Multi-chain smart contract network Astar Network will burn 350 million ASTR tokens representing 5% of its total supply following a governance vote. Source

Day: July 2, 2024

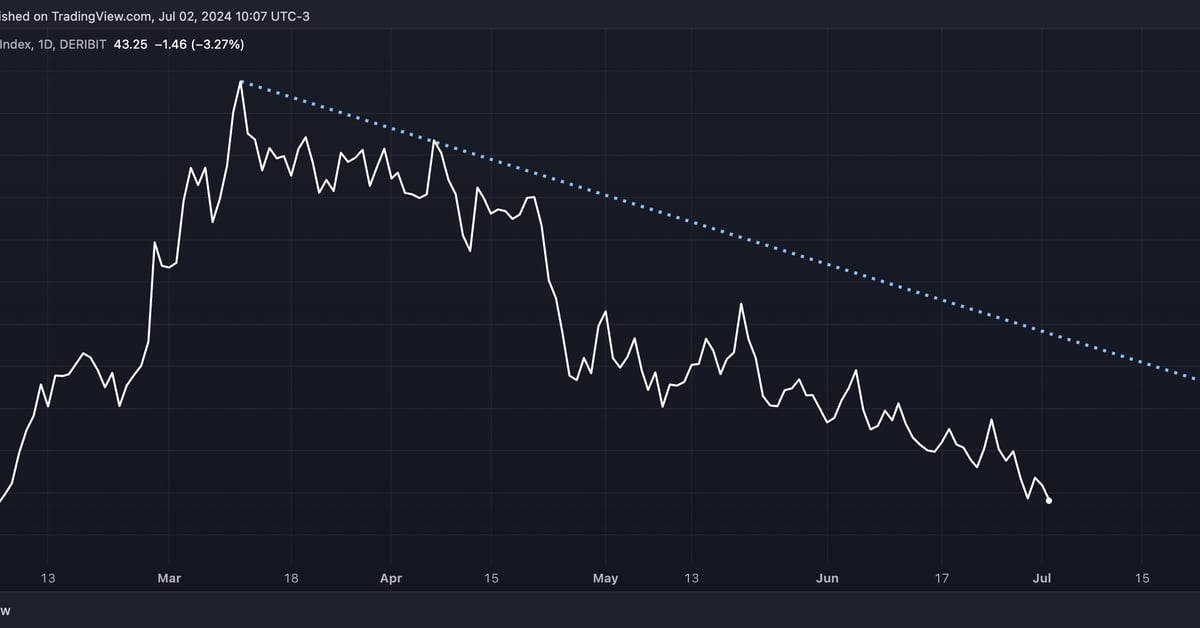

Bitcoin's Retreat From $70K Characterized by 'Vol Lethargy'

Deribit’s BTC DVOL index, a measure of volatility expectations, has slipped to lowest since early February. Original

Peter Thiel's Founders Fund Leads $85M Seed Investment Into Open-Source AI Platform Sentient

The round was co-led by Pantera Capital and Framework Ventures. Source

Bitcoin price growth lagged crypto mining stocks following halving, data shows

Despite Bitcoin’s strong start in early 2024, crypto mining stocks outperformed BTC after the halving, with Hut 8 and Bitfarms delivering the highest returns. The fourth Bitcoin halving event has brought significant shifts in the crypto mining landscape, impacting smaller mining firms more severely, analysts at CCData wrote in a research report. This is due to “suboptimal infrastructure and the lack of economies of scale,” As a result, private equity firms consolidated smaller firms and integrated their infrastructure, despite recent headwinds for Bitcoin (BTC) itself. This strategic interest has led…

Polkadot’s $245M Treasury Would Last 2 Years at Current Spending Rate

Marketing and outreach activities accounted for the biggest chunk of spending, with over $36 million spent on advertisements, events, meetups, conference hosting, and other initiatives. These efforts were intended to attract new users, developers, and businesses to the ecosystem. Source

Horizon Protocol Launches Perpetual Futures, Delivering an Unparalleled Trading Experience

PRESS RELEASE. Horizon Protocol’s Futures is a decentralized perpetual futures exchange that sets itself apart from other decentralized exchanges (DEX) by offering low fees, deep liquidity, and zero slippage with lightning speed. The exceptional trading UX provides traders with one of the smoothest and fastest on-chain trading experiences ever. Horizon Protocol makes trading the real-world […] Source CryptoX Portal

US Spot Bitcoin ETFs Record $129 Million Inflow, Fidelity Leads

U.S. spot bitcoin exchange-traded funds (ETFs) saw the largest net inflow since June 7, 2024, accumulating $129.45 million. Fidelity’s FBTC led the inflow on Monday with $65.03 million. Fifth Consecutive Day of Inflows for U.S. Bitcoin ETFs On Monday, U.S. spot bitcoin ETFs recorded $1.36 billion in trading volume and attracted $129.45 million in inflows. […] Original

Dogwifhat Targets New Peaks As WIF Exceeds $2.1 Resistance Level

Dogwifhat (WIF) has recently achieved a significant milestone by breaking through the $2.1 resistance level, generating bullish sentiment among market analysts. This pivotal breakthrough indicates potential for further upward movement and new highs. Analysts are optimistic about WIF’s prospects, forecasting continued strength and momentum in the market. As WIF surpasses this critical threshold, investor interest is expected to rise, driving further gains and positioning the asset for sustained growth. This article analyzes the recent bullish sentiment among analysts as WIF breaks through the $2.1 resistance level. It also seeks to…

Bitcoin (BTC) Bulls Hopeful Entering July as ETFs Record $130M Inflows

Spot ether ETFs in the U.S. could see net inflows of $5 billion in the first six months, according to crypto exchange Gemini. The flows, when combined with the current Grayscale Ethereum Trust (ETHE) assets under management give a total AUM for spot ETH ETFs in the U.S. of $13 billion-$15 billion in the first six months, the report said. Gemini noted that ether’s market value relative to bitcoin remains close to multiyear lows, and the inflows could improve ether’s relative standing. “Given the AUM comparable in international ETF markets,…

Worldcoin Hires Former Google, X and Apple Execs to Beef Up Privacy, Security

Adrian Ludwig, who served as director of Android security at Google and chief information officer at Atlassian, a developer of collaboration software, becomes chief information security officer. Ajay Patel, who led the Google Payments identity team, becomes head of World ID. Source