Plasma, a startup focused on developing a blockchain tailored for stablecoin transactions, has raised $20 million in a Series A funding round led by Framework Ventures, following an earlier $4 million seed round. The investment, which includes participation from notable figures such as Peter Thiel and Tether CEO Paolo Ardoino, aims to enhance Plasma’s capabilities […] Original

Day: February 14, 2025

Bitcoin Scarcity is Real as Trump promotes

Bitcoin mined has crossed the 19.96 million mark, meaning over 95% of Bitcoin in existence has been issued. The largest cryptocurrency could soon experience a scarcity amidst fast-paced BTC withdrawals from exchanges. U.S. President Donald Trump’s plan for a strategic Bitcoin reserve and developments like institutional adoption and Layer 2 rollout on BTC could catalyze demand for the digital asset. Bitcoin scarcity and BTC demand drivers Bitcoin supply on exchanges decreased by nearly 15% since the declaration of the U.S. Presidential election results in November 2024. In the same timeframe,…

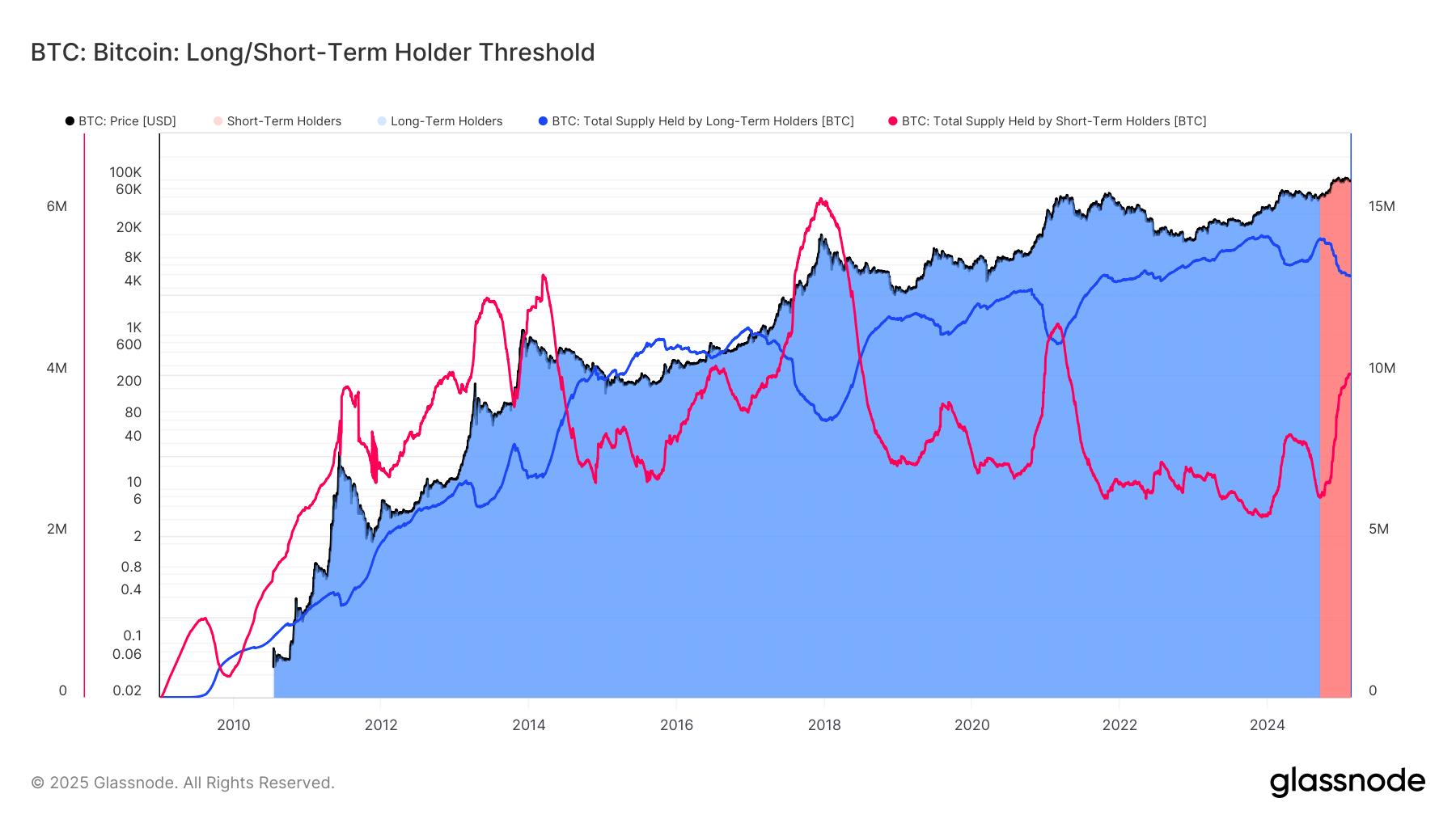

Bitcoin Short-Term Holders Surpass 4M BTC, Cycle Has More Room To Run: Van Straten

