MARA reported a record-high revenue of $214.4 million in Q4 of 2024, a 37% increase from the same period in 2023. MARA’s Block Wins Rise 25% Bitcoin miner and publicly listed firm MARA (Nasdaq: MARA) said it registered a record-high revenue of $214.4 million in the fourth quarter of 2024, up 37% from $156.8 million […] Original

Day: February 27, 2025

$63M Investment Fuels Raise’s Blockchain-Powered Smart Cards

Raise, a Chicago-based gift card marketplace, secured $63 million in funding led by Haun Ventures and backed by Paypal to expand its blockchain-based Smart Cards system, the company announced this week. Paypal-Backed Raise Raises $63M; Aims to Revolutionize Gift Cards via Blockchain The funding round, which included Accel, New Enterprise Associates and others, brings Raise’s […] Source CryptoX Portal

SEC says memecoins aren’t securities, but fraud will still be policed

The US Securities and Exchange Commission says it does not view memecoins as securities but warned any fraudulent tokens could still be subject to enforcement actions by other regulators. The agency’s Division of Corporation Finance said in a Feb. 27 statement that, in its view, memecoins “do not involve the offer and sale of securities under the federal securities laws” and “are akin to collectibles.” “As such, persons who participate in the offer and sale of meme coins do not need to register their transactions with the Commission,” the SEC…

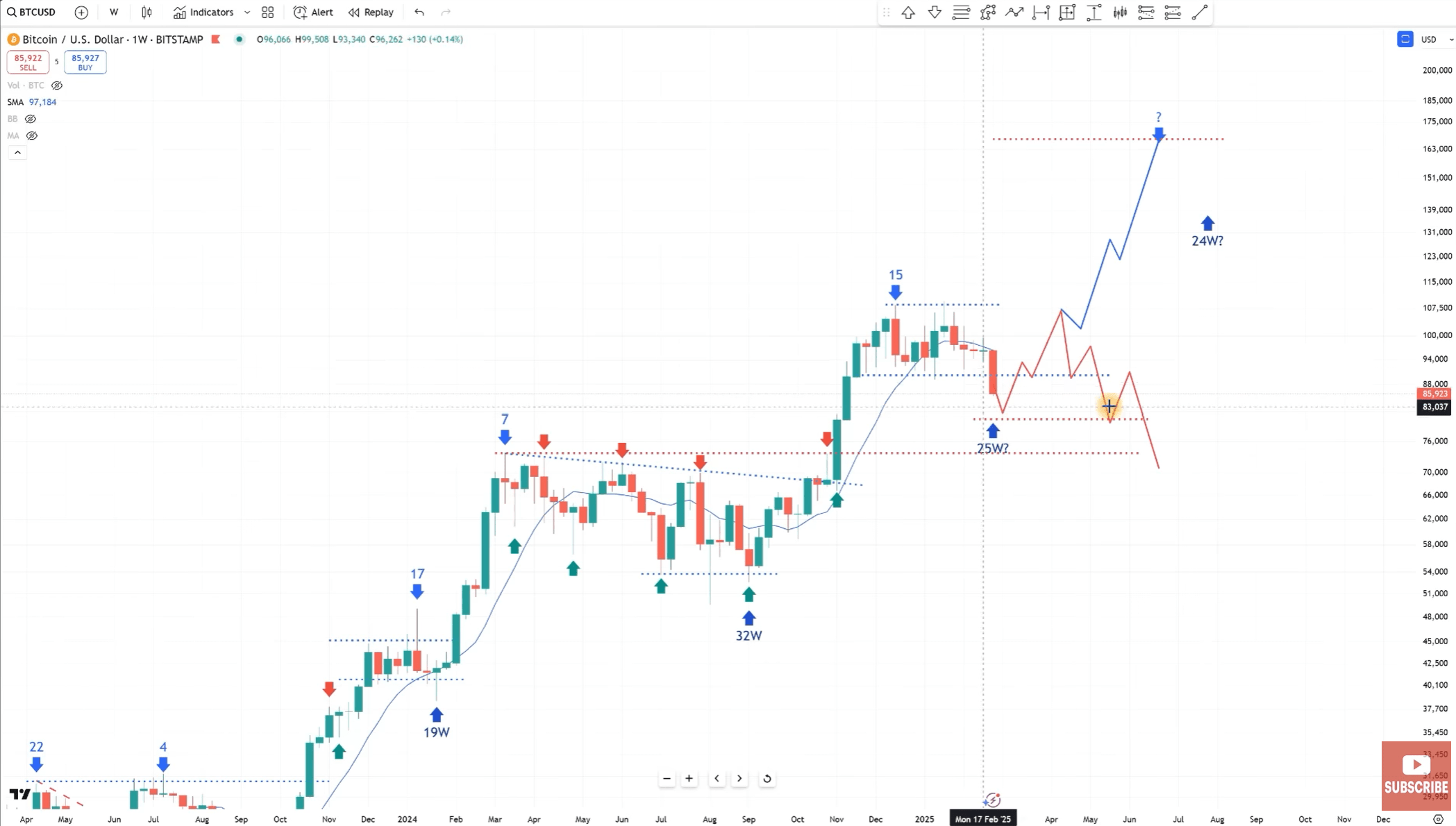

Bitcoin Crashes, Fear Spikes—But Analyst Sees $153,000 Ahead

Este artículo también está disponible en español. In his latest video update, long-time market analyst and self-described “four-year cycle” trader Bob Loukas delivered a breakdown of Bitcoin’s current trajectory. Despite a roughly 22% pullback from its recent all-time high, Loukas asserts that the leading cryptocurrency’s price action remains “nothing we have not seen before.” Loukas opened his video by acknowledging growing anxiety among traders following Bitcoin’s drop from around $110,000 to the mid-$80,000 range. However, he emphasized that such swings are a natural part of Bitcoin’s characteristic volatility. “As I record…

Hyperliquid flips Solana in fees, but is the ‘HYPE’ justified?

