The biggest difference between the 2020 halving and the 2024 halving is skyrocketing institutional demand. Prior to the previous halving, institutions were on the sidelines. The market was dominated by retail investors. Since then, the market dynamic has drastically shifted. As one example, MicroStrategy didn’t make its first BTC purchase until August 2020. As of April 2024, the company reportedly holds 214, 246 BTC (roughly $13.625 billion). Of the 21 million bitcoins that will ever exist, around 12.27% currently belong to publicly traded and private companies, ETFs and countries. Original

Month: April 2024

Is the Bitcoin (BTC) Price Rally Over? Reasons to Stay Bullish Despite Crypto Correction

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Arkham Releases Top 5 Crypto Rich List

Arkham Intelligence, an industry leader in on-chain data tracking, has released a list of the richest people in crypto according to their wallet balances. This list has been making the rounds in the crypto community due to the top 5 alone being worth billions of dollars. But perhaps, what is more interesting is how much of this money has now been deemed inaccessible. 3 Of The Top 5 Crypto Rich List Lost Forever Arkham took to X (formerly Twitter) to share the top 10 richest individuals in crypto ranked by…

Grayscale’s Bitcoin ETF fund has lost half of assets since launch

The volume of Bitcoins managed by Grayscale Bitcoin Trust has decreased by almost 50% since the conversion to a spot ETF. Unlike other issuers such as BlackRock or Fidelity, Grayscale’s investment vehicle launched on the New York Stock Exchange with approximately 619,220 BTC. According to Coinglass, the volume of cryptocurrency in Grayscale Bitcoin Trust (GBTC) had at its disposal as of April 16 has decreased to 311,621 BTC. Source: Coinglass Since January, the value of assets under management (AUM) has decreased by only 31% from $28.7 billion to $19.6 billion…

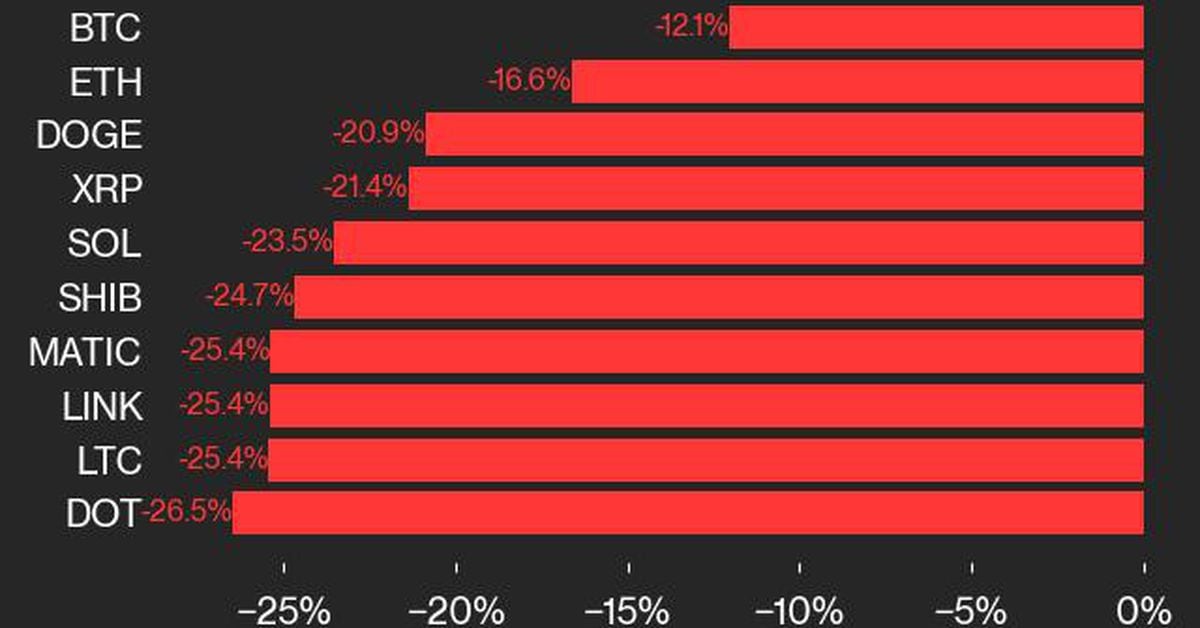

Bitcoin and Ethereum Show Relative Resilience Amid Widespread Losses: CoinDesk Indices Market Update

CoinDesk 20 tracks top digital assets and is investible on multiple platforms. The broader CMI comprises approximately 180 tokens and seven crypto sectors: currency, smart contract platforms, DeFi, culture & entertainment, computing, and digitization. Source

Drift Foundation Announces 100 Million Token Airdrop for Solana-Based Dex Users

On April 16, 2024, the Drift Foundation, which supports the Solana-based decentralized exchange (dex) platform Drift, disclosed plans to distribute 100 million tokens to its users. The tokens will function as the platform’s governance coin, to be utilized by the community and the Drift decentralized autonomous organization (DAO). Solana-Based Dex Platform Drift to Distribute Governance […] Source BitcoincryptoexchangeExchanges CryptoX Portal

‘DePIN’ Is Venture Capitalists’ Latest Crypto Obsession. Can It Match the Hype?

