“Self-custody wallet experience was completely broken and required users to go through several hurdles of the Web3 space like blockchain, self-custody, security and trust, signing transactions or gas fees,” said Khandelwal. “Okto is the first such system which provides a Web 2-like single click mobile experience in the Web3.” Source

Day: May 14, 2024

Bitcoin Price Stuck In Key Range, What Could Spark Major Move?

Bitcoin price managed to stay above the $60,000 support. BTC recovered and is now facing hurdles near the $63,500 resistance zone. Bitcoin seems to be trading in a range between $60,000 and $63,500. The price is trading above $61,800 and the 100 hourly Simple moving average. There was a break above a major bearish trend line with resistance at $61,400 on the hourly chart of the BTC/USD pair (data feed from Kraken). The pair could rally if it clears $63,500 or might revisit the range support at $60,000. Bitcoin Price…

Report: Russian Authorities Propose Steep Fines for Crypto Miners Operating in Residential Apartments

Russian authorities have reportedly proposed to impose hefty fines on suspected crypto miners operating from residential properties. Authorities may also consider including amendments to the Code of Administrative Offenses which imposes liability on those misusing electricity. Proposed Measures Aimed at Curbing Rising Power Outage Cases Authorities in Russia have signaled their intention to pursue private […] Source CryptoX Portal

Bitcoin Will Be Set For New ATHs If It Breaks This Resistance: Analyst

An analyst has explained how Bitcoin could be positioned for new all-time highs (ATHs) if it can break through this on-chain resistance level. Bitcoin On-Chain Data Could Suggest This Level Holds Major Resistance In a new post on X, analyst Ali discussed Bitcoin’s current on-chain resistance. In on-chain analysis, the strength of support and resistance levels is based on the total amount of cryptocurrency last acquired at each level. Below is a chart for Glassnode’s UTXO Realized Price Distribution (URPD) metric, which shows the supply distribution across the various price…

Is The Crypto Winter Thawing? US Bitcoin ETFs Record First Inflows In Weeks

After experiencing outflows for four consecutive weeks, US spot Bitcoin exchange-traded funds (ETFs) have marked a notable shift in momentum, witnessing net inflows once again. According to recent data from CoinShares, digital asset investment products have seen inflows totaling $130 million for the first time in five weeks. This change suggests renewed investor interest in crypto-focused investment products, particularly in the United States, where most of these inflows, totaling over $130 million, occurred. Related Reading A Mixed Bag Of Global Investment Flows Grayscale, a major player in the digital asset…

Biden Orders Chinese-Backed Crypto Mining Firm to Divest Land Near US Missile Base

President Joe Biden has issued an order that blocks Mineone Partners Ltd., a Chinese-backed cryptocurrency mining company, from owning land near Wyoming’s Francis E. Warren Air Force Base, which is a strategic missile base. This measure requires the divestment of land used for crypto mining and the removal of surveillance-capable equipment, citing national security risks. […] Source CryptoX Portal

Crypto investment product net inflows see $130m rebound

Weekly digital asset investment products broke a five-week outflow streak as crypto traders in the U.S. and Hong Kong deployed more capital than withdrawals. According to CoinShares, $130 million flowed into these crypto vehicles, with the U.S. comprising the lion’s share last week. Dwindling Grayscale outflows cushioned activity in the region as GBTC marked its lowest weekly withdrawals in five months at $171 million. Hong Kong Bitcoin (BTC) ETFs amassed $19 million in inflows but paled compared to Wall Street offerings, which raked $135 million across some 11 products. Analysts noted…

Latam Powerhouse Crypto Exchange Bitso Launches Web3 Wallet

Bitso, the Mexico-based, Latam-focused cryptocurrency exchange, recently launched its own Web3 wallet, targeting the decentralized finance (defi) ecosystem. The idea behind this new product is to ease the onboarding of Bitso’s customers into this landscape, allowing them to dabble in non-fungible tokens (NFTs), decentralized exchange, and other services from a trustable platform. Bitso Launches Web3 […] Source