The decentralized perpetual futures trading sector has a new leader: Hyperliquid (HYPE). Launched in December 2024, Hyperliquid has its own Layer-1 blockchain, which has surpassed Solana in 7-day fees. What’s fueling its rapid growth, and how does HYPE compare relative to Solana’s native token SOL (SOL)? Protocols ranked by 7-day fees, USD. Source: DefiLlama Hyperliquid’s core offering is its perpetual futures DEX, which enables traders to access up to 50x leverage on BTC, ETH, SOL, and other assets. It features a fully onchain order book and zero gas fees. Unlike…

SEC Affirms They Typically Do Not Qualify As Securities

In a recent statement, the US Securities and Exchange Commission (SEC) provided insights into the classification of memecoins within the context of federal securities laws. This move, a part of the SEC’s attempt to make clear how these regulations apply to different assets, could prove to be a significant victory for these altcoins and the exchange-traded funds (ETFs) that have been filed with the regulator. Memecoins Not Subject To Federal Securities Laws According to the SEC’s criteria, a memecoin is generally characterized as a type of cryptocurrency that draws inspiration…

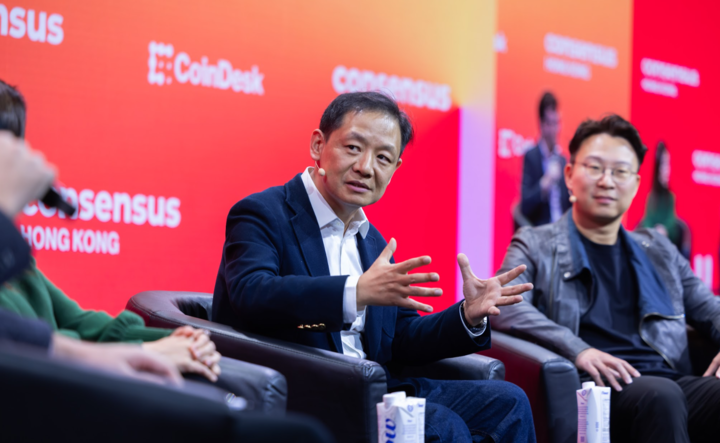

Here’s How Mainland China Allows Chinese Traders Access to BTC

Blockchain and Crypto have a complicated status in China: Beijing says no to crypto but yes to blockchain. It bans trading yet builds infrastructure. Now, with Hong Kong offering regulated crypto markets, insiders say a loophole is emerging. If China already allows investors to buy U.S. stocks through its Qualified Domestic Institutional Investor (QDII) program, why not bitcoin? The key, one expert argued on stage at Consensus Hong Kong, is control, and Beijing may have just found a way to keep it. In China, there are two systems for mainland…

Saga CEO discusses crypto industry’s shift toward GOP — ETH Denver

Rebecca Liao, co-founder and CEO of layer-1 blockchain Saga, believes that digital assets began as a bipartisan issue but gravitated toward the Republican Party in the last election cycle due to the previous administration’s anti-crypto policies. In an interview with Cointelegraph’s Turner Wright during the ETHDenver Conference, Liao pointed to the Securities and Exchange Commission’s (SEC) lack of cohesive policy as the industry’s primary challenge. The CEO said: “The crypto community felt as though the administration of power was not really helping out the crypto community with policies that would…

Texas Senate to consider Bitcoin reserve law

Texas policymakers have roughly $24 billion in sovereign wealth as the State’s Senate weighed passing Bitcoin reserve legislation. The Texas Senate Committee on Business and Commerce unanimously supported a bill to invest state surplus dollars into Bitcoin (BTC) as governments mulled crypto reserve adoption. Republican Charls Schwertner, chair of the Committee, scored a landslide 10-0 vote for his proposal titled the Texas Strategic Bitcoin Reserve and Investment Act. The State’s Senate will now consider Schwertner’s following overwhelming bipartisan backing. “Today’s vote was a critical first step in making a strategic…

Dogecoin Open Interest Declines 67% In Three Months – Can Meme Coins Recover?

Este artículo también está disponible en español. Dogecoin is trading at key demand levels after two weeks of massive selling pressure, with bears pushing DOGE down more than 30%. The meme coin sector has been hit the hardest during this market-wide correction, which began in mid-January, and as the market leader, Dogecoin has suffered the most. Related Reading Investors have started to question the sustainability of the meme coin rally, especially as sentiment continues to weaken across the board. Glassnode metrics confirm this downward trend, revealing that Dogecoin’s open interest…