Este artículo también está disponible en español. The meme coin industry has been rather quiet in the last couple of months. However, analysts believe this is just a brief cool-off before the next meme coin supercycle begins. A meme coin supercycle is a market phenomenon in which several meme coins see exponential growth in a short period of time. This growth results from bullish market sentiment, social media trends, hype, and cultural relevance. Instead of relying on strong technical and fundamental metrics, meme coins derive their value from community perception.…

Day: February 20, 2025

If gold isn’t there, we’re gonna be very upset

Elon Musk raised concerns about whether Fort Knox is still holding $425 billion worth of gold. The posts reignited an old conspiracy theory about gone gold and sparked discussion about the advantages of Bitcoin. Donald Trump said he will audit “the fabled Fort Knox.” As a head of the Department of Government Efficiency Musk has been busy scrutinizing the government institutions lately. Fort Knox was another target for his daring eyes as Musk published an X post saying that “it would be cool to do a live video walkthrough of…

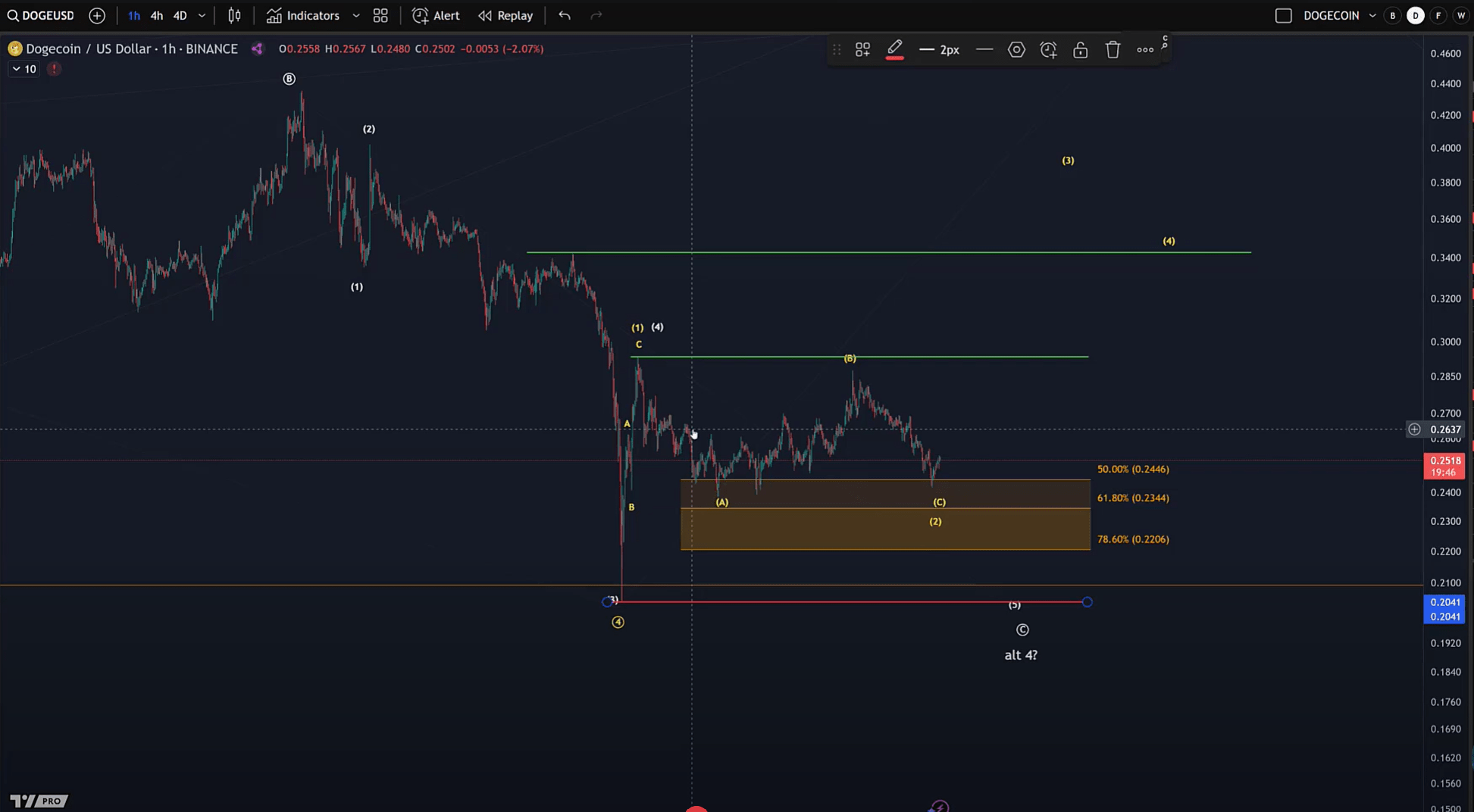

Dogecoin Could Collapse If This Support Fails, Analyst Warns

Este artículo también está disponible en español. In a video on Wednesday, the popular YouTube channel More Crypto Online offered an analysis of Dogecoin’s price structure, suggesting that the meme-inspired cryptocurrency could be on the cusp of a breakout or breakdown—provided it falls below critical support levels. The analyst’s outlook centers around Elliott Wave counts, potential consolidation patterns, and pivotal price thresholds that could define Dogecoin’s short-term trajectory. Dogecoin Teeters On The Edge The analyst notes that Dogecoin has shown “only sideways action over the last few days, actually last…

Anthony Scaramucci Predicts Bitcoin Will Reach $200,000 in 2025

Anthony Scaramucci, founder of Skybridge Capital, has forecasted that bitcoin will soar to $200,000 this year, with a potential U.S. reserve for the cryptocurrency also on the horizon. In an interview with Saxo Bank, Scaramucci emphasized that for bitcoin to solidify its status as an asset class, it would need to reach a market cap […] Original

Argentina’s LIBRA Memecoin Fiasco Destroyed $251M in Investor Wealth, Research Shows

The LIBRA memecoin scandal that rocked Argentina over the weekend destroyed millions of dollars in investor wealth, according to research by Nansen. On-chain data tracked by Nansen show 86% of traders lost a total of $251 million, while the winners secured just $180 million in profits. In other words, it was a “net-negative wealth-generating” event that potentially sucked out liquidity from the market. The episode is a stark reminder that tokens associated with political figures can be just as risky as random memecoins and celebrity cryptocurrencies in making or breaking…

