European central banks could start accumulating Bitcoin in 2025, according to blockchain expert Fiorenzo Manganiello. The prediction follows the rollout of the EU’s Markets in Crypto-Assets regulation, which aims to stabilize the crypto market by introducing clear legal frameworks. Manganiello, co-founder of LIAN Group and a professor at Geneva Business School, argues that MiCA’s regulatory clarity will encourage institutional investors to enter the market, reducing volatility and legitimizing Bitcoin (BTC) as a financial asset, according to a note shared with crypto.news. He believes this shift could extend to central banks,…

Day: February 3, 2025

Dogecoin Crashes 40%, But This Analyst Sees A Bullish Setup

Este artículo también está disponible en español. In a dramatic reversal, Dogecoin (DOGE) plunged from around $0.34 as low as $0.20, wiping out nearly 40% of its value before finding tentative stability near $0.25 at press time. However, crypto analyst “Coosh” Alemzadeh (@AlemzadehC) maintains a bullish long-term outlook, sharing a weekly chart of DOGE/USD and remarking, “DOGE: Looking really good here,” despite the recent turmoil. Why Dogecoin Is Still Looking Bullish The unexpected news of new tariffs by the Trump administration on major trading partners like China, Mexico, and Canada…

India Could Turn Pro-Crypto as Bull Market Continues. Can $BEST Presale 100x in 2025?

India, known for its anti-crypto approach, could soon take a U-turn on the matter after a change in global sentiments. Ever since the appointment of the pro-crypto Donald Trump as the US president, countries seem to be in a race to adopt crypto, and India doesn’t want to be left too far behind. Currently, the country imposes a draconian 30% capital gains tax on crypto assets without distinguishing between long-term and short-term holdings. This is among the highest tax slabs in the country. For comparison, only winnings from lottery and…

Bitcoin, Ethereum ETFs are here; XYZ aims to be next altcoin to soar

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. The approval of Bitcoin and Ethereum ETFs has sparked interest in other altcoins, with speculation growing about XYZVerse potentially gaining SEC endorsement next. The launch of Bitcoin and Ethereum ETFs has opened new doors in the world of cryptocurrency investment. With these leading digital currencies gaining regulatory approval, eyes are now on other contenders. There’s growing speculation about whether XYZVerse (XYZ) might be the next altcoin to secure the…

Cryptocurrency Czar David Sacks, Lawmakers to Discuss US Crypto Leadership Plan

White House cryptocurrency director David Sacks will hold a press conference on Tuesday, Feb. 4, at 2:30 p.m. ET to discuss the U.S. digital asset strategy. White House to Outline U.S. Digital Asset Strategy in Press Conference Reports and a recently published memo state that David Sacks, who serves as President Donald Trump’s artificial intelligence […] Source

Ethereum Long-Term Bullish Structure At Risk – $2,700 Support Is Key for a $7K Target

Este artículo también está disponible en español. Ethereum faced a brutal capitulation event on Sunday, plummeting over 30% in less than 24 hours as market-wide panic took hold. The dramatic sell-off was fueled by growing fears of a U.S. trade war, sending shockwaves across the crypto space and causing Bitcoin and major altcoins to drop significantly. ETH, which had been struggling to reclaim key levels, saw a sharp decline, shaking investor confidence and raising concerns about its long-term trend. Related Reading Top analyst Ali Martinez shared a technical analysis, revealing…

Microstrategy’s $30 Billion Bitcoin War Chest on Ice Amid Tariff Turmoil

On Monday, Michael Saylor, founder of Microstrategy, disclosed that the enterprise refrained from divesting Class A common shares and abstained from expanding its bitcoin reserves. Saylor: No MSTR Share Selling, No Bitcoin Buying as Market Trembles Following a multi-week acquisition spree of bitcoin (BTC), Microstrategy (Nasdaq: MSTR) entered a strategic hiatus this week, halting its […] Original

MicroStrategy halts Bitcoin buying spree after 12 straight weeks

Software designer MicroStrategy ended its 12-week Bitcoin buying streak, holding onto its current $44 billion stash until further notice. MicroStrategy did not execute a Bitcoin (BTC) buy for the first time in three months, according to Form 8-K disclosure documents filed with the U.S. Securities and Exchange Commission. After 12 consecutive weekly Bitcoin purchases, the firm did not sell any class A common shares from its at-the-market program. With no share sales between January 27 and February 2, the company had an outstanding $4.35 billion worth of equity offerings available…

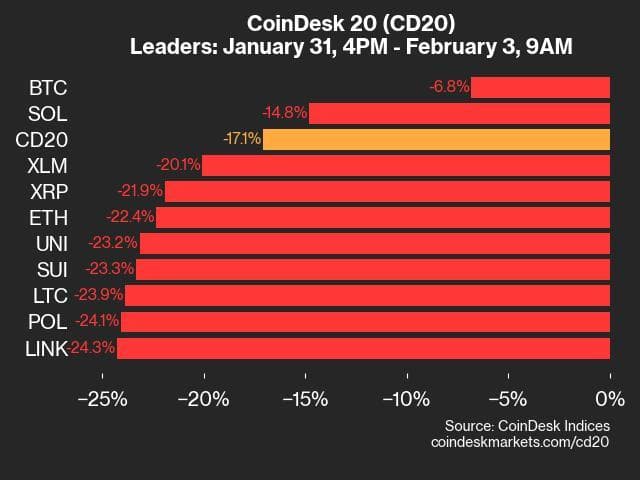

Index Plunges 17.1% Over the Weekend

CryptoX Indices presents its daily market update, highlighting the performance of leaders and laggards in the CryptoX 20 Index. The CryptoX 20 is currently trading at 3112.63, down 17.1% (-641.58) since 4 p.m. ET on Friday. None of the 20 assets are trading higher. Leaders: BTC (-6.8%) and SOL (-14.8%). Laggards: FIL (-33.9%) and AAVE (-29.3%). The CryptoX 20 is a broad-based index traded on multiple platforms in several regions globally. Source CryptoX Portal

Bybit CEO estimates crypto wipeout crossed $8b, more than $2b reported

Bybit CEO Ben Zhou has suggested that the ongoing crypto market liquidation event may be significantly larger than widely reported. According to CoinGlass data, over $2 billion in digital liquidations in 24 hours on Monday, Feb. 3, marking the single largest liquidation event in crypto history. Several analysts estimated liquidations exceeded $2.2 billion, surpassing the COVID crash and FTX collapse, two of the most significant liquidation events ever recorded. Yet, Zhou said the numbers may be underreported due to API limits. According to Bybit’s co-founder, the crypto exchange limits how…