More than 30 U.S. states have explored the idea of publicly funded Bitcoin reserves, with at least two jurisdictions nearing the passage of related legislation. Policy makers in Washington haven’t agreed on federal laws to create a Bitcoin (BTC) reserve, Wyoming Republican Senator and chair of the Senate Banking Subcommittee on Digital assets, Cynthia Lummis said at the New York Bitcoin Investor Week. Utah and Arizona have pushed forward proposals to purchase Bitcoin using public funds, though not all lawmakers support the idea of state-run Bitcoin reserves. Since Donald Trump…

Month: February 2025

Competitors want to ‘kill Tether,’ most altcoins ‘won’t make it’ in 2025: Finance Redefined

Tether’s competitors are exerting increasingly more pressure to push the world’s largest stablecoin issuer out of the crypto market, including political pressure aimed at reducing the firm’s leading market share. In the wider crypto markets, analysts are suggesting that most cryptocurrencies won’t see a widespread “altcoin season” rally in 2025, and only select tokens with sustainable investor interest and revenue-generating models will be able to outperform the rest of the tokens. Paolo Ardoino: Competitors and politicians intend to “kill Tether” Tether’s competitors are working to push the world’s largest stablecoin…

SEC Commissioner dissents on agency’s memecoin stance

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities. According to the commissioner’s Feb. 27 statement, memecoins could satisfy the Howey test’s condition of profiting from the managerial efforts of others due to the coordination between developer teams and promoters. The commissioner added that most, if not all, cryptocurrencies could be defined as memecoins under the SEC’s recent guidance, which was released on the same day. In this guidance, the agency stated that memecoins represent online social…

SEC again delays Ether ETF options on Cboe

The US Securities and Exchange Commission has once again extended its deadline for deciding whether or not to permit Cboe Exchange to list options tied to Ether exchange-traded funds (ETFs). The agency has given itself until May to make a final decision to approve or disapprove of Ether (ETH) ETF options trading on the US exchange, according to a Feb. 28 regulatory filing. Cboe initially requested to list Ether ETF options in August 2024, but the SEC sought extra time to reach a decision in October. The exchange is seeking…

