May 2022 was not for the faint-hearted. Even the most embattled and experienced crypto traders were tested in the first two weeks of the month on a brutal drop following the United States Federal Reserve’s announcement that interest rates would be rising by 0.5%.

Crypto used to exhibit a lower correlation with real-world events and was generally unaffected by capitalistic successes and failures. However, a very steady approximate peg between Bitcoin (BTC) and the S&P 500 index was seen throughout the first five months of 2022. Inflation and war fears have not been kind to both markets either.

Crypto mimicking the equity market could be due to the massive market capitalization growth in 2020 and 2021. At unprecedented rates, retail investors from equities have flocked to cryptocurrencies, causing far greater overlap in price movements.

Bitcoin dipped below $29,000 before coming back up to $31,800 on May 31, while Ether (ETH) fell to just above $1,700 before reclaiming prices above $1,900 by May 30. But many altcoins fared far worse, and the resulting reactions from once-patient traders turned to about as much FUD as one would imagine.

Four stablecoins, two different directions

TerraUSD (UST) was a stablecoin built on the Terra blockchain and sitting in the top six stablecoin by market cap. However, on May 9, the coin, which was designed to maintain a $1 value all the time, progressively dropped down to $0.29, leaving the crypto world in shock. Its price has not recovered since.

As for how this impacted the rest of the stablecoin landscape, a major “shuffling of the deck” resulted from a trusted stablecoin’s reputation imploding overnight. Tether (USDT), the largest stablecoin by market cap, saw a fall of its own, albeit one much less drastic, to $0.95. It has since recovered, but there have been renewed claims about the coin’s solvency.

Dai and USD Coin (USDC) seemed to reap the reward amid the debacle as the above chart clearly indicates the top 10 largest whale addresses from each stablecoin show an increased trust level in these two assets, and coins moving in massive waves onto exchanges from USDT and UST (now TerraUSD Classic). Binance USD (BUSD) also can’t be ignored, as the third-largest stablecoin grew to a nearly $19-billion market cap last month.

LUNA’s tragic fall from grace

UST’s sister token LUNA Classic (LUNC) plunged from its all-time high of about $119 just seven weeks ago and now sits at a staggering $0.000125, equating to a -99.9999% decrease in price and market cap. UST’s depegging from $1 appeared to be the final nail in the coffin as the algorithm wasn’t swift enough to burn LUNC when UST was in freefall due to large withdrawals on the Anchor Protocol.

But while the story of LUNC may seem like old news at this point, talks of LUNA 2.0 appear to be bringing in some new life and optimism. The project’s GitHub has actually exploded with new action at a rate that has never been seen from the original LUNC.

