Este artículo también está disponible en español. Bitcoin’s recent price crash took the entire market by surprise, leaving bullish investors reeling in losses. Particularly, this crash saw Bitcoin losing its foothold at the $90,000 price level and extended a crash across multiple cryptocurrencies. Technical analyst Rekt Capital identified this pullback as a downside deviation within a re-accumulation range, hinting at potential market changes in the coming weeks. Bitcoin’s Drop Below $90,000: A Necessary Reset? Bitcoin’s break below $90,000 in the past few days marks its first time trading below this…

Day: February 26, 2025

Oklahoma’s Bitcoin reserve bill passes State House vote amidst BTC price crash

A Strategic Bitcoin Reserve Bill is heading towards a full vote after passing in the Oklahoma State House Committee, despite BTC’s recent drop below $90,000. According to a state document, the Strategic BTC Reserve bill has been recommended to pass by the Oklahoma State House Committee. The bill passed with a majority vote of 12 to 2. It will now proceed to the full voting stage in the House of Representatives. Known as House Bill 1203, the bill would allow the state treasury to invest 10% of its public funds…

Story Protocol’s IP Rockets 40% as Traders Bet on IP Tokenization

Crypto traders are likely still reeling from Tuesday’s market carnage, but bullish bets on two altcoins are paying off handsomely. Intellectual property upstart Story’s IP is up nearly 40%, beating a 5.20% rally in major tokens tracked by the broad-based CoinDesk 20, while on-chain exchange Hyperliquid’s HYPE is up 15%. Monitoring outperforming tokens during a market rally or rebound indicates demand — making these ripe to put on one’s radar as any future dips could turn profitable for traders. IP-tracked futures showed a…

Crypto Looks Like July 2024—Here’s What Happened Next

Este artículo también está disponible en español. In a memo released on February 25, 2025, Matt Hougan—Chief Investment Officer (CIO) at Bitwise Asset Management—drew striking parallels between today’s crypto market and what he observed in July 2024. Titled “Short-Term Pain, Long-Term Gain (Redux),” Hougan’s latest analysis suggests that, despite the current pullback, the industry’s underlying fundamentals remain as compelling as ever. Crypto Echoes Of July 2024 Hougan opened his memo by recalling the environment in July 2024, when he penned an earlier piece called “Short-Term Pain, Long-Term Gain.” Back then,…

ATM Operator Bitcoin Depot Expands Treasury Holdings With Additional BTC Purchase

Bitcoin Depot (NASDAQ: BTM), a U.S.-based Bitcoin ATM operator has announced the acquisition of an additional 11.1 BTC as part of its ongoing treasury strategy, initially revealed in June 2024. This latest purchase follows the company’s recent acquisition of 51 bitcoin earlier this month, elevating its total treasury holdings to 82.6 BTC. CEO Brandon Mintz […] Original

