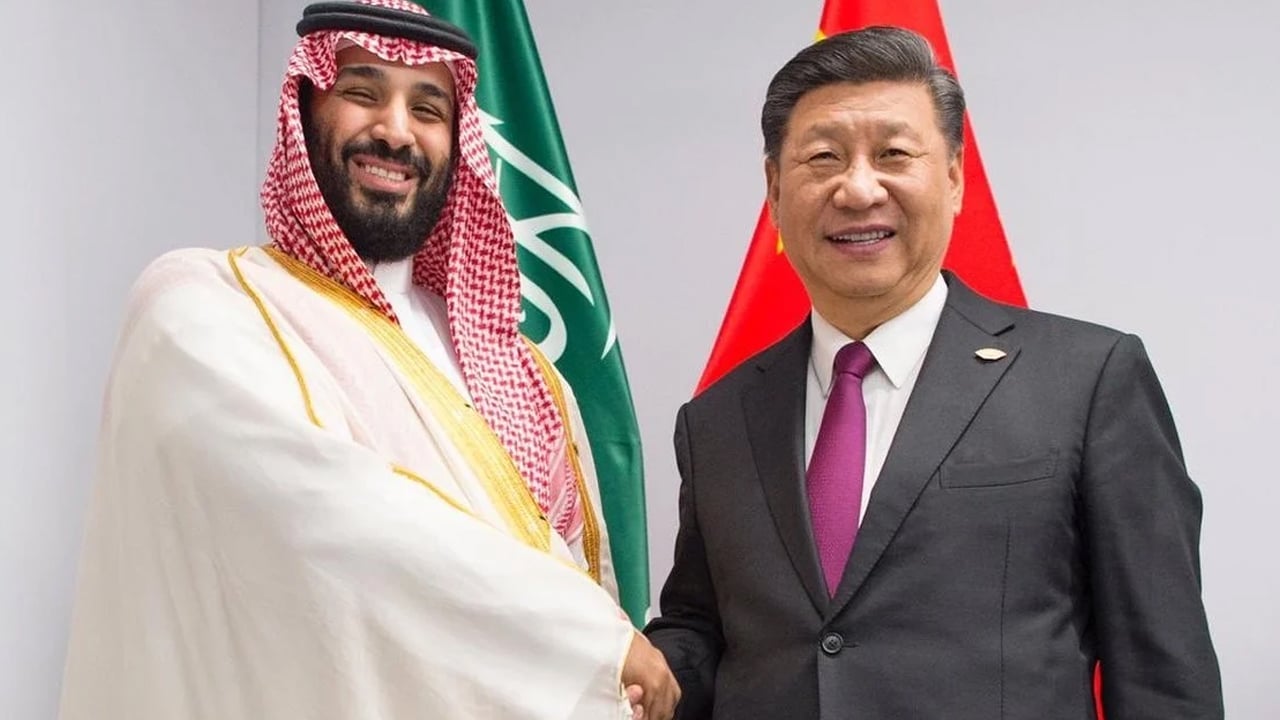

After Saudi Arabia and members of the Organization of the Petroleum Exporting Countries (OPEC) surprised the world by announcing cuts to oil production, a spokesperson for U.S. president Biden’s National Security Council stated that reducing production is not advisable. According to a recent report, Saudi Arabia’s crown prince Mohammed bin Salman has told associates that Riyadh is no longer interested in pleasing the United States.

The Growing Shift Away from U.S. Dollar Hegemony in Global Trade and Finance

There has been a lot of focus on OPEC members and the BRICS countries (Brazil, Russia, India, China, and South Africa) recently as several members of these groups are shifting alliances. On Sunday, April 2, several major oil producers, including Saudi Arabia, Russia, the United Arab Emirates (UAE), Iraq, Kuwait, Oman, and Algeria, announced plans to cut oil production in 2023. The cuts will begin in May, and it is estimated that production will be reduced by 1.15 million barrels of oil per day.

After the decision, the White House responded to the news by stating that cutting oil production was not advisable. Despite statements from the Biden administration and various Democratic policymakers vowing consequences the last time major oil producers cut production in October 2022, Saudi Arabia’s leaders do not seem to care. According to a Wall Street Journal (WSJ) report published on April 3, Prince Mohammed “told associates late last year that he was no longer interested in pleasing the [United States].”

According to a report by Summer Said and Stephen Kalin in the WSJ, “people familiar with the conversation” explained that the prince wants “something in return for anything he gives Washington.” The report also claims that the oil production cut “has major political ramifications and could add to Riyadh’s already significant tensions with Washington.” Last October, Saudi government officials reportedly mocks president Joe Biden over his mental acuity. In July, Biden flew to Saudi Arabia to meet with the prince and pressed the Saudis for more oil production.

However, the Saudi government refused his requests, and after Biden left, the U.S. president was ridiculed on a television broadcast aired in Saudi Arabia, calling him “Sleepy Joe.” At that time, people familiar with the matter told the WSJ that unnamed members of the Saudi government say the prince and his team privately make fun of president Biden behind his back. Biden was also mocked when he traveled to see the prince and decided not to shake the prince’s hand, instead offering a pandemic-inspired fist bump.

Amid the Saudi government’s message and America’s tensions with the BRICS nations, the U.S. government’s exceptionalism that inspired the 2004 comedy “Team America: World Police” seems to be fading faster than ever before. This year, after a 48-year relationship solely with the U.S. dollar, Mohammed Al-Jadaan, Saudi Arabia’s finance minister, said the kingdom is open to trading in currencies other than the U.S. dollar.

Many analysts and economists have stressed that the U.S. dollar has been propped up by the petrodollar scheme since 1944. The recent events in 2023 indicate that the greenback’s superiority is taking a back seat, and many officials abroad don’t seem to care what the U.S. thinks these days.

What do you think the long-term implications of these tensions between the U.S. and Saudi Arabia will be on the global oil market and the international relations between these two countries? Share your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.