Short-term bitcoin (BTC) holders (STHs) have added 1.5 million bitcoin (BTC) since September taking the total to over 4 million bitcoin, according to Glassnode. This equates to an average accumulation of approximately 300,000 BTC per month. During this period, bitcoin surged from $60,000 to $109,000 before pulling back below $100,000. Glassnode defines STHs as those who have held bitcoin for less than 155 days. Historically, in previous bull market cycles, bitcoin’s price tends to peak when STHs exhaust their buying momentum, leading to a slowdown in price appreciation. This pattern…

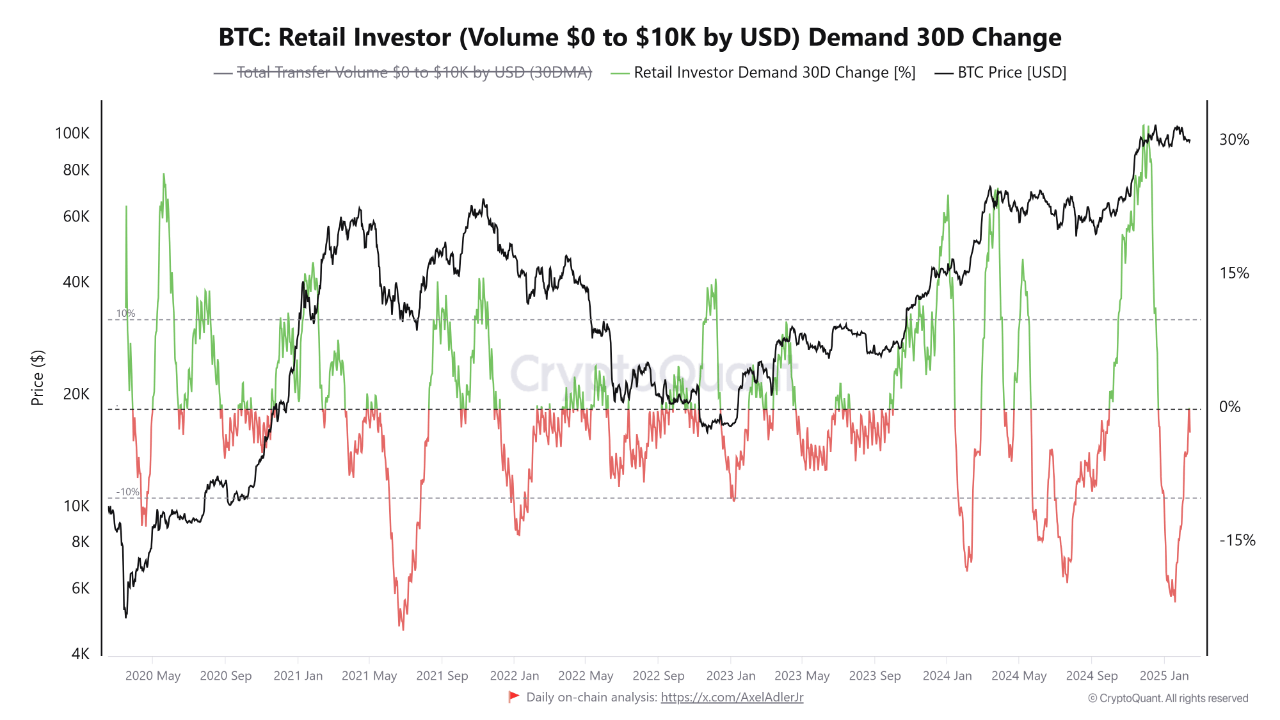

Bitcoin Retail Volume Close To Growing Again: Bullish Sign?

On-chain data shows the demand for using Bitcoin is now neutral from retail investors and could be heading toward a reversal to the upside. Bitcoin Retail Volume No Longer Plummeting As explained by an analyst in a CryptoQuant Quicktake post, the demand among the retail investors may be close to growing again. The on-chain indicator of relevance here is the “Retail Investor Demand,” which measures, as its name suggests, the demand for the Bitcoin network that’s present among the smallest of entities. Since these investors have such small wallets, their…

Massive Ethereum Whales Ape Into Lightchain AI Presale Token

PRESS RELEASE. The crypto sphere just got a huge boost of excitement! 🚀 Ethereum whales—crypto investors holding wallets with over six figures in ETH—are making major moves by aping into the Lightchain AI presale. The buzz? Lightchain AI is pioneering game-changing advancements by merging blockchain technology with artificial intelligence. If you’re a tech-savvy trader or […] Source CryptoX Portal