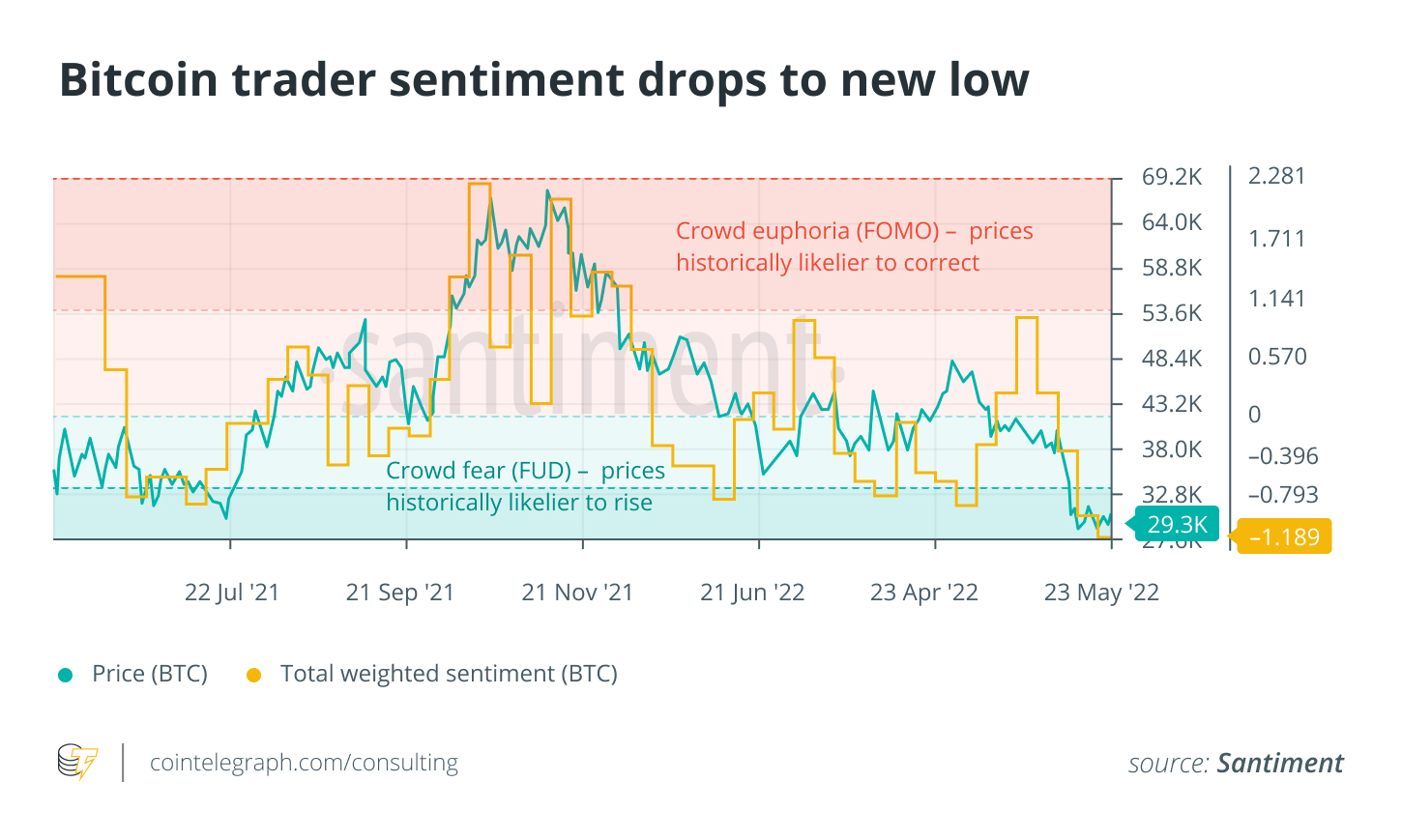

Bitcoin trader sentiment at historic pain levels

Bitcoin could be reaching a bottom as sentiment hit its most negative levels since March 2020. The social dominance of BTC also gets smaller and smaller. Typically, three waves of diminished dominance of BTC is a clear sign that traders are no longer interested in buying a frustrating and unpredictable “dip.” And when traders lose interest, prices historically wake up.

Among Telegram, Reddit and Twitter social volume, the three platforms have seen wildly different discussion rates about crypto over the past year, let alone the past couple of months. Reddit saw by far the most notable spike when prices bottomed out about two weeks ago, while Telegram discussions have completely died down.

