The price of Bitcoin (BTC) and Ethereum’s Ether (ETH) plunged by 13% and 21%, respectively, within minutes on Aug. 2. The move liquidated more than $1 billion worth of futures contracts as BTC/USD dropped from around $12,000 to as low as $10,550.

BTC/USD 1-hour chart. Source: Tradingview

There appear to be two main reasons behind the sudden cascade of liquidations. First, the volume in the cryptocurrency market tends to drop during weekends. Second, the market was heavily swayed to longs or buyers.

Cryptocurrency market snapshot, Aug. 2. Source: Coin360

Surprise weekend move hits the crypto market once again

The cryptocurrency market tends to see large liquidations during the weekend. The liquidity often drops as there are fewer active traders in the market. Lower volume leads to massive price movements, as cryptocurrencies become more vulnerable.

Mass liquidations become more likely during the weekend because one large liquidation could trigger a cascade of liquidations. When a long contract gets liquidated, as an example, it forces the buyer to market sell, causing selling pressure.

As hundreds of millions of dollars worth of long contracts began to get liquidated, Bitcoin and Ether dropped rapidly. Bitcoin declined from $12,000 to $10,600 within 15 minutes, while ether declined from $417 to $300.

But mass liquidations happened several times in the past five months. Most notably, on the so-called “Black Thursday” on March 13, $1 billion worth of liquidations occurred. Similarly, right before the halving on May 11, the price of Bitcoin dropped to $8,100 resulting in mass liquidations.

Bitcoin and Ethereum were heavily swayed to buyers

In the last several days, especially after Bitcoin’s upsurge above $11,000, the cryptocurrency market was heavily swayed to the side of the buyers. The funding rates of Bitcoin and Ether were nearing levels that are not sustainable over a prolonged period.

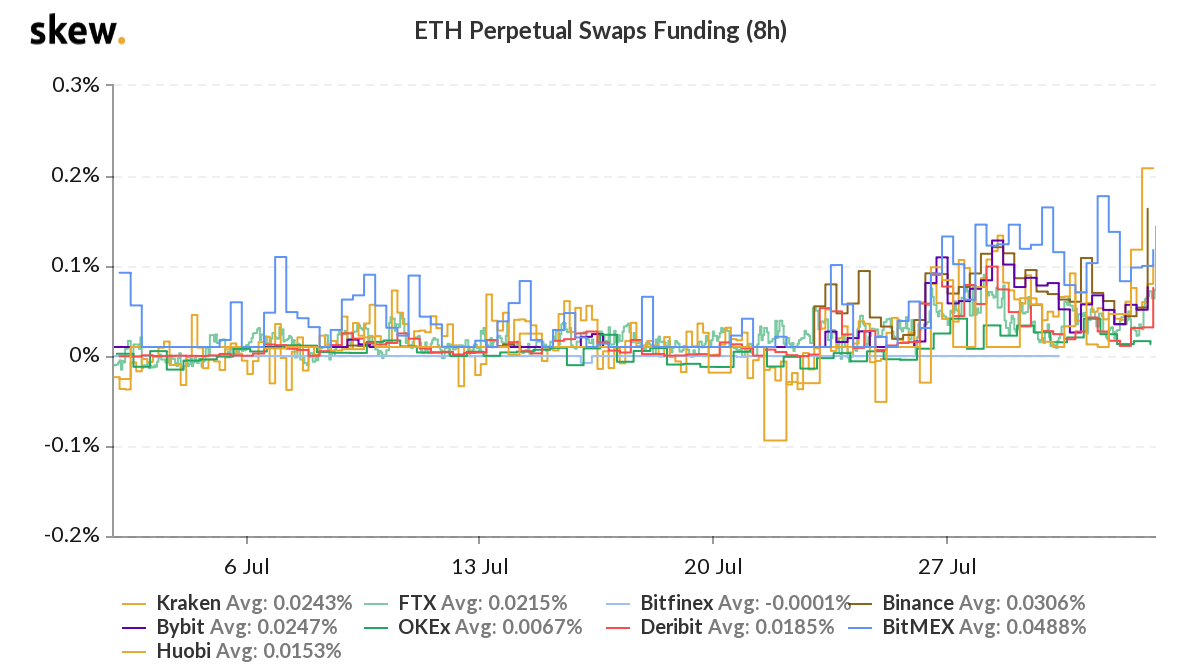

Futures exchanges, like BitMEX and Binance Futures, utilize a mechanism called “funding” to implement balance in the market. When the overwhelming majority of market participants are holding long contracts, then short holders are incentivized with a fee and vice versa.

Prior to the drop, the funding rate of Bitcoin was hovering at around 0.0721%. Since the average funding rate of BTC is at around 0.01%, the market was dominated by long contracts.

The market imbalance was even worse for Ether. The ETH funding rate was at 0.21%, which indicates significant bullish bias. But after the liquidations, the predicted funding rate of ETH is at 0.19%. It suggests that ETH longs were not flushed out, unlike Bitcoin.

Ether funding rate across major futures exchanges. Source: Skew

Michael van de Poppe, a trader at the Amsterdam Stock Exchange, previously anticipated Ether to drop to $300 as a result. He said:

“Let’s see $ETH at $300-320.”

For now, some traders anticipate sideways action for the days ahead as Bitcoin has rebounded to a key support level at $11,300 and a CME futures gap will likely emerge on Monday given Friday’s close price of $11,630.

“The bullish scenario depends on the crucial threshold of $11,300-11,400 as the pivot to hold for the price of Bitcoin,” Van de Popped explained in his latest BTC technical analysis.

In the medium-term, meanwhile, there is increasing optimism about the price trend for Bitcoin. When asked whether BTC will hit a new all-time high, Spartan Black’s Kelvin Koh said:

“Without a doubt. BTC hit a new ATH in each of the last 3 cycles and this one will be no exception. The scarcity effect, the halving and more capital coming into crypto will ensure that.”