Recent tariffs imposed by President Donald Trump on imports from Canada, China, and Mexico are expected to have varying impacts on the cryptocurrency mining sectors in these countries. U.S. and China The U.S. has announced a 25% tariff on Canadian and Mexican imports and a 10% tariff on Chinese goods, effective Feb. 1, 2025, according to the Associated Press. While these tariffs primarily target traditional industries, the cryptocurrency sector may experience indirect effects. Here’s why: Most U.S. mining hardware is imported, making miners vulnerable to changes in trade policies or…

Day: February 2, 2025

Latam Insights Encore: El Salvador Yields to IMF Pressure, Coinbase Lands in Argentina

Welcome to Latam Insights, a compendium of the most relevant crypto and economic news from Latin America over the past week. In this week’s edition, El Salvador de-risks its economy from bitcoin, Coinbase launches in Argentina, and Hive Digital expands its operations in Paraguay. El Salvador Complies With IMF Requirements: Bitcoin Legal Tender Status Withdrawn […] Source CryptoX Portal

Chainlink Set for $36? Whale Moves Suggest a Big Rally—Analyst

Este artículo también está disponible en español. Analysts anticipate a potential breakout to $36, as Chainlink (LINK) is currently exhibiting robust upward momentum. In recent weeks, large investors, more commonly known as “whales,” have been aggressively accumulating LINK. Their increasing interest indicates that they are optimistic about the asset’s long-term potential. However, is this rally enduring, or is it merely another brief surge? Related Reading Chainlink: Strong Whale Appetite Data shows that large investors (whales) have been steadily buying more LINK when the price is between $17 and $21. In…

The Myth of Trump’s ‘Painless’ Revenue: How Taxes and Tariffs Both Betray Free Market Principles

Since Donald Trump was sworn in, debate has intensified over replacing income tax with tariffs—a tactic free market purists contend is simply another form of economic interference—prompting this editorial to explain why tariffs are considered unworkable and to explore alternative funding methods for a minarchist-style government dedicated to protecting citizens. Examining the Economic Case for […] Source CryptoX Portal

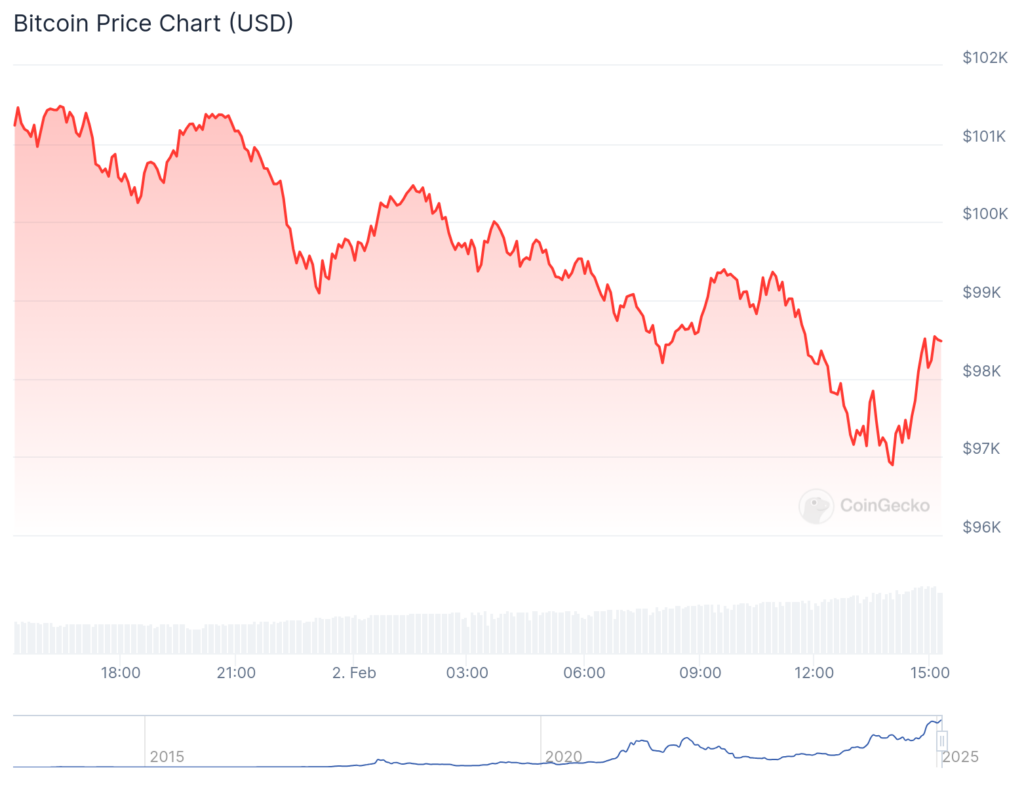

Bitcoin Bull Market at Risk if $97,000 Support Fails to Hold: Analyst

Este artículo también está disponible en español. Bitcoin is now retesting the psychological $100,000 price level again after a 2.22% decline in the past 24 hours. Notably, Bitcoin recently rebounded around an order block at $99,200 in the past 24 hours as it continues to trade with intense volatility. Meanwhile, crypto analyst Ali Martinez has pointed to $97,190 as a key support level, stressing that Bitcoin must stay above it to maintain its bullish trajectory. This insight comes amidst sharp price swings that have tested investor sentiment, but optimism remains…

India takes cue from US, re-examines crypto regulations

India is reevaluating its cryptocurrency stance in response to changing global attitudes. Economic Affairs Secretary Ajay Seth told Reuters that India’s review considers the changing positions of multiple jurisdictions regarding cryptocurrency usage and acceptance. This reassessment has delayed the release of a cryptocurrency discussion paper originally scheduled for September 2024. “More than one or two jurisdictions have changed their stance towards cryptocurrency in terms of the usage, their acceptance, where do they see the importance of crypto assets. In that stride, we are having a look at the discussion paper…

Bitcoin over a 529? Crypto parents rethink college savings

Never mind that Bitcoin is extremely volatile. Some parents are seeing beyond that and opting to invest in cryptocurrency instead of traditional 529 college savings plans, hoping for higher returns despite the risks. According to Bloomberg, a growing number of families are banking on Bitcoin (BTC) as a hedge against inflation, which got worse in December, as consumer prices rose 2.6% compared to a year earlier. That’s up from a 2.4% annual pace in November. The bet is that Bitcoin is an asset with stronger long-term growth potential than conventional…

Bitcoin Price Is Trading In This Bearish Flag — What’s The Downside Target?

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies. Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking”…

Trade War Escalates: Trump’s Tariffs Ignite Retaliation From Canada, Mexico, China

The U.S. has imposed new tariffs on Canada, Mexico, and China, igniting a trade war. Canada strikes back with billions in tariffs, Mexico retaliates, and China warns of consequences. US Tariffs on Canada, Mexico, and China Spark Retaliation and Economic Concerns A trade dispute is intensifying among the United States, Canada, Mexico, and China in […] Source CryptoX Portal

USDC Expands At 2021 Levels—What’s Driving The Surge?

Este artículo también está disponible en español. Stablecoins, often taking the backseat from Bitcoin and other top cryptocurrencies, are now in the spotlight. According to on-chain data, the stablecoins market has surged to over $200 billion, with Tether’s USDT and USDC as the main growth drivers. Related Reading Based on CryptoQuant’s data, the stablecoins market increased by $37 billion since the first week of November last year, when Donald Trump won his second presidency. The same CryptoQuant report shared that the stablecoin’s performance may spill over to Bitcoin and other…