’ Trader Says

“Bitcoin remains a viable doomsday asset in 2024, as its correlation to Gold recently increased, and investors continue to diversify away from traditional financial assets,” Edouard Hindi, the chief investment officer at Tyr Capital, said in an email to CoinDesk. Original

Etherland Tecra Space Crowdfunding Goes Live

PRESS RELEASE. The Etherland Tecra Space campaign has officially gone live, giving participants the opportunity to stake their claim in a real-world assets (RWA) blockchain project that approaches on-chain real estate with a unique angle. This campaign aims to accelerate the development of innovative RWA solutions powered by blockchain technology for the real estate industry. […] Source CryptoX Portal

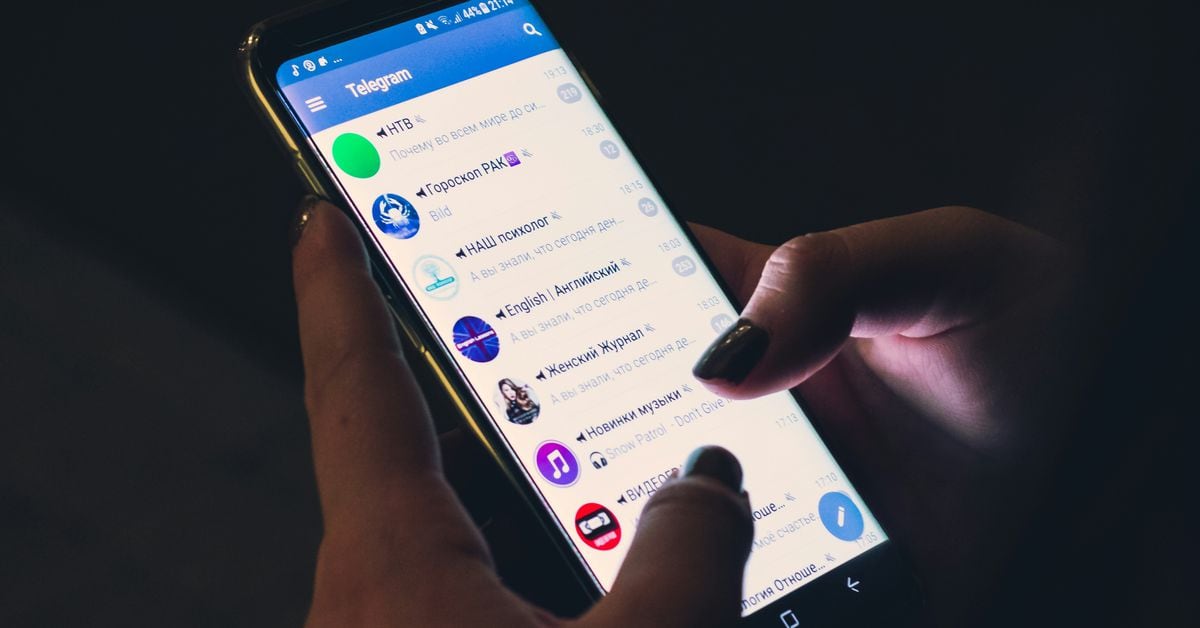

TON-Based Economy Starting to Take Root in Telegram, TON Foundation Says

The Open League program, announced on April 1, is bringing users on-chain in “unprecedented numbers,” TON Foundation’s Justin Hyun said. Source

Whale Snags Nearly 24,000 ETH At Bargain Price

Ethereum, the second-largest cryptocurrency by market capitalization, has faced choppy waters. Over the past few days, Ethereum’s price has taken a nosedive, plunging to lows of $2,800 on April 12, echoing the broader downturn witnessed across the crypto landscape. However, in the face of volatility, a fascinating development has emerged: Ethereum whales, the behemoths of the crypto world, have begun to flex their muscles, showcasing strategic maneuvers that have captured the attention and speculation of the crypto community. Strategic Accumulation Amidst Turbulence As Ethereum’s price plummeted, Ethereum whales wasted no…

Liquid Restaking Protocol Puffer Raises $18M, Led by Brevan Howard, Electric Capital

The round was led by Brevan Howard Digital and Electric Capital, with investments from Coinbase Ventures, Kraken Ventures, Lemniscap, Franklin Templeton, Fidelity, Mechanism, Lightspeed Faction, Consensys, Animoca and GSR, the company said in a press release. Source