“Among the top reasons for the price drop was the German government moving more than $50 million to crypto exchanges, creating sell speculation in the market,” Lucy Hu, a senior analyst at crypto investment firm Metalpha, said in a Telegram message. Original

Day: July 4, 2024

UAE’s Zand Bank to Offer Crypto Services

Zand Bank, the UAE’s first digital bank, has entered into a strategic partnership with Taurus SA, a global leader in digital asset technology for banks. This partnership will cover all aspects of Zand’s digital asset infrastructure, including custody, tokenization, and blockchain connectivity. Zand will leverage Taurus’ integrated custody and tokenization solutions to expand its digital […] Source CryptoX Portal

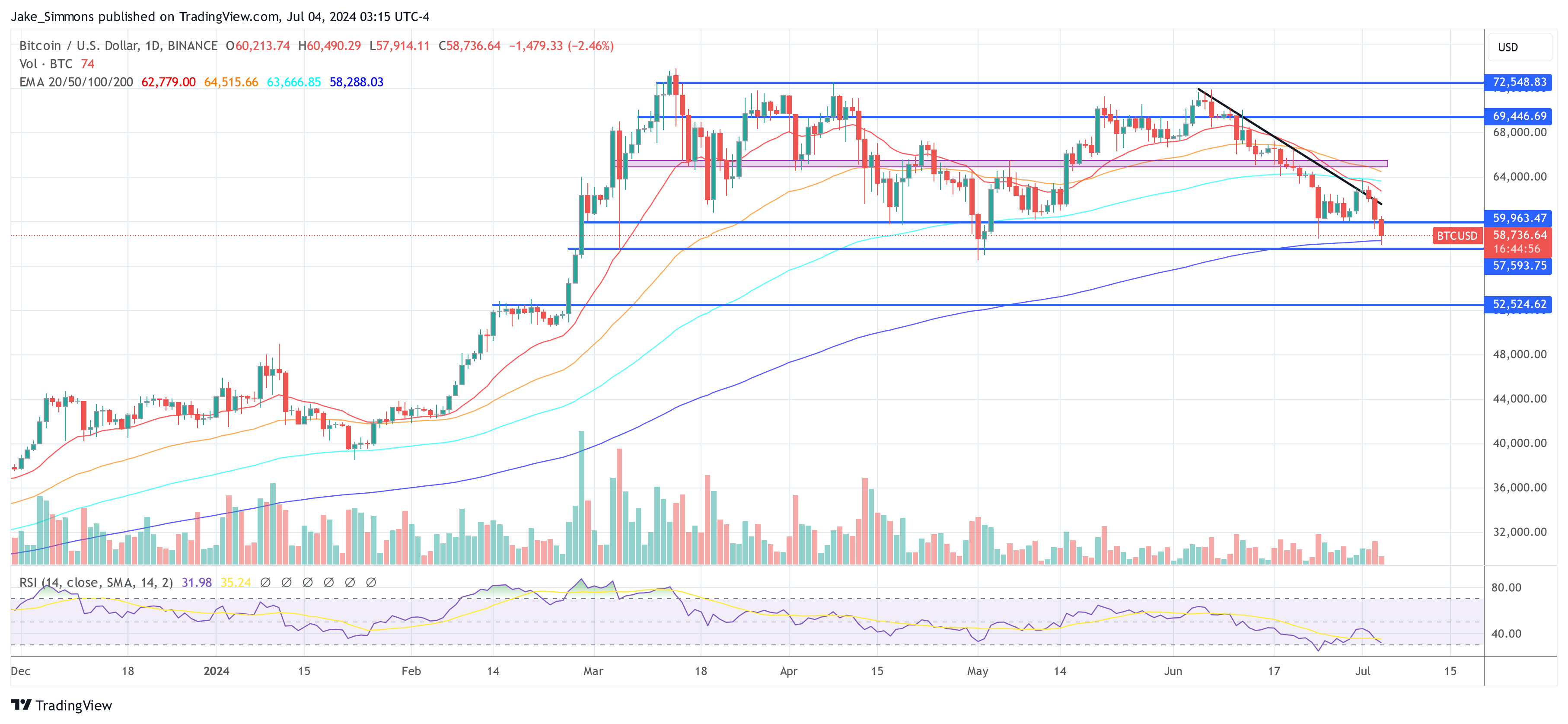

These Critical Points Are ‘Very Bad’ For BTC, Analyst Says

Popular crypto analyst Crypto Rover is navigating the choppy waters of the Bitcoin market, offering a measured analysis tinged with cautious optimism. In a recent YouTube video, Rover dissected the recent price action, highlighting both bearish indicators and potential bullish triggers that could send Bitcoin soaring. Related Reading Bitcoin Tests Crucial Support, Buy Orders Set The immediate future of Bitcoin appears to hinge on its ability to hold key support levels. Rover pinpointed the $58,000 to $60K mark as a critical zone, with a breach potentially leading to further price…