DePIN projects collectively have tokens worth tens of billions of dollars. But how much revenue are they, as a group, generating? Something like $15 million a year, said Rob Hadick, a general partner at Dragonfly, a crypto venture capital fund. “Most of the protocols aren’t constrained by supply, but by a lack of demand,” he said in an interview. Source

Analyst Points To Possible 30% Bitcoin Correction, Calls For Caution

Popular cryptocurrency expert Cold Blooded Shiller has made a grim prediction that Bitcoin may be on the verge of a significant correction and could crash as low as 30%, given the current heightened volatility in the market. Bitcoin Could Be Poised For 30% Pullback Cold Blooded Shiller believes it is important to note that Bitcoin is holding up and now showing much more strength, regardless of the different factors influencing the nascent sector, such as ETFs, fundamentals, and Halving. Given that pullbacks of 30% are historically common for BTC, Shiller…

Bitcoin Depot Thrives Amid Cryptocurrency Volatility

Bitcoin Depot, the largest Bitcoin ATM operator in the United States, has demonstrated remarkable resilience in its revenues despite the volatile nature of cryptocurrency prices. According to its recently filed 10-K annual report on April 15, the company disclosed revenues of $689 million in 2023 and $647 million in 2022, indicating a strong performance unaffected by Bitcoin’s price fluctuations. Bitcoin Depot’s Robust Revenue Amid Market Volatility Despite the tumultuous movements in cryptocurrency prices, Bitcoin Depot has maintained steady revenue growth, showcasing its stability amidst market turbulence. Even during periods of…

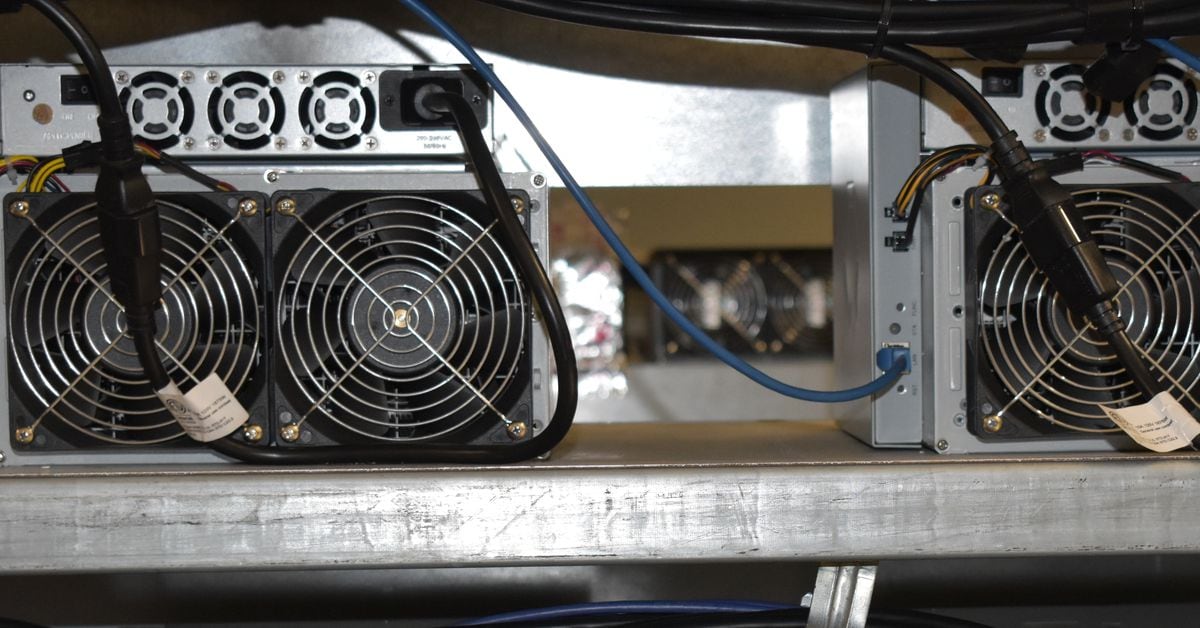

Bitcoin Miners Must Optimize to Survive

Bitcoin miners who have not optimized their existing infrastructure, built their own high-performing data center team, developed their own software stack, and managed their power contracts effectively will face a difficult period after the halving. They will be highly vulnerable to larger players who have the infrastructure to dramatically improve their operations. As a result, the bitcoin mining industry will likely see consolidation as miners with access to more capital continue to expand their operations opportunistically. To remain competitive, it is even more important for smaller miners to prioritize efficient,…