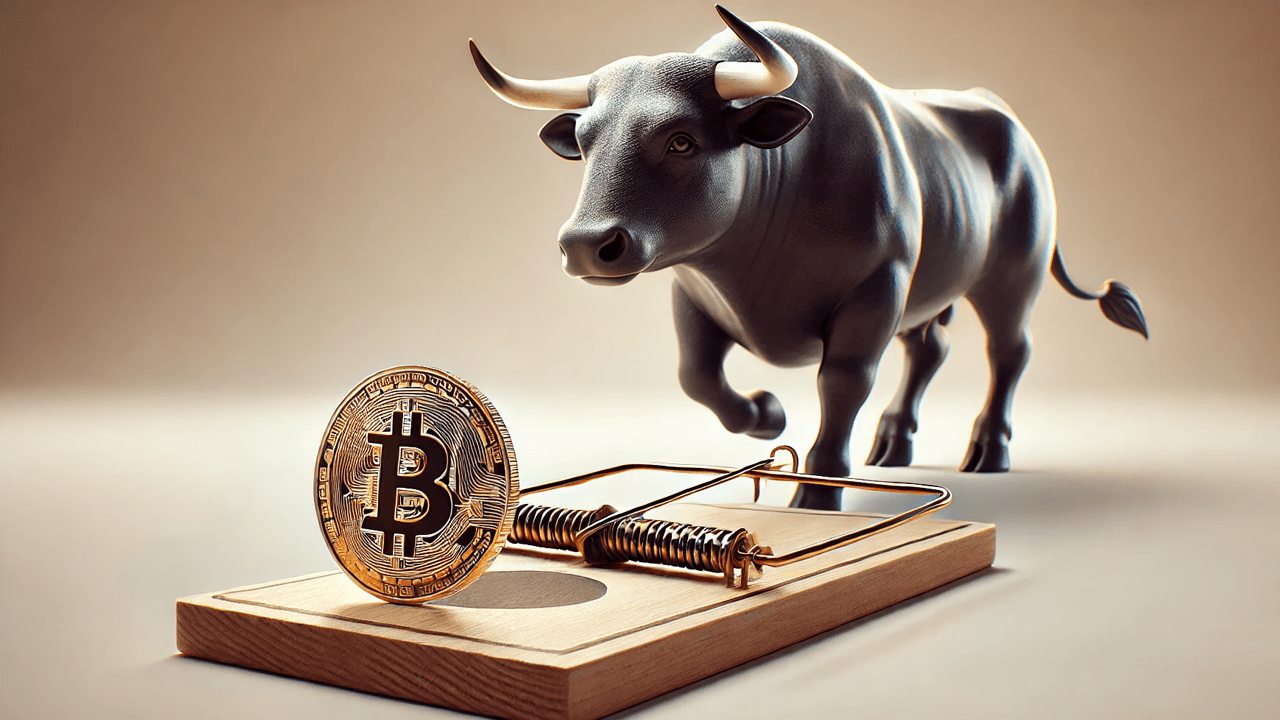

Bitcoin Price Watch: Signs of a Bull Trap as Resistance Holds Strong

Bitcoin is currently priced at $83,779, with a market capitalization of $1.66 trillion and a 24-hour trading volume of $91.22 billion, as price action remains volatile within an intraday range of $78,197 to $84,854, potentially signaling a bull trap as technical indicators point to underlying weakness despite short-term rebounds. Bitcoin Recent price movement suggests bitcoin […] Original

Is Solana In A Macro Trend Move? Charts Show Potential Shift

Este artículo también está disponible en español. Solana (SOL) is trading at its lowest price level since September 2024, as the entire crypto market struggles with fear and intense selling pressure. Solana has lost over 55% of its value in less than six weeks, erasing the gains from its post-election rally and raising concerns among investors about a potential prolonged downtrend. Related Reading Panic has taken over the market, and traders are growing fearful that Solana’s correction may continue into lower price levels. Despite multiple attempts to reclaim momentum, bulls…

Bitcoin rebounds to $84K — Analysts say BTC crash was ultimate buy signal

Bitcoin (BTC) price dropped 21.3% between Feb. 21 and Feb. 28, retesting the $78,300 level for the first time since November 2024. The correction led to over $1.6 billion in leveraged long (buy) liquidations, adding to market volatility as exchanges forcefully sold contracts. The $21,210 decline marked the largest seven-day drop in Bitcoin’s history. Despite the pullback, several Bitcoin analysts see this as a strong buying opportunity. They cite factors such as regulatory developments, sovereign fund exposure, onchain and technical signals, and increasing integration with traditional finance, including bank adoption…

Bitcoin price rebounds to $84k as Nansen analyst predicts consolidation phase

Bitcoin price bounced back and moved above the key resistance level of $84,000 after tumbling to a multi-month low of $78,200 on Friday. Bitcoin’s (BTC) rebound coincided with a recovery in U.S. equities, which pared back earlier losses. The Dow Jones index rose 165 points, while the Nasdaq 100 gained 80 points. A potential catalyst for the recovery was news that BlackRock maintained its bullish stance on Bitcoin this week. The world’s largest asset manager confirmed plans to allocate about 2% of its model portfolio assets to its IBIT ETF. …

BlackRock adds BTC ETF to $150B model portfolio product

BlackRock, a global investment firm with $11.5 trillion in assets under management, has added its Bitcoin exchange-traded fund (ETF) to its model portfolio product, according to a Feb. 28 report from Bloomberg. Portfolios that allow for alternative assets will be able to put a 1%–2% allocation into the firm’s iShares Bitcoin ETF Trust (IBIT), potentially creating new demand for the exchange-traded fund. The 1%–2% allocation is due to Bitcoin’s (BTC) volatility, which the firm called a “reasonable range” in a paper authored by the BlackRock Investment Institute. Anything more would…

SEC Closes Investigation Into Crypto Exchange Gemini Without Recommending Enforcement Action: Cameron Winklevoss

Gemini co-founder Cameron Winklevoss says that federal securities regulators have ended their probe into the US-based crypto exchange. According to Winklevoss, the U.S. Securities and Exchange Commission (SEC) has informed Gemini lawyer Jack Baughman that it has concluded its investigation and will not pursue an enforcement action against the platform. The SEC has already dropped its case against the crypto exchange Coinbase and is shutting down investigations into the non-fungible token (NFT) marketplace OpenSea, the retail trading app Robinhood and the decentralized cryptocurrency exchange (DEX) UniSwap. Winklevoss says these developments mark a milestone…