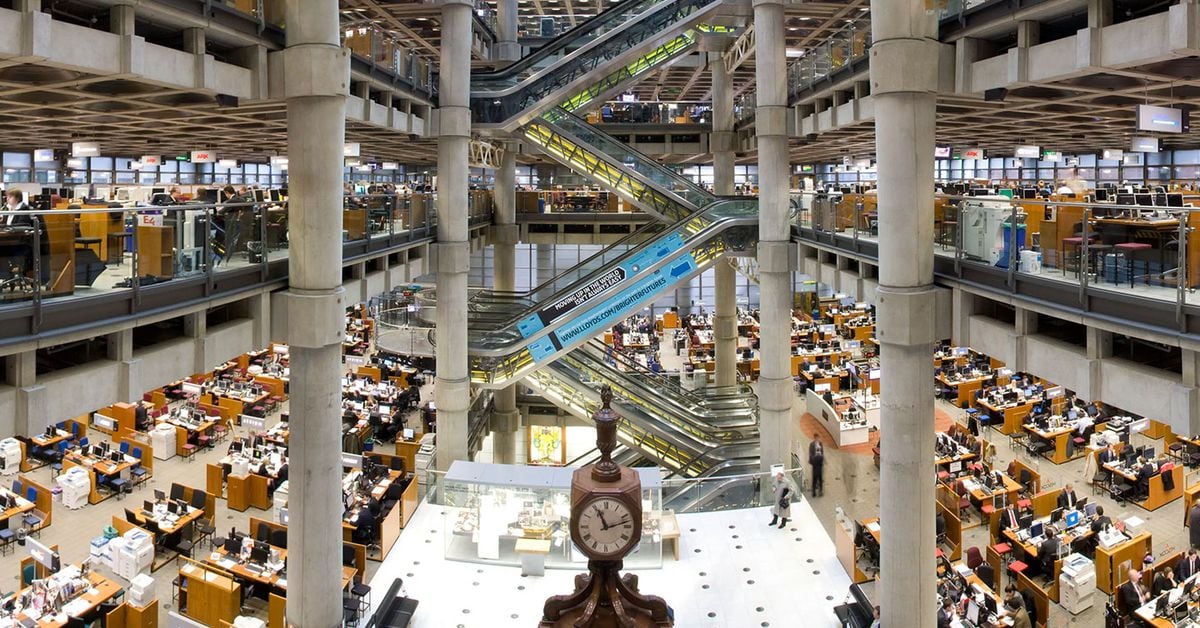

“What we’re enabling is for people using public blockchain infrastructure to interact with highly regulated, traditional, fiat-backed institutions in a way that is seamless,” said Evertas CEO J. Gdanski in an interview. “Whether it’s to pay in USDC or native crypto, or to place policies completely on-chain with the blockchain helping coordinate between a broker, the insured, and the insurers, we think this is a seminal piece of infrastructure.” Source

Month: July 2024

Russian Diplomat: El Salvador Proposes Settling Trade With Crypto

El Salvador has proposed using cryptocurrency as an alternative payment method for trade with Russia. The Central American nation has reportedly expressed interest in joining the BRICS bloc and may formally apply for membership within one or two years. Ukraine-Russia Conflict Echoes in Central America El Salvador has proposed settling trade with Russia using cryptocurrency, […] Source CryptoX Portal

Global Crypto Exchange Coinbase (COIN) Concerned About ‘Ongoing Regulation by Enforcement’ in Australia

“We’ve been quite vocal with our concerns about ASIC potentially just continuing to make enforcements”, during the “four or five roundtables” in recent weeks, O’Loghlen said, even though he complimented a new ASIC team for “very much reaching out to all industry players” … “proactively” having “a coffee conversation with 50 or so groups.” Source

Crypto Market Stabilizes After Nursing Losses

Nvidia is expected to see more significant price swings than bitcoin and ether. NVDA’s 30-day options implied volatility, a gauge of anticipated price swings over four weeks, recently surged from an annualized 48% to 71%, according to Fintel. Deribit’s bitcoin DVOL index, a measure of 30-day implied volatility, declined from 68% to 49%, according to charting platform TradingView. The ETH DVOL index fell from 70% to 55%. NVDA, a bellwether for AI, has emerged as a barometer of sentiment for both equity and crypto markets. Both bitcoin and NVDA bottomed…

Render Continues To Flash Red In All Timeframes

Render investors and traders continue their sell-off, following the broader market’s bearish attitude. After weeks of continuous bullish action, CoinGecko data shows that the market is down a few percent, translating to losses in the altcoin market. Related Reading Although the environment brought gains to a number of tokens, it dragged several tokens, like Render, to the ground. The latest market data shows that the latter is down in almost all timeframes, with the biggest loss in the monthly timeframe at nearly 25%. This presents a big question to investors…

Terra Blockchain Restarts After Reentrancy Attack Leads to $4M Exploit

The blockchain halted at block height 11430400 for an emergency patch to fix the vulnerability. The fix was completed at 04:19 UTC. Validators, the entities that support the network, with over 67% of the voting power on Terra upgraded their nodes to prevent the exploit from recurring, according to a post on the X. Source

Bitcoin drops below $66k as Mt. Gox moves $2b

On Wednesday, Bitcoin’s price dipped below $66,000 as news surfaced of another multi-billion dollar BTC transfer from defunct crypto exchange Mt. Gox . On Tuesday, July 30, the Mt. Gox estate moved another batch of nearly 34,000 Bitcoin (BTC) — worth around $2.25 billion at current prices — to a new wallet, indicating that the exchange might be actively repaying its creditors after it shut down in 2014. Per data from Arkham Intelligence, Mt. Gox moved 33,963 BTC to a fresh wallet where the funds are still sitting as of…

Analyst Says ETH Price Will Struggle As Spot Ethereum ETFs Expectations Crash

Pseudonymous trader and analyst Roman has made a bold prediction regarding the ETH price, suggesting that investors should lower their short-term expectations. This comes amid a drop in the hype around the Spot Ethereum ETFs, with these funds currently suffering significant outflows. What To Expect From The ETH Price Roman mentioned during an interview with Hall of Flame that he doesn’t see Ethereum “doing that well” for the next few months. The analyst believes that ETH will suffer a similar fate to the rest of the crypto market as Bitcoin…

Huawei Aims to Drive AI Adoption in Africa With Data Center Expansion

Chinese tech giant Huawei says it will leverage its experience to help African customers. The company aims to achieve this by providing storage products and services to manage data. Huawei will also offer cloud services to support African businesses. According to the company, data centers are the new digital hubs. However, they must be faster, […] Source CryptoX Portal

Bitcoin (BTC) Keeps Weekly Loss as ‘Anti-Risk’ Yen (JPY) Strengthens After Bank of Japan Rate Hike

Bitcoin held steady near $66,000, nursing a weekly loss of 2% on expectations for renewed rate cuts from the U.S. Federal Reserve. That spurred demand for the “anti-risk” yen, sending the USD/JPY rate down to nearly 150, the strongest for yen since March, according to data source TradingView. Futures tied to the S&P 500 rose 0.4%, signaling a positive open on Wednesday. Original