Fidelity International has listed its physical Bitcoin exchange-traded product on the London Stock Exchange, providing professional investors with access to the world’s largest digital asset by market cap. Trading under the ticker FBTC, the ETP is fully backed by Bitcoin (BTC), and tracks its price its price. The launch on the LSE follows approval by the United Kingdom’s Financial Conduct Authority in late May. This approval allows issuers to list crypto-backed exchange-traded notes for professional investors. Other firms like 21Shares, WisdomTree, and Global X have also announced similar products in…

Month: July 2024

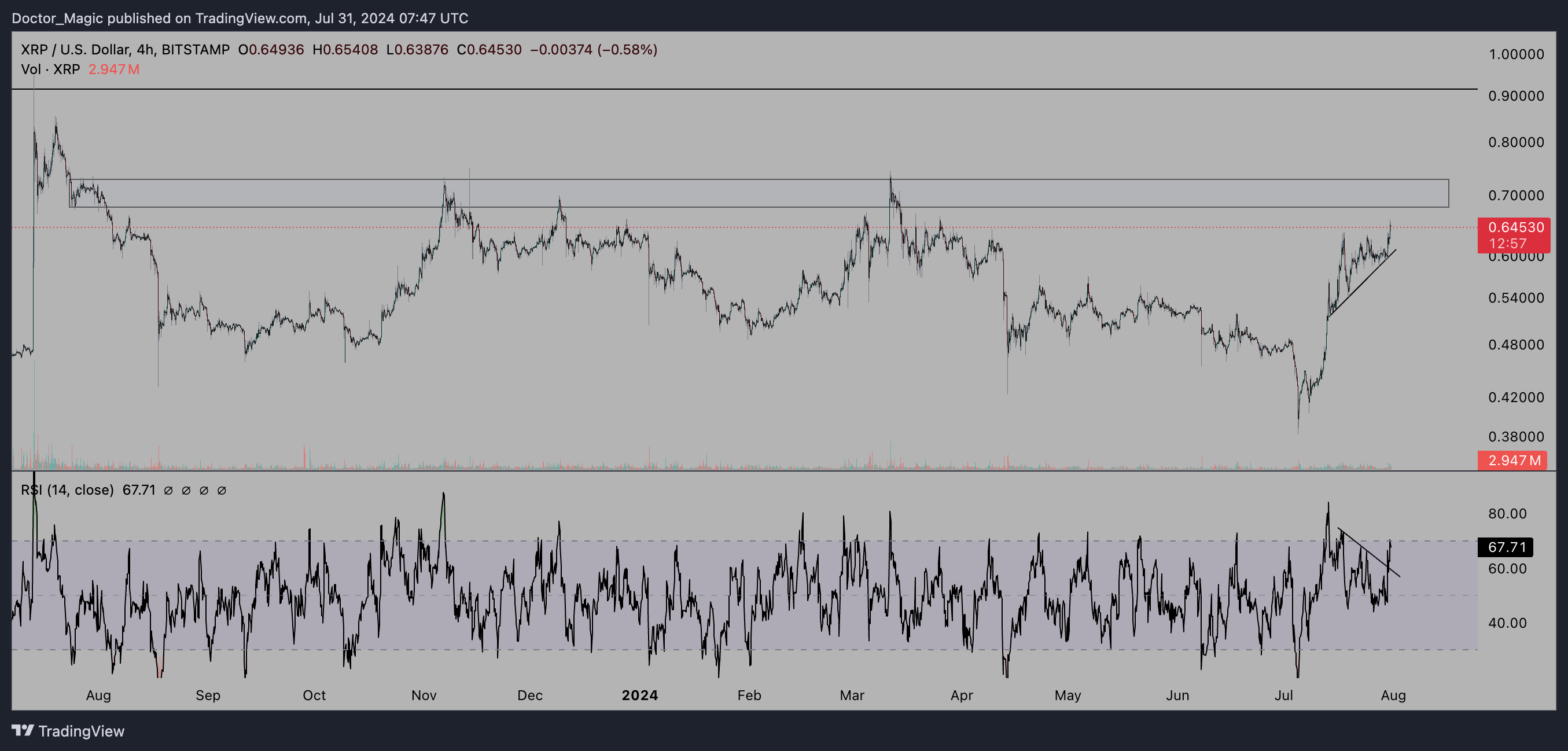

XRP Goes To All-Time High If This Resistance Breaks: Analyst

XRP has emerged as a standout performer among the top-100 cryptocurrencies by market capitalization today, recording a substantial 7% increase over the past 24 hours. This surge in XRP’s price occurs amidst swirling speculations of a forthcoming settlement or remedies ruling in the Ripple-SEC case. Amid these developments, XRP is dominating discussions on X (formerly Twitter), where a flurry of optimistic posts paint a bullish scenario for the cryptocurrency. Among the vocal proponents contributing to this positive outlook is crypto analyst Doctor Magic (@Doctor_Magic_), who shared several different time frame…