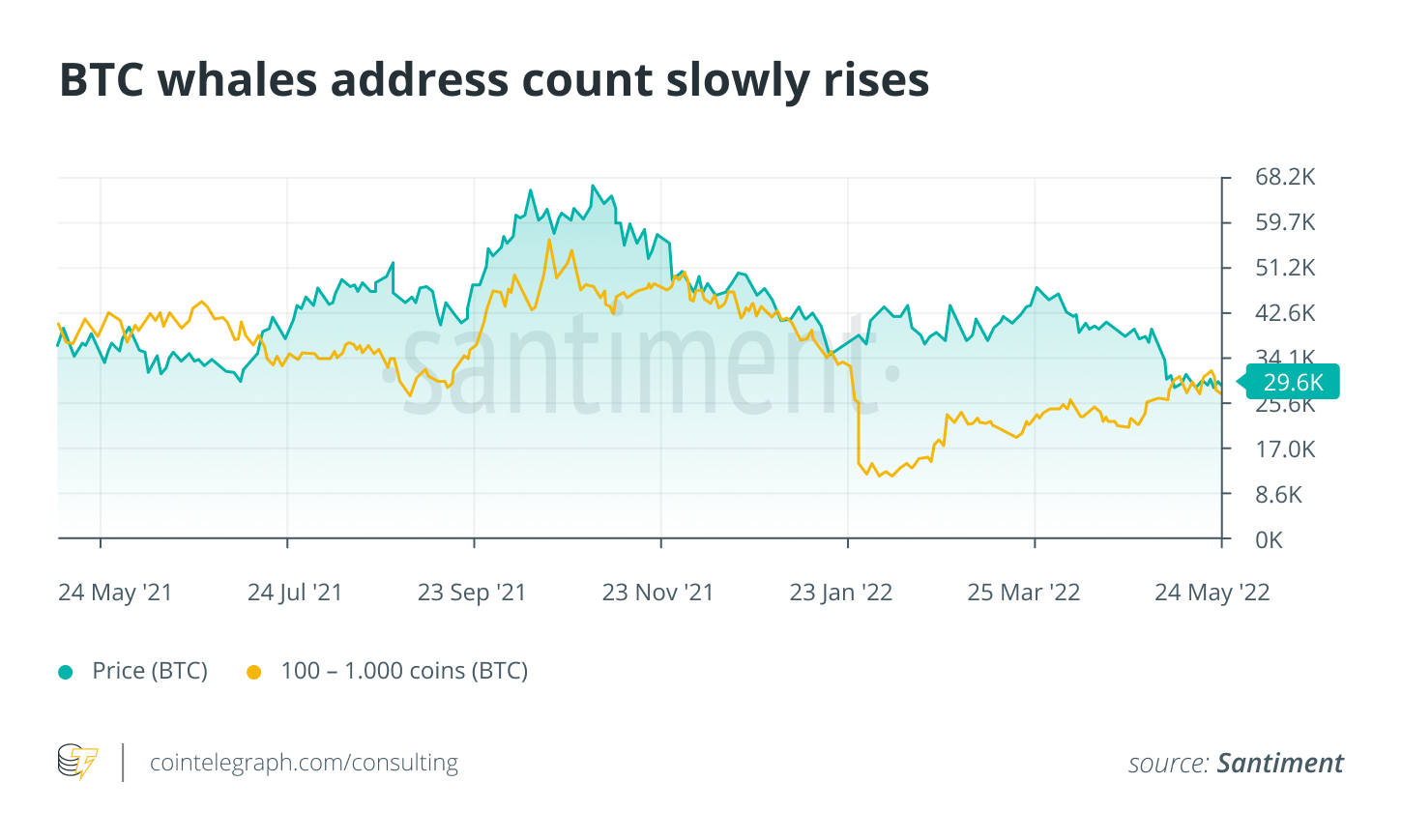

BTC amount held by whales is low, address count rises

There is good and bad news about the May Bitcoin whale activity. The good news is the number of whale addresses holding 100–1,000 BTC has risen for about four straight months now, a trend that began seeing a turnaround in late January. Meanwhile, the bad news is the actual total amount held by these whale addresses still shows a long-term dump pattern dating back to late October, right before the all-time high.