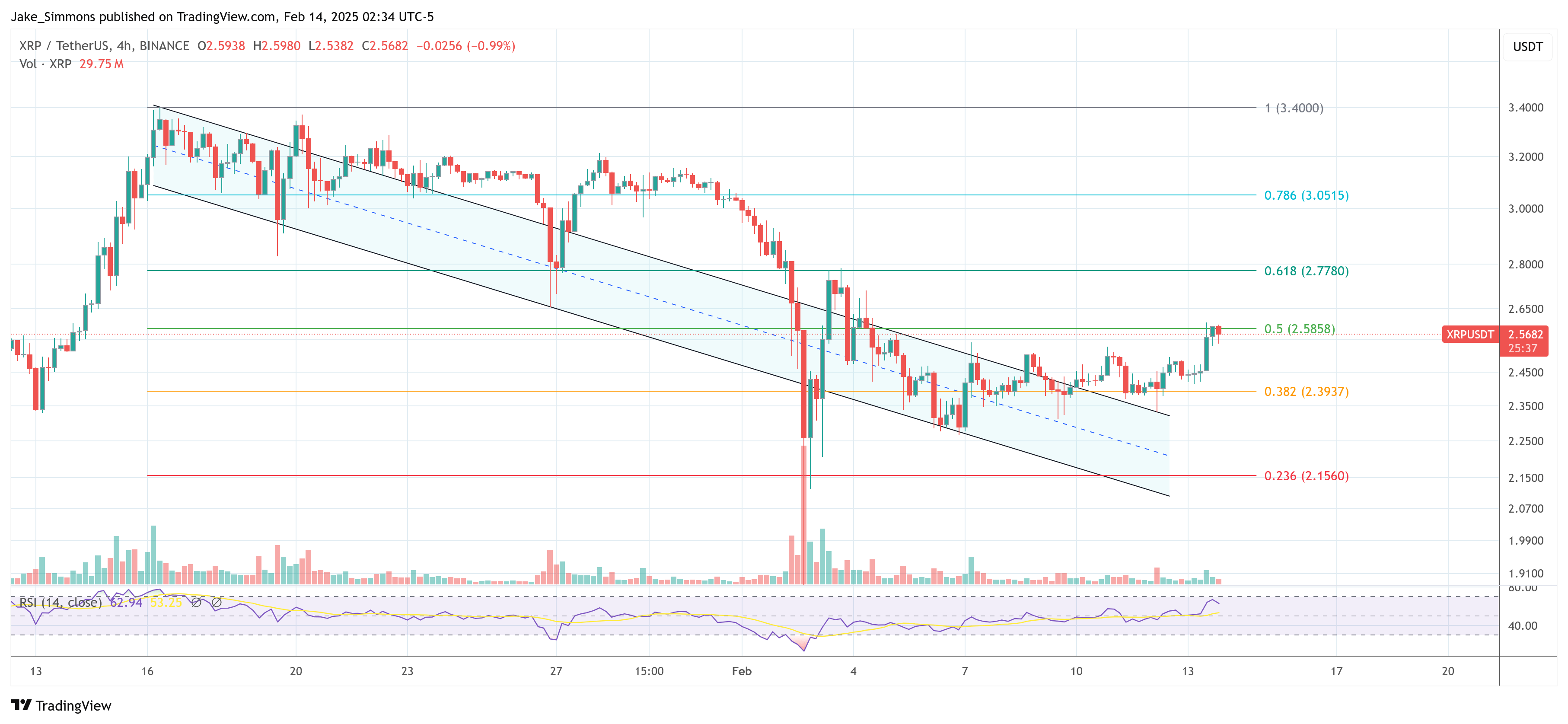

Analyst Says The Upside Isn’t Over Yet

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others. Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more…