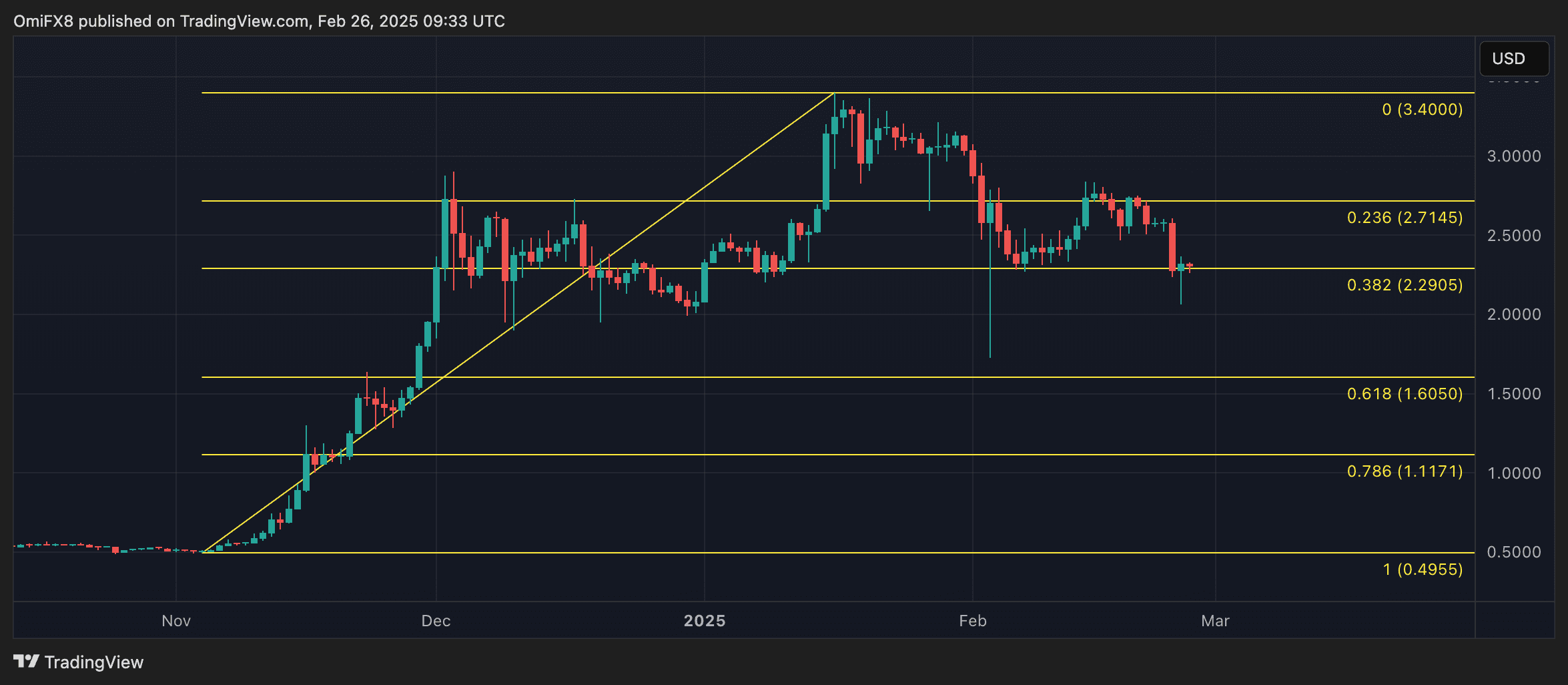

XRP Rally Hopes Alive as Prices Hold 38.2% Fib Level, DOGE Uptrend Has Ended

Payments-focused cryptocurrency XRP is down but not out, whereas the outlook for dogecoin (DOGE) appears grim, based on an analysis of Fibonacci retracement levels. XRP reached a peak of $3.40 in mid-January and has since entered a downtrend, with the price dropping 25% this month to $2.28, according to data from TradingView and CoinDesk. While the sell-off has been steep, it corresponds to only a 38.2% Fibonacci retracement of the rally that started at Nov. 4’s low of 49.5 cents through the Jan. 16 high of $3.40. A retracement is…

Bitcoin for America? Lummis Teases “Big Things Cooking”

Is the U.S. Treasury about to hold Bitcoin? Lummis proposed a strategic Bitcoin reserve last year—now she says “Big things cooking.” What’s really on the table? Lummis puts Bitcoin on the big stage Senator Cynthia Lummis has announced that she will be the co-host for Bitcoin (BTC) for America, an event taking place on Mar. 11 in Washington, D.C. I’m thrilled to announce I will be the honorary co-host for Bitcoin for America! I hope you tune in on March 11. ₿ig things cooking.🇺🇸 https://t.co/fmM4fzbINx — Senator Cynthia Lummis (@SenLummis)…