Is Bitcoin Out Of The Woods? Analyst Bullish On 6-Figure Future

Bitcoin (BTC) began the month with the deepest retrace of the cycle, falling to the $56,000 support level. The retrace raised alarms for some crypto investors and market watchers, who feared the bull run had ended. Since then, the largest cryptocurrency by market capitalization has recovered crucial levels, and analysts have identified bullish patterns on BTC’s chart, suggesting that it might finally be out of the woods. Related Reading Is Bitcoin Out Of Danger? As the May 1st retrace developed, crypto analyst Rekt Capital highlighted the similarities between Bitcoin’s 2016…

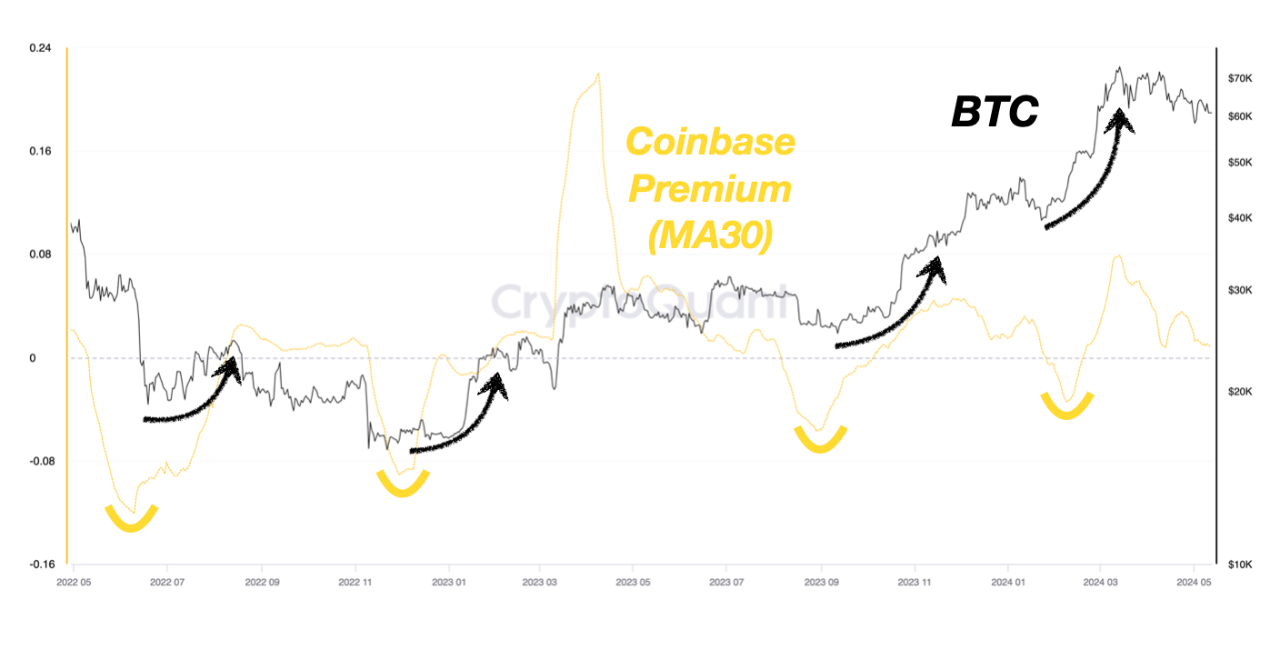

Buy Or Sell Bitcoin? Quant Reveals What Leading Metric Says

A quant has explained what a potential leading Bitcoin indicator could say about what’s next for the cryptocurrency’s price. Bitcoin Coinbase Premium May Hold The Answer To Where BTC Goes Next In a CryptoQuant Quicktake post, an analyst has talked about the trend currently taking place in the Bitcoin Coinbase Premium. “We can use the trend of Coinbase Premium as a leading indicator of the future direction of BTC price,” notes the quant. The “Coinbase Premium” is a metric that keeps track of the difference between the Bitcoin price listed…