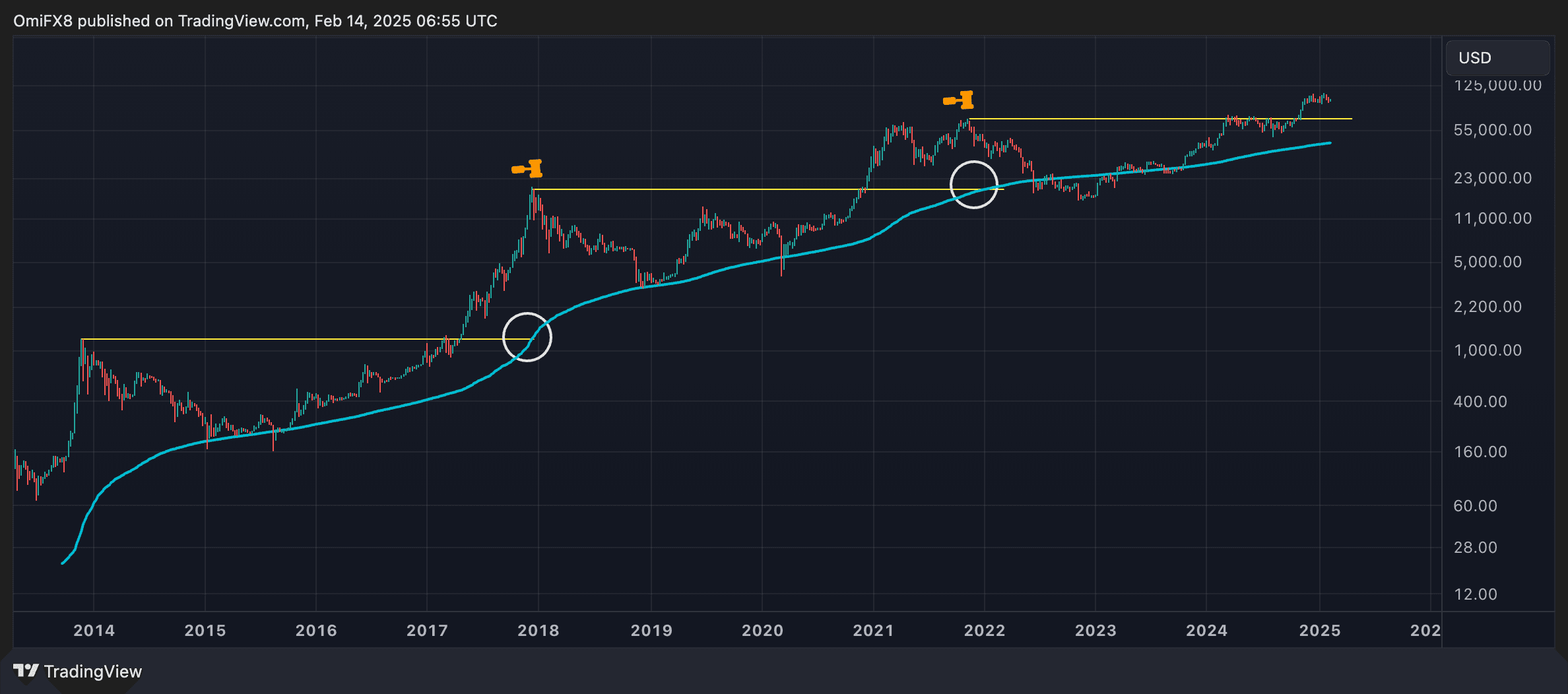

BTC Bull Market Is Far From Over, Historical Trends Tied to 200-Week Average Suggest

Historical trends tied to a key indicator suggest that bitcoin (BTC) has plenty of upside left as renewed inflation in the U.S. threatens to challenge the current uptrend. The 200-week simple moving average (SMA) of bitcoin’s price, which smooths out short-term market fluctuations to provide a clearer picture of the overall trend, stood at $44,200 at the time of writing, according to TradingView. Although this average is at its highest point ever, it is still significantly below the previous bull market’s peak of $69,000 in November 2021. That may be…

Bitcoin ETFs log fourth consecutive day of outflows, totaling $650m as BTC struggles

Spot Bitcoin exchange-traded funds in the United States experienced their fourth consecutive day of outflows on Feb. 13, with a total loss of $156 million, primarily driven by withdrawals from Fidelity’s FBTC and ARK 21Shares’ ARKB. According to SoSoValue data, the 12 spot Bitcoin ETFs recorded $156.69 million in net outflows, representing a 37.6% drop from the $251.03 million in outflows recorded the previous day. Fidelity’s FBTC led outflows for the fourth consecutive day, with $94.46 million exiting the fund, followed by ARK 21Shares’ ARKB with $52.73 million. Additional outflows…

Bitcoin At Risk? Analyst Says Breaking This Price Level Could Spark Significant Volatility

Este artículo también está disponible en español. Bitcoin (BTC) has faced heightened volatility in recent weeks, initially driven by Donald Trump’s proposed trade tariffs and later exacerbated by the latest Consumer Price Index (CPI) data. The inflation report sent BTC plummeting to as low as $94,000 before it managed to recover some losses. However, according to crypto analyst Ali Martinez, Bitcoin must defend a critical price level to avoid a significant correction. Analyst Identifies Critical Bitcoin Price Level In an X post shared earlier today, Martinez brought attention to the…