Nexo has announced a three-year partnership with the DP World Tour, becoming the Tour’s Official Digital Asset and Wealth Partner through 2027. This collaboration will kick off with six premier tournaments in 2025, including the Genesis Scottish Open and the BMW PGA Championship, featuring top players like Rory McIlroy and Scottie Scheffler. A highlight of […] Source CryptoX Portal

Tag: Platform

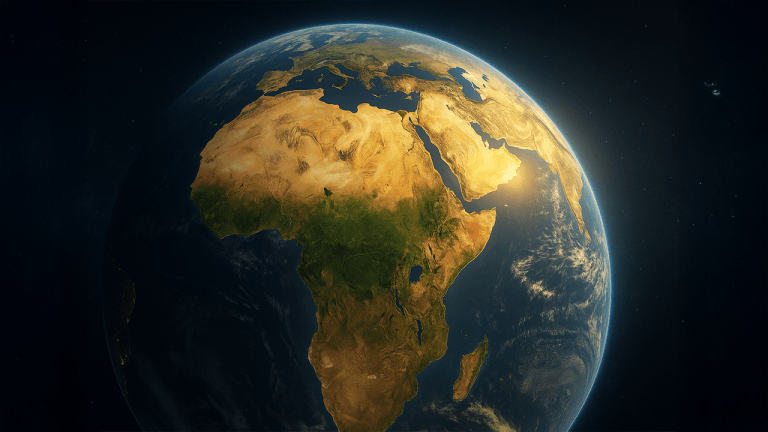

Africa Unites in Currency Revolution: PAPSS Launches Dollar-Free Trade Platform

The Pan-African Payment and Settlement System has officially launched a currency marketplace aimed at reducing reliance on the U.S. dollar for intra-African trade. No Hard Currency Involved The Pan-African Payment and Settlement System (PAPSS) has launched the African Currency Marketplace, a major step toward reducing reliance on the U.S. dollar for intra-African trade settlements. This […] Source CryptoX Portal

Titobet: A Privacy-First Crypto Gambling Platform

This content is provided by a sponsor. Titobet is a unique platform where you can register without the need for KYC verification or submitting any documents, allowing you to freely enjoy casino, live casino, and sports betting. Among the increasingly popular crypto gaming platforms, Titobet stands out as one of the most reliable. It offers […] Source CryptoX Portal

GoldenMining Investors Earn Average Profit of $9,800 on Bitcoin Surge Day Stable Daily Income Model Attracts Thousands to Join Global Cloud Mining Platform

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. As geopolitical developments continue to impact global markets, the cryptocurrency space remains highly reactive. Earlier this week, Bitcoin (BTC) dipped below the $100,000 mark amid heightened tensions in the Middle East. However, with tensions easing, market…

Aptos and Jump Crypto Launch Shelby, a Web3 Cloud Storage Platform

Aptos Labs and Jump Crypto have introduced a cloud-based storage network tailored for Web3 and decentralized applications — a system its creators say rivals traditional cloud services. Unveiled on Tuesday, the network — called Shelby — is a globally distributed platform powered by Aptos’ high-throughput technology. It is chain-agnostic, offering compatibility with Ethereum, Solana and other major blockchains. Shelby is built for developers who need cloud-like speed and remote access for demanding use cases, including streaming video, artificial intelligence and decentralized physical infrastructure (DePIN) applications. Aptos Labs is the creator…

$90 Billion Fiserv Partners Circle, Solana to Launch FIUSD Stablecoin Platform

Key Notes Fortune 500 payment processor Fiserv collaborates with Circle and Paxos to create bank-friendly digital dollar infrastructure. FIUSD will integrate with PayPal’s PYUSD for cross-platform transactions, enhancing merchant and consumer payment options. The launch coincides with the GENIUS Act’s Senate passage, providing regulatory clarity for USD-pegged stablecoin issuers. Fiserv is entering the stablecoin space with its own digital dollar, FIUSD, backed by Solana and Circle Internet Group. The move signals a broader shift by traditional finance toward blockchain-powered payments. The Fortune 500 firm, which processes over 90 billion transactions…

Dollar-Free Future Accelerates as Putin and BRICS Bank Chief Discuss Digital Payment Platform

BRICS nations are accelerating a bold push to upend dollar dominance as Putin and the BRICS Bank leader discuss digital payment platforms and national currency systems reshaping global finance. Putin and BRICS Bank Head Discuss Payment Platform to Undercut Dollar Dominance As global economic blocs accelerate de-dollarization efforts and seek to reduce dependence on the […] Source CryptoX Portal

Putin and XI to Kickstart Global South BRICS Investment Platform

Vladimir Putin and Xi Jinping are discussing launching a platform that will offer investment initiatives under a BRICS-Global South inclusive banner, which will be detailed next month. Putin and Xi: BRICS to Unveil Global South Inclusive Investment Platform Vladimir Putin and Xi Jinping, leaders of two of the world’s largest countries, are developing a platform […] Source CryptoX Portal

Binance’s CZ Calls for ‘Will Function’ on Every Crypto Platform

As billions in crypto wealth surge globally, urgent calls intensify for platforms to adopt inheritance-ready “will functions,” safeguarding digital assets and empowering responsible, future-proof financial planning. ‘Will Function’ Needed to Protect Billions in Crypto, Says Binance’s CZ Binance founder and former CEO Changpeng Zhao (CZ) reignited industry-wide concerns about the lack of proper estate planning […] Source CryptoX Portal

10 Signs a Crypto Investment Platform Is a Scam—and How to Avoid It

Key takeaways Fake crypto investment platforms give themselves away in a few obvious ways. Many use fake reviews, incorrect contact information and unrealistic promises to lure you in. The best approach is a healthy dose of skepticism. Watching for these red flags will keep you safe while investing. The burgeoning cryptocurrency market, with its lack of centralized authority and a constant flow of inexperienced users, makes digital assets a prime target for scammers. Fake crypto investment platforms are a common scam method, masquerading as useful services for crypto traders. Before…