ETF Outflows Will End Bitcoin Bull Cycle

CryptoQuant CEO Ki Young Ju believes Bitcoin’s bull cycle will persist as long as demand for Bitcoin ETFs remains net positive. In a Feb. 20 X post, Ju noted that while Bitcoin (BTC) ETF inflows have slowed, they continue to outweigh outflows. He warned that a prolonged period of net negative demand would likely signal the start of a bear market. According to SoSoValue data, Bitcoin ETFs recorded $71.07 million in outflows on Feb. 19, marking the second consecutive day of net redemptions. Fidelity’s FBTC saw the largest withdrawals at…

Is Bitcoin Showing Early Signs Of Bullish Divergence? Analyst Explains

Este artículo también está disponible en español. According to a recent post on X by crypto analyst Rekt Capital, Bitcoin (BTC) may finally be showing early signs of bullish divergence. If this pattern plays out, BTC could target the $101,000 level as its first milestone before moving higher. Bitcoin Showing Signs Of Bullish Divergence? Analyst Weighs In Since the beginning of February, the flagship cryptocurrency has endured multiple macroeconomic uncertainties, including US President Donald Trump’s proposed trade tariffs, the US Federal Reserve’s (Fed) hawkish statements, and the stock market downturn…

Hong Kong Powerhouses Unite: Standard Chartered, Animoca Brands, HKT to Pursue Stablecoin License

Standard Chartered Bank, Animoca Brands, and HKT have formed a joint venture to pursue a stablecoin issuing license from the Hong Kong Monetary Authority. ‘Digital Assets Here to Stay’ Standard Chartered Bank (Hong Kong), Animoca Brands, and HKT recently agreed to form a joint venture to pursue a stablecoin issuing license from the Hong Kong […] Source CryptoX Portal

Montana moves closer to allowing Bitcoin investment in state reserves

The House Business and Labor Committee in Montana has advanced a bill that seeks to establish a reserve allowing investments in Bitcoin, precious metals, and stablecoins. Introduced by Representative Curtis Schomer, House Bill 429 first landed in the House on Feb. 7 and has now cleared its first major hurdle with a 12-8 committee vote on Feb. 19. Despite unified opposition from Democrats, the bill secured enough support from Republicans to move forward. Now, the bill heads to the full Montana House for a vote. If it passes there, it…

Metaplanet expands Bitcoin reserves with 68 BTC, now holds 0.01% of total supply

Japanese investment firm Metaplanet has expanded its Bitcoin holdings with a $6.6 million purchase, bringing its total to 2,100 BTC. Tokyo-based investment firm Metaplanet announced Thursday it has purchased 68.59 Bitcoin (BTC) for about 996 million Japanese yen (or around $6.6 million), bringing its total Bitcoin holdings to 2,100 BTC, or roughly 0.01% of the total Bitcoin supply. In a Feb. 20 notice of additional purchase, the firm said the latest purchase had an average price of 14.53 million yen per BTC. Metaplanet also tracks BTC Yield, which measures changes…