Bitcoin (BTC) Price Drops Below 200-Day Average; Bull Market Trendline in Focus

Markets that consistently trade below the 200-day SMA are said to be in a downtrend, while those trading above the average are bullish. BTC rose past the 200-day SMA in October, when the average value was $28,000. The breakout – fueled by expectations for a spot bitcoin ETF in the U.S. – paved the way for a sharp rally to record highs above $70,000 by March. Original

Bitcoin dips below $59k as miners show signs of capitulation

Bitcoin’s drop below $59,000 highlights heavy selling, with QCP analysts seeing miner capitulation as a potential sign of a market bottom. Bitcoin (BTC) is facing yet another day of intense selling pressure, dropping below the crucial $60,000 support level and hitting lows of $57,875 which marks a significant downturn as BTC struggles to maintain its footing amid market turbulence. In their recent research note, QCP analysts highlight that Bitcoin miners appear to be showing “signs of capitulation,” adding that this historical indicator is often associated with a price bottom. “Historically…

Decoding The $7B Decline in Bitcoin's Notional Open Interest

The decline in notional open interest masks bullish undercurrents. Source

Opera’s Minipay Expands Stablecoin Support: Adds USDC and USDT to Its Digital Wallet

Minipay, an integral feature of the Opera Mini browser, has announced a significant upgrade with the introduction of ‘Pockets’. This new feature now supports USDC and USDT, two of the most widely used stablecoins, thereby enhancing its existing digital asset management capabilities. The innovative ‘Drag & Swap’ feature simplifies the process of switching between USDC, […] Source CryptoX Portal

Bitcoin Price Could Crash Like In May 2021, Warns Fund Manager

Bitcoin’s price has fallen below the critical support level of $60,000, reaching a low of $57,914. Since Tuesday, Bitcoin has experienced a further 7% decline, reinforcing the ongoing downward trend. Currently, market sentiment is shifting markedly towards the bearish side. Is A May 2021-Style Bitcoin Crash Looming? Andrew Kang, co-founder of Mechanism Capital, has raised significant concerns regarding the pattern emerging in the Bitcoin market, reminiscent of the conditions that led to the dramatic crash of May 2021. In a detailed analysis shared via X (formerly Twitter), Kang highlighted the…

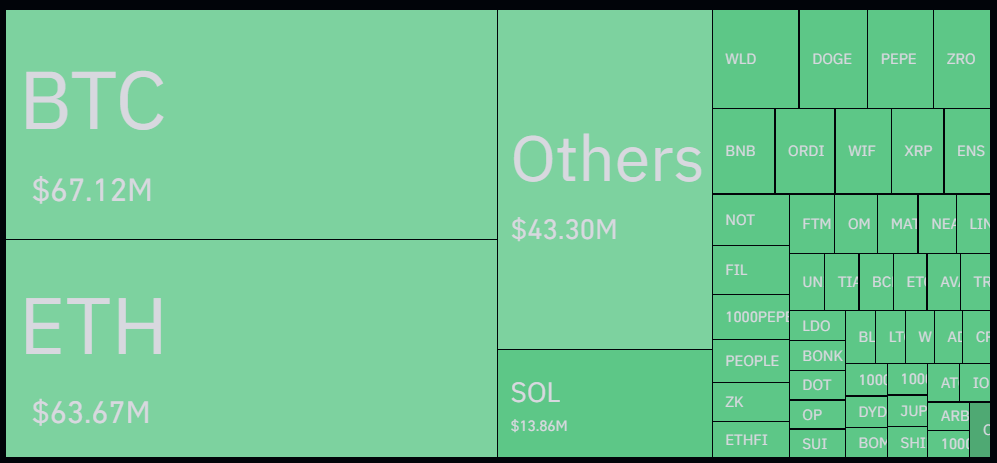

Crypto liquidations doubled as market cap fell to 2-month-low

The total amount of cryptocurrency liquidations increased by over two times over the past day as the global market capitalization plunged to its two-month lows. According to data provided by Coinglass, the total crypto liquidations rallied by 114% in the past 24 hours — currently sitting at $265 million. Data shows that $236 million worth of long positions have been liquidated. Crypto liquidations map – July 4 | Source: Coinglass Per Coinglass data, only 11% of the liquidations, worth $29 million, belong to short-position holders. In total, more than 102,000…

Mt. Gox Doomsday Scenario Involves Bitcoin Cash (BCH), not Bitcoin (BTC)

In addition to the roughly $9.5 billion in BTC the former exchange will send back to its customers, Mt. Gox will also send back 143,000 BCH worth around $73 million. CoinGecko data shows that Bitcoin Cash has a daily trading volume of $308.8 million, making this redemption worth around 24% of that number. Original