To be sure, the dual-banking system itself at present is far from federalism perfected, and state and federal jurisdiction over banks does overlap in important ways; state-chartered banks that are members of the Federal Deposit Insurance Corporation and/or the Federal Reserve System, for example, face additional federal supervision. But such federal bank supervision makes even less sense for stablecoin issuers, which ultimately provide a payment tool (tokens designed to maintain a 1:1 peg with the U.S. dollar), not banking services. Source

Month: April 2024

Why the DOJ May Have Recommended a Three-Year Sentence for Binance’s Changpeng Zhao

By asking for a longer sentence, the DOJ seems to be sending a strong message, said Tama Kudman, a partner with Kudman Trachten Aloe Posner LLP. The DOJ has been trying to tamp down on money laundering via crypto, and Zhao was “pretty flagrant with anti-money laundering rules.” Source

First Mover Americas: Bitcoin, Ether Sink Amid U.S. Stagflation Fears

The latest price moves in bitcoin (BTC) and crypto markets in context for April 29, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets. Original

USDT Issuer Tether Invests $200M in Brain-Computer Interface Company Blackrock Neurotech

“Tether has long believed in nurturing emerging technologies that have transformative capabilities, and the Brain-Computer-Interfaces of Blackrock Neurotech have the potential to open new realms of communication, rehabilitation, and cognitive enhancement,” Paolo Ardoino, CEO of Tether, said in a statement. Source

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Meme coins and NFTs have outlived their relevance, and it is now time for crypto investors to focus on DePin and RWA projects like ETFSwap (ETFS). Over the last three years, meme coins and non-fungible tokens (NFTs) have been among the leading narratives in the crypto space. Thanks to the hype around these meme coins and NFTs, crypto investors have made insane returns on their investments, However, there is a change in the tide that the time has come to pivot from these meme coins and NFT projects and focus…

Solana, Arbitrum, and Milei Moneda show maximum bull run gains

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Market experts forecast significant gains for Solana ($435.99), Arbitrum ($5.38), and Milei Moneda as lucrative investments for 2024’s bull market. Solana (SOL) rebounds as the meme coin market receives a boost. Meanwhile, Arbitrum (ARB) attempts to reverse its losses after losing 38% of its value over the past year. On the other hand, experts tip Milei Moneda (MEDA) to be a leading meme coin in the upcoming bull run. …

Crypto Banking Firm BCB Group To Expand in Europe After French Regulatory Approval

“This is a game changer for BCB Group, allowing us to expand our footprint into the EEA for the first time since Brexit,” Oliver Tonkin, CEO of BCB Group, said in the release. “We have been very impressed with our engagement with the French regulators, and we look forward to integrating ourselves into the burgeoning blockchain ecosystem in France,” he added. Source

CZ Sentencing Letters Paint Former Binance CEO as Devoted Family Man, Friend

More than 160 of Changpeng “CZ” Zhao’s loved ones, friends and colleagues have written to a Washington judge ahead of the Binance founder and former CEO’s sentencing tomorrow, asking for leniency and painting a picture of Zhao as a devoted father and friend, and a “geeky” tech nerd who shuns luxury purchases despite his immense personal wealth. Source

Legendary Trader Predicts When Bitcoin’s Bull Run Will End

In a recent analysis, veteran trader Peter Brandt delved into the price behavior of Bitcoin, suggesting that the cryptocurrency might have reached its peak for the current cycle. According to Brandt, Bitcoin is exhibiting signs of “Exponential Decay,” indicating a weakening in the momentum of its bull market cycles over the years. “Does history make a case that Bitcoin has topped? It’s called Exponential Decay — and it describes Bitcoin,” Brandt wrote. He further explained, “The fact is that the bull market cycles in Bitcoin have lost a tremendous amount…