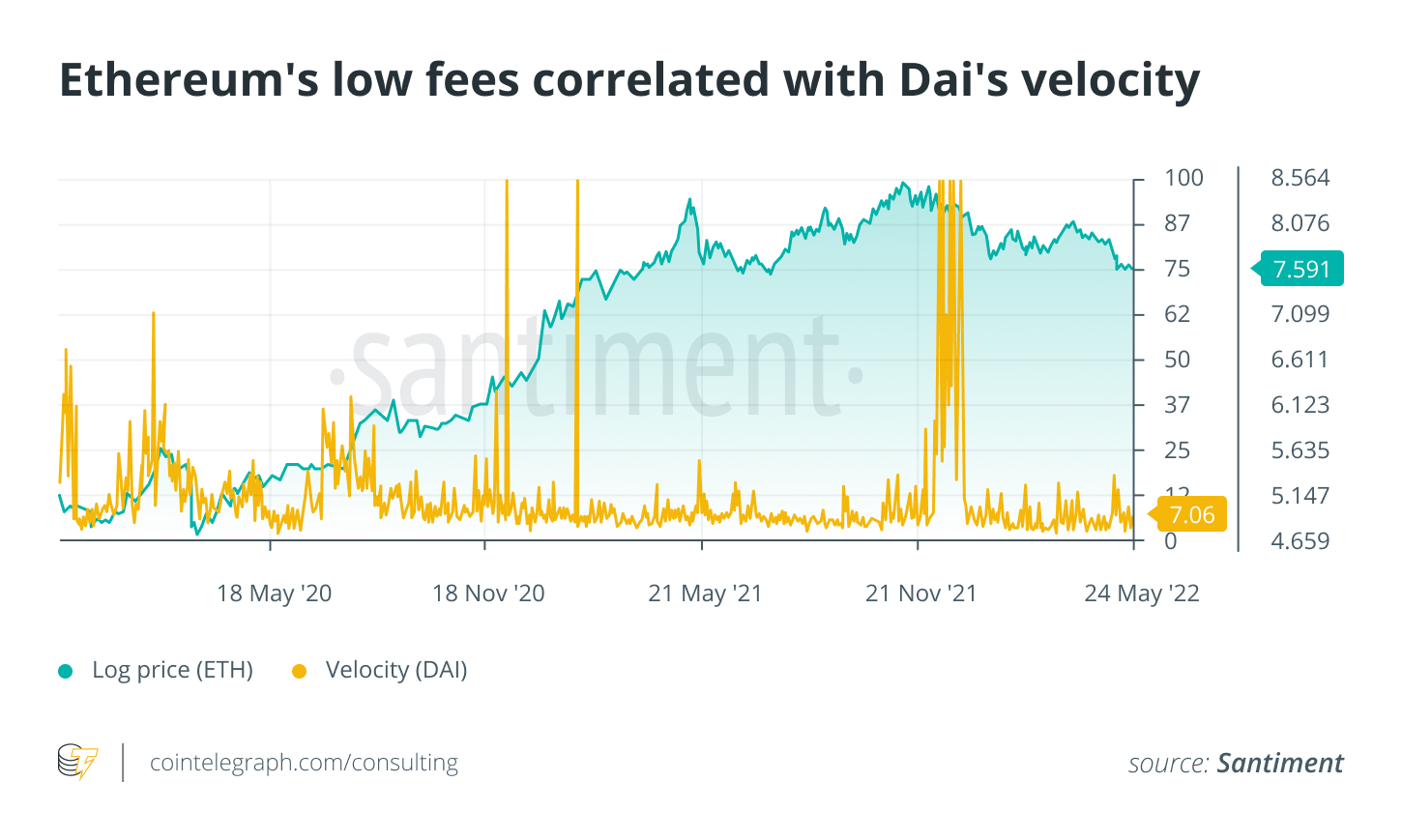

Dai velocity staying low, a good sign for Ether

With top altcoin Ether, there appears to be a correlation between its price and the amount of velocity, which is the average number of times that a coin changes wallets every day, as seen on the Dai network.

A series of major spikes in Dai’s velocity was seen weeks after Ether’s mid-November all-time high but has been fairly dormant in recent months. As long as this metric remains at low levels, there’s no threat of an isolated dump for ETH compared to the rest of the cryptocurrency market.