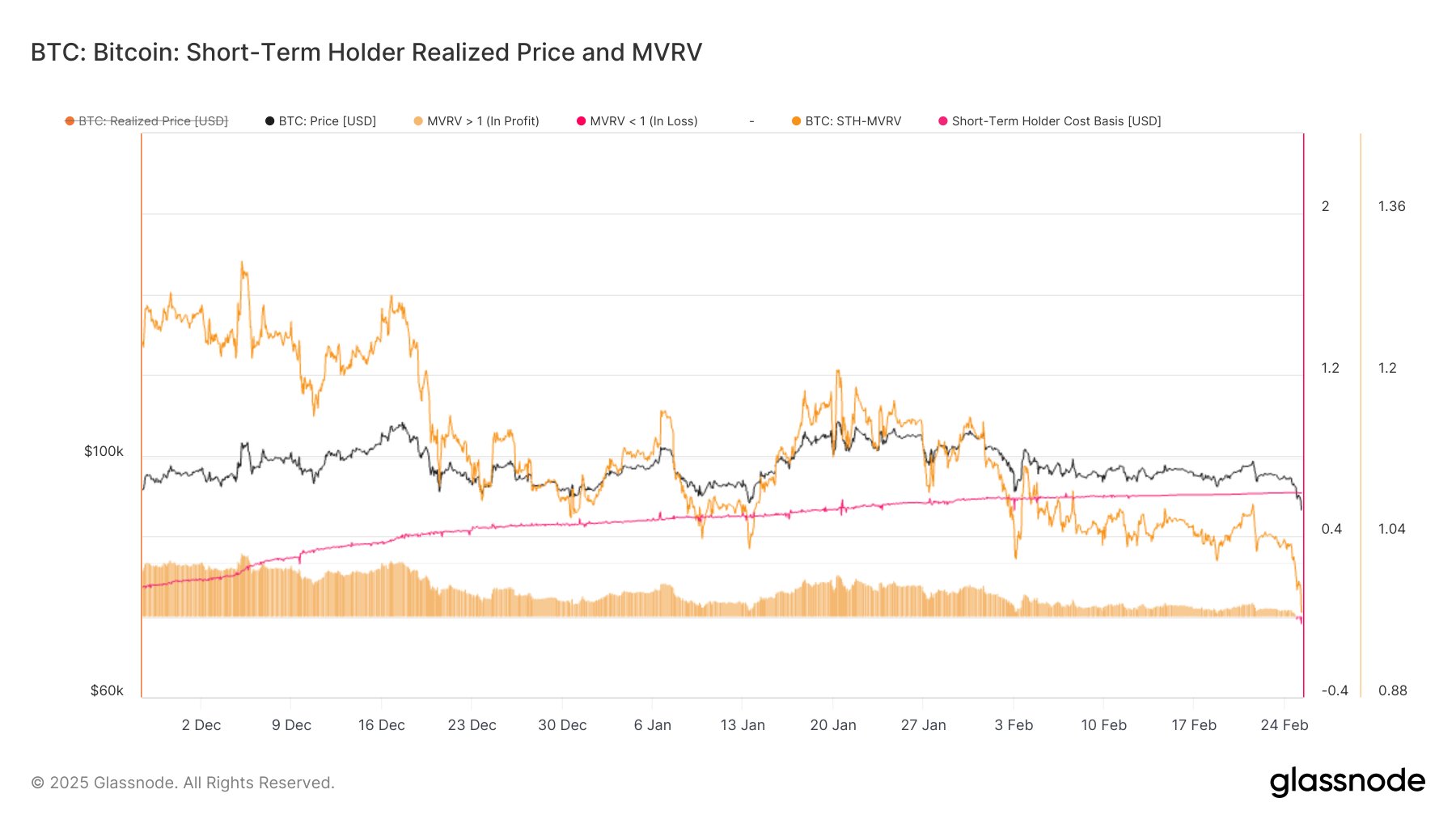

Bitcoin Headed For $72,000? These Metrics Could Hint So

Este artículo también está disponible en español. Bitcoin has seen a crash to the $87,000 level in the past day, but if on-chain data is to go by, the plunge could get much deeper. Bitcoin Has Lost An Important Support Level With The Crash In a new post on X, the on-chain analytics firm Glassnode has discussed about how some Bitcoin indicators have changed following the plunge in the cryptocurrency’s price. Related Reading The first metric that the analytics firm has shared is the Realized Price of the short-term holders.…

Bitcoin risks dipping below $80k as technical pressure builds, analysts warn

Bitcoin could be hitting a top as traders react to Trump’s tariff plans and regulatory delays. Institutional trading is playing a bigger role in Bitcoin’s (BTC) price moves, with Wall Street’s influence growing, according to a report by Singapore-based blockchain firm Matrixport. Bitcoin’s market dominance remains at 60%, making it the key benchmark for crypto traders, the analysts noted in an X post on Feb. 26. Still, concerns over Trump’s proposed tariffs and a possible six-month delay in the Bitcoin Strategic Reserve consultation may have contributed to a “technical topping…

Coinbase whales drives Bitcoin price action

Bitcoin’s recent price action has been heavily influenced by whales on Coinbase, according to CryptoQuant CEO Ki Young Ju. In a Feb. 26 post on X, Ju noted that Coinbase’s spot volume dominance, which refers to the share of total Bitcoin (BTC) spot trading volume occurring on the exchange, had surged above 30% in the past week. At the same time, the Coinbase BTC premium, which tracks the price difference between Bitcoin on Coinbase and other exchanges like Binance, remained negative. This suggests that U.S. investors, particularly institutional ones, are driving…