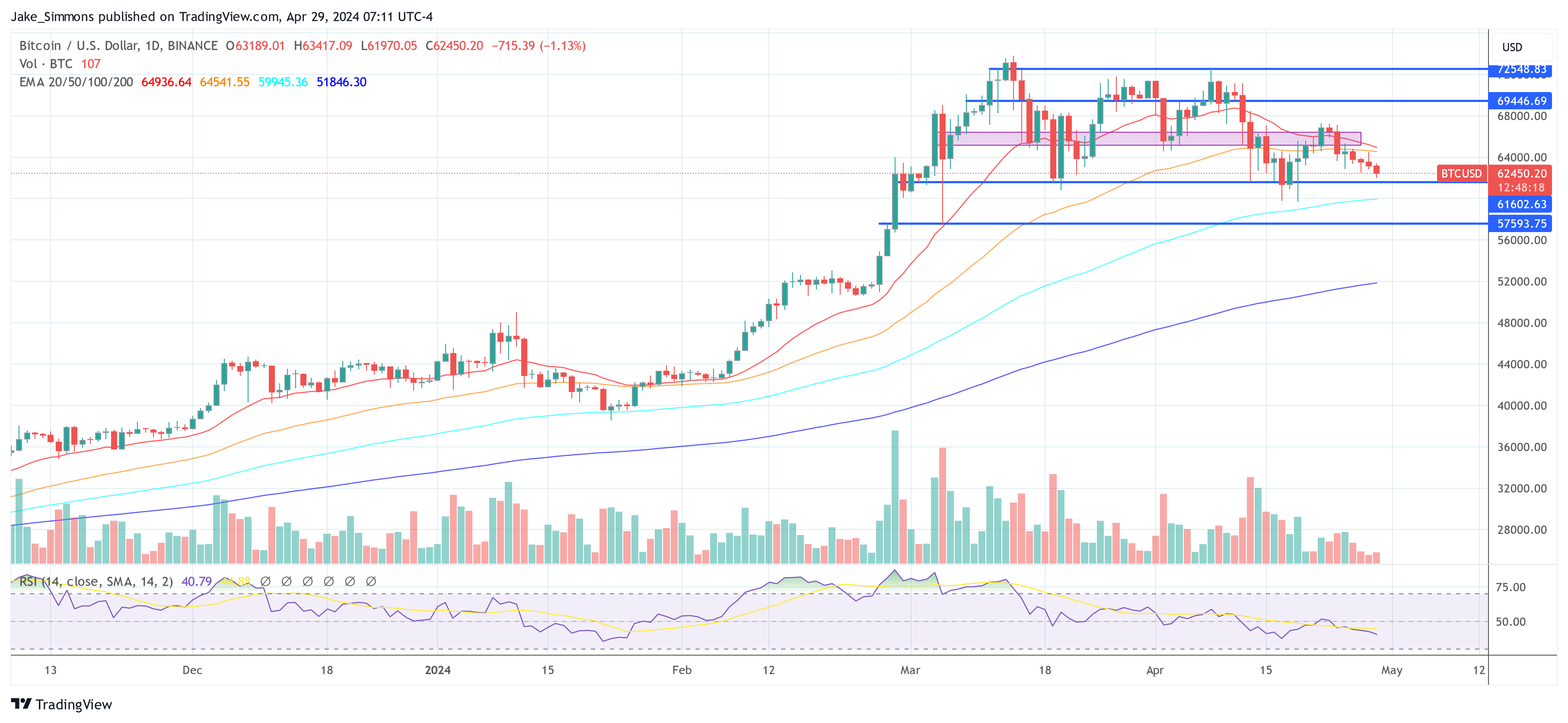

Bitcoin Technical Analysis: Persistent Bearish Trends Hinder BTC’s Recovery

As of April 29, 2024, bitcoin remains under considerable bearish pressure according to multiple indicators across different time frames. Currently trading at $62,279, bitcoin has shown a 24-hour range between $61,994 and $63,929. Bitcoin Bitcoin’s (BTC) daily chart presents a stark bearish trend with a series of lower highs and lower lows, suggesting that sellers […] Original