Riot buys 10.23m more Bitfarms shares in July, increasing stake to 15.9%

Riot Platforms has increased its acquisition efforts of Bitfarms by buying over 10 million more shares this month. According to a filing with the US Securities and Exchange Commission on July 31, Riot, a Bitcoin (BTC) mining company, now owns 71.56 million Bitfarms shares, valued at $159.1 million. This means Riot now holds a 15.9% stake in Bitfarms. According to the SEC filing, Riot purchased Bitfarms shares throughout the month of July, ranging from $2.48 to $2.84 per share. Riot has an earnings call after trading hours on July 31.…

Bitcoin Price Shrugs Off Latest $2B Mt. Gox Transfer as Distribution Nears Its End

Bitcoin holdings of Mt. Gox wallets are down to $3 billion from $9 billion a month ago, Arkham data shows. Original

Crypto Fear and Greed Index Shows ‘Greed’ Despite Bitcoin’s Price Drop

While bitcoin briefly reached the $70,000 mark on July 29, the price has since declined. Over the past week, BTC has decreased by 0.6%. During the last 18 days, the Crypto Fear and Greed Index (CFGI) has transitioned from “extreme fear” back to “greed.” From ‘Extreme Fear’ to ‘Greed’ in 18 Days Approximately 18 days […] Original

How Founders Can Revitalize VC Tokens

To get listed on major exchanges, many crypto projects are over-inflating their valuations at launch, scaring away investors. How do founders get exposure to VC funding without playing the inflation game? CoinDesk columnist Azeem Khan, a VC himself, has some ideas. Source

BIS and UK Bank of England Project Successfully Shows Stablecoin Balance Sheets can be Supervised

“Should a mismatch occur between a stablecoin issuer’s liabilities (the coins in circulation) and the assets backing that stablecoin, this could undermine confidence in the ability of the issuer to offer redemption at par and prompt a ‘run,’ ie a sudden loss of belief in the stablecoin’s value,” the report said. Source

US Bitcoin ETFs Record $18.3 Million in Net Outflows

On Tuesday, U.S. spot bitcoin exchange-traded funds (ETFs) experienced net outflows of approximately $18.3 million, contrasting with inflows observed in their ethereum counterparts. The most significant gain was recorded by Blackrock’s IBIT, while Grayscale’s GBTC suffered the largest losses. $18.3M Net Outflows in U.S. Bitcoin ETFs; GBTC Hit Hardest The total reduction across the 11 […] Original

Elliot Wave Theory Suggests Bitcoin Price will Crash Below $40,000

The Elliot Wave theory has become very popular among Bitcoin analysts, given its effectiveness in helping to estimate where the cryptocurrency’s price is headed next. Using this same theory, pseudonymous crypto analyst XForceGlobal has estimated what could happen next for the Bitcoin price. Elliot Wave Theory Points To A Recovery In the analysis posted on TradingView, XForceGlobal used the 5-wave Elliot Wave theory to predict further upside for the Bitcoin price. The chart maps out the waves and subwaves, all of which carry various implications for the Bitcoin price. Related…

Trump’s Bitcoin speech sparks $2.6m Polymarket dispute

Some Polymarket betters challenged the platform’s resolution of $2.6 million worth of wagers on Trump’s Bitcoin reserve pledge in Nashville. Last weekend, former U.S. President and Republican candidate Donald Trump informed 20,000 Bitcoin (BTC) 2024 attendees of plans to stop government selling if elected come November. The U.S. government is the largest geopolitical Bitcoin owner, with a trove of 183,000 BTC worth over $12.7 billion, per Arkham. Polymarket judged that Trump’s remarks on retaining America’s BTC holdings would effectively create a strategic national Bitcoin stockpile. “For the purposes of this…