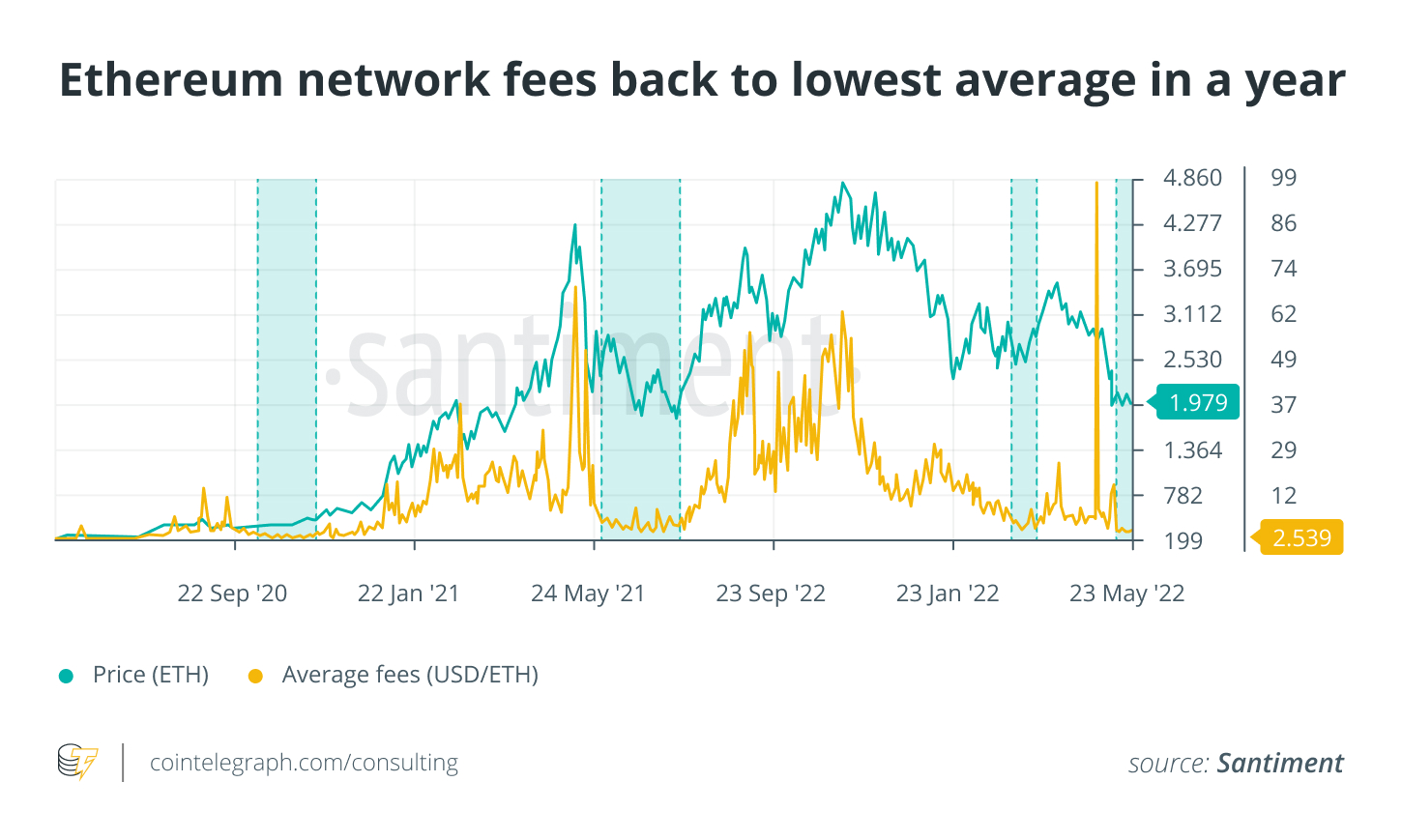

Ethereum fees are also encouragingly quite dormant

On top of the low velocity on Dai, fees on the Ethereum network are approaching year lows. With so much stagnancy among many networks, this has caused the cost per transaction to decline.

The above chart illustrates the massive spike in average fees (to $98) in mid-May. This was an obvious sign that some further downside was likely. One can only hope that fees stay down where bulls like them.

Cointelegraph’s Market Insights Newsletter shares our knowledge on the fundamentals that move the digital asset market. This analysis was prepared by leading analytics provider Santiment, a market intelligence platform that provides on-chain, social media and development information on 2,000+ cryptocurrencies.

Santiment develops hundreds of tools, strategies and indicators to help users better understand cryptocurrency market behavior and identify data-driven investment opportunities.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.