We may not need to reuse OpenStack directly, but we need to build something similarly usable (and similarly reliable, which is the difficult part). We will have to blend our home-grown incentive structures with Web2 and cloud hyperscaler monitoring, compliance and security technologies in order to succeed. We need to design hybrid centralized/decentralized SLAs (service level agreements — the contracts between you and a cloud storage provider). We need to secure it with a buffet of reliability incentives, security attestations, zero-knowledge proofs, fully homomorphic encryption, computation fraud proofs, governance protocols…

Month: April 2024

Miners Race to Discover Block 840,000 as Bitcoin Halving Nears

Many enthusiasts in the Bitcoin community were anticipating the next halving to coincide with Saturday, April 20, 2024, but the latest data suggest it will likely occur a day earlier, on April 19. Despite a recent uptick in mining difficulty, miners have managed to maintain a high hashrate, resulting in block times dropping below the […] Original

Why is Bitcoin down from its March high?

Bitcoin recently dropped from its March peak, influenced by a stronger U.S. dollar and geopolitical issues. What should we expect next? Bitcoin (BTC) has seen a sharp decline in its price, trading at around $63,000 levels as of Apr. 16. This comes after it reached an all-time high of $73,750 on Mar. 14, marking a 15% pullback from its peak. BTC one-month price chart | Source: CoinMarketCap The surge to the all-time high was largely propelled by the approval of spot Bitcoin ETFs by the U.S. SEC in January 2024.…

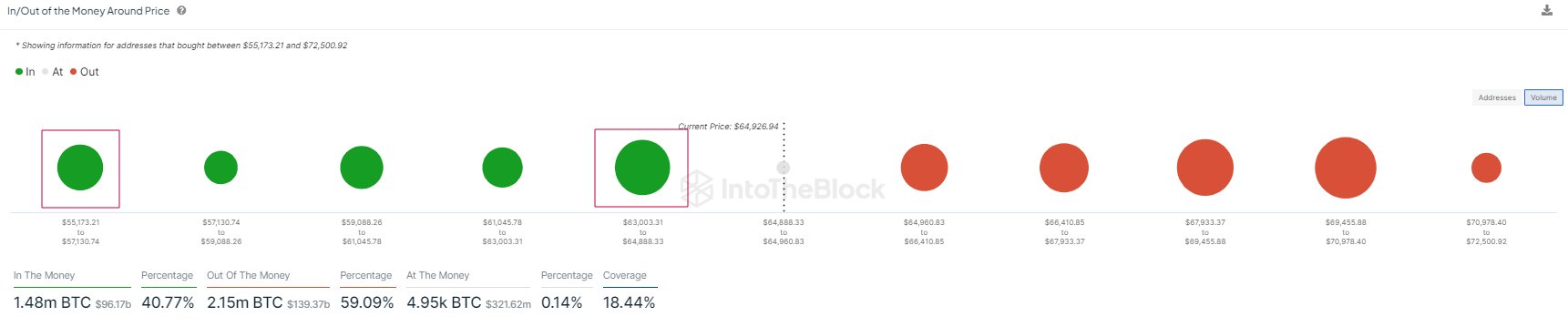

Bitcoin Has Next Major Demand Zone At $56,000: Brace For Impact?

On-chain data shows the next major Bitcoin demand zone is around $56,000, a level BTC might end up revisiting if the decline continues. Bitcoin Has Next Major On-Chain Support Around $56,000 According to data from the market intelligence platform IntoTheBlock, BTC’s recent drawdown has meant that it may end up having to rely on the price range around $56,000 for support. In on-chain analysis, a level’s potential as support or resistance is based on the total number of coins that the investors last acquired there. Below is a chart that…

‘Real-World Implementations of Both AI and Web3’ Fuel AI Tokens’ Rally, Says Daniel He

With socialfi platforms, financial incentives serve not only as a reward mechanism for content creators but also “fundamentally transform the engagement model for all users,” Daniel He, the CEO of the artificial intelligence (AI)-powered socialfi platform, Republik, said. He believes that by offering incentives for user engagement beyond liking or commenting, socialfi platforms have a […] Source CryptoX Portal

U.S. Senator expresses CBDC concerns, supports Bitcoin

U.S. Senator Marsha Blackburn highlighted the personal privacy and government surveillance risks of Central Bank Digital Currencies and Bitcoin. In recent remarks at the Bitcoin Policy Summit, the Tennessee Republican expressed strong concerns about Central Bank Digital Currencies (CBDCs), labeling them as potential spy tools for government oversight. “Central Bank Digital Currencies are essentially a way for the government to have a peephole into everyone’s personal finances,” Blackburn said. She argued that such digital currencies could enable unprecedented access to individual financial transactions, thereby increasing the potential for governmental control…

Arbitrum’s Massive $107 Million Token Unlock Threatens To Send Price Below $1

Arbitrum (ARB) runs the risk of a significant price decline due to its upcoming token unlock on April 16. These token unlock events are known to be a recipe for high volatility because of what could happen in the aftermath of their occurrence. $107 Million Arbitrum Tokens Set To Be Unlocked Data from TokenUnlock shows that 92.65 million Arbitrum tokens (3.49% of its circulating supply) are set to be unlocked on April 16. 56.13 million ($65.10 million) of these tokens will be distributed to the team, future team, and advisors,…

Imminent BTC Supply Squeeze: Bybit Report Suggests Bitcoin Exchanges to Run Dry in 9 Months

As the crypto landscape evolves, a significant tightening in bitcoin’s available supply on exchanges has emerged, hinting at just nine months of reserves left. Bybit’s latest halving report unveils the reasons behind this tightening grip, indicating a looming scarcity that could reshape market dynamics. Bitcoin Faces Unprecedented Supply Squeeze as Exchange Reserves Plummet According to […] Original

OG Bitcoin L2 Stacks Is Getting a Major Overhaul

Alongside BTC’s dramatic 50% rise since the launch of spot bitcoin exchange-traded funds (ETFs) in the U.S. in January, Stack’s native token, STX, has risen over 70%. The token has gained over 250% since the launch of the Ordinals Protocol, pushing it into the ranking of the top 30 largest tokens. Source

Tokenized RWA Firm PV01 Completes Proof-of-Concept With Bond Issuance on Ethereum

Tokenization company PV01, helmed by founders of crypto market maker B2C2, has completed its first tokenized bond sale under English law, the team said Tuesday, marking a crucial step towards a goal of creating a bond market on blockchain rails – including